Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An old forklift is due for a replacement analysis. It has a current market value $10,000. The market values and operation and maintenance costs

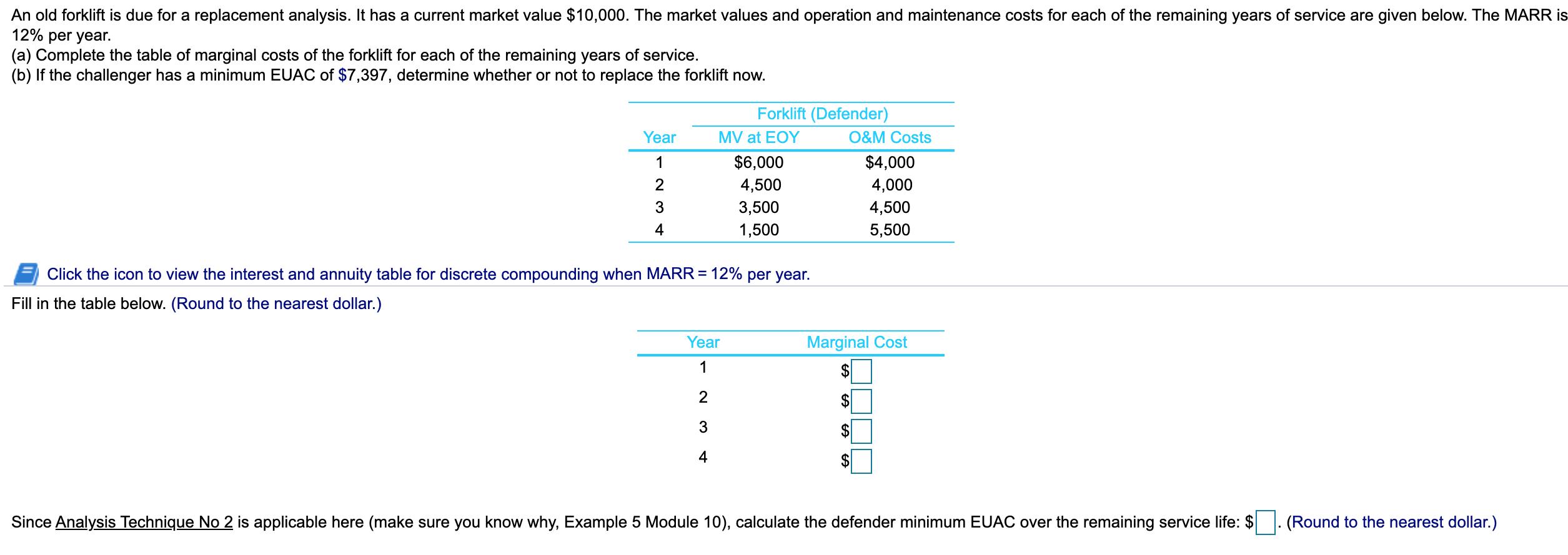

An old forklift is due for a replacement analysis. It has a current market value $10,000. The market values and operation and maintenance costs for each of the remaining years of service are given below. The MARR is 12% er year. (a) Complete the table of marginal costs of the forklift for each of the remaining years of service. (b) If the challenger has a minimum EUAC of $7,397, determine whether or not to replace the forklift now. Forklift (Defender) Year MV at EOY O&M Costs 1 $6,000 $4,000 2 4,500 4,000 3,500 4,500 4 1,500 5,500 Click the icon to view the interest and annuity table for discrete compounding when MARR = 12% per year. Fill in the table below. (Round to the nearest dollar.) Year Marginal Cost 1 4 Since Analysis Technique No 2 is applicable here (make sure you know why, Example 5 Module 10), calculate the defender minimum EUAC over the remaining service life: $. (Round to the nearest dollar.) %24 %24 %24

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS The marginal cost in any year k has three components namely 1 Loss in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started