Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. An ordinary annuity of S650 per period, d as a present value of $2,252. If this same annuity was an annuity due, what would

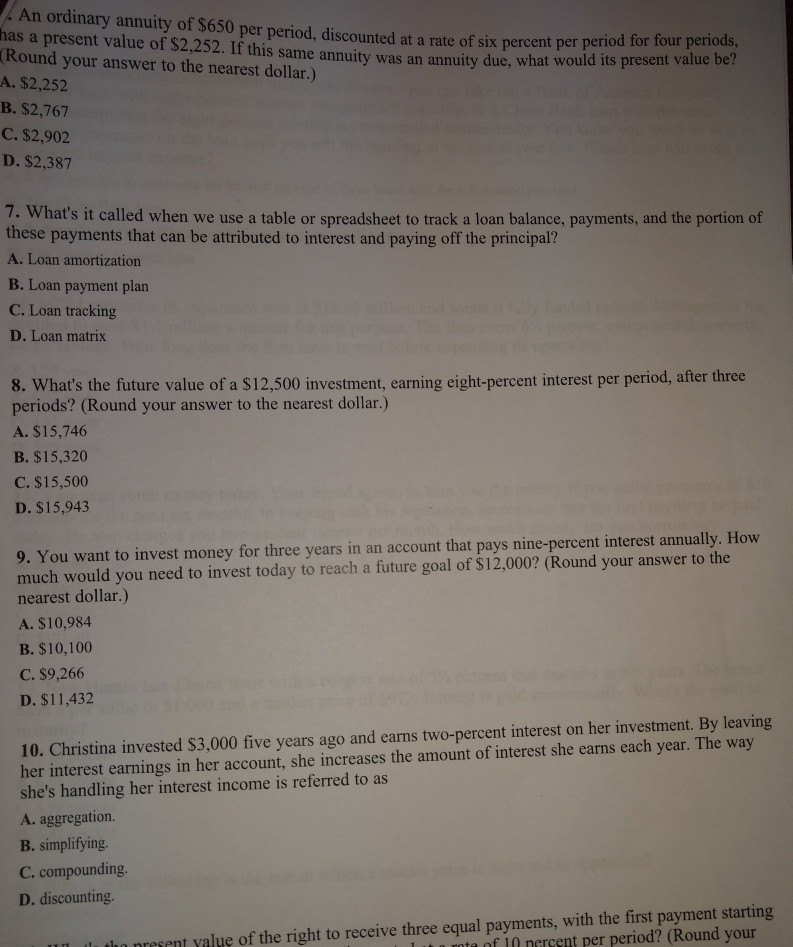

. An ordinary annuity of S650 per period, d as a present value of $2,252. If this same annuity was an annuity due, what would its present vaiue b Round your answer to the nearest dollar.) A. $2,252 B. $2,767 C. $2,902 D. $2,387 iscounted at a rate of six percent per period for four periods, 7. What's it called when we use a table or spreadsheet to track a loan balance, payments, and the portion of these payments that can be attributed to interest and paying off the principal? A. Loan amortization B. Loan payment plan C. Loan tracking D. Loan matrix 8. What's the future value of a $12,500 investment, earning eight-percent interest per period, after three periods? (Round your answer to the nearest dollar.) A. $15,746 B. $15,320 C. $15,500 D. $15,943 9. You want to invest money for three years in an account that pays nine-percent interest annually. How much would you need to invest today to reach a future goal of $12,000? (Round your answer to the nearest dollar.) A. $10,984 B. $10,100 C. $9,266 D. $11,432 10. Christina invested $3,000 five years ago and earns two-percent interest on her investment. By leaving her interest earnings in her account, she increases the amount of interest she earns each year. The way she's handling her interest income is referred to as A. aggregation. B. simplifying. C. compounding D. discounting. l tho nresent yalue of the right to receive three equal payments, with the first payment starting f 10 nercent per period? (Round your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started