Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An ordinary share pays dividends on each 31 December. A dividend of 35p per share was paid on 31 December 2017. The dividend growth

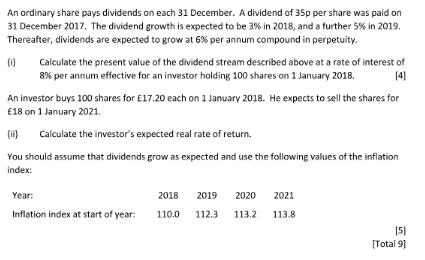

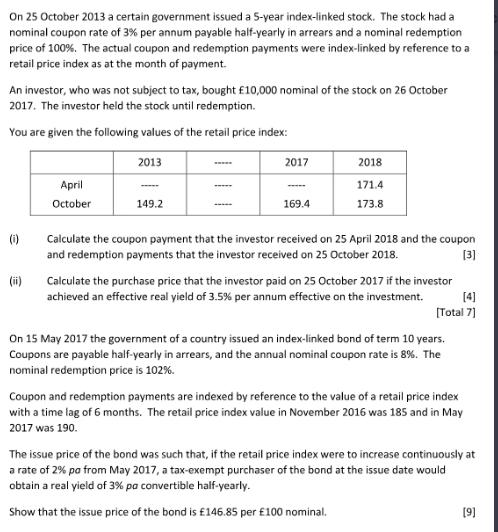

An ordinary share pays dividends on each 31 December. A dividend of 35p per share was paid on 31 December 2017. The dividend growth is expected to be 3% in 2018, and a further 5% in 2019. Thereafter, dividends are expected to grow at 6% per annum compound in perpetuity. (0) Calculate the present value of the dividend stream described above at a rate of interest of 8% per annum effective for an investor holding 100 shares on 1 January 2018. [4] An investor buys 100 shares for E17.20 each on 1 January 2018. He expects to sell the shares for E18 on 1 January 2021. (ii) Calculate the investor's expected real rate of return. You should assume that dividends grow as expected and use the following values of the inflation index: Year: Inflation index at start of year: 2018 2019 110.0 112.3 113.2 2020 2021 113.8 [5] [Total 9] On 25 October 2013 a certain government issued a 5-year index-linked stock. The stock had a nominal coupon rate of 3% per annum payable half-yearly in arrears and a nominal redemption price of 100%. The actual coupon and redemption payments were index-linked by reference to a retail price index as at the month of payment. An investor, who was not subject to tax, bought 10,000 nominal of the stock on 26 October 2017. The investor held the stock until redemption. You are given the following values of the retail price index: 2013 (0) April October 149.2 2017 169.4 2018 171.4 173.8 Calculate the coupon payment that the investor received on 25 April 2018 and the coupon and redemption payments that the investor received on 25 October 2018. [3] Calculate the purchase price that the investor paid on 25 October 2017 if the investor achieved an effective real yield of 3.5% per annum effective on the investment. [4] [Total 7] On 15 May 2017 the government of a country issued an index-linked bond of term 10 years. Coupons are payable half-yearly in arrears, and the annual nominal coupon rate is 8%. The nominal redemption price is 102%. Coupon and redemption payments are indexed by reference to the value of a retail price index with a time lag of 6 months. The retail price index value in November 2016 was 185 and in May 2017 was 190. The issue price of the bond was such that, if the retail price index were to increase continuously at a rate of 2% pa from May 2017, a tax-exempt purchaser of the bond at the issue date would obtain a real yield of 3% pa convertible half-yearly. Show that the issue price of the bond is 146.85 per 100 nominal. [9]

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve the first image questions one by one i Calculate the present value of the dividend stream described above at a rate of interest of 8 per annum effective for an investor holding 100 shares o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started