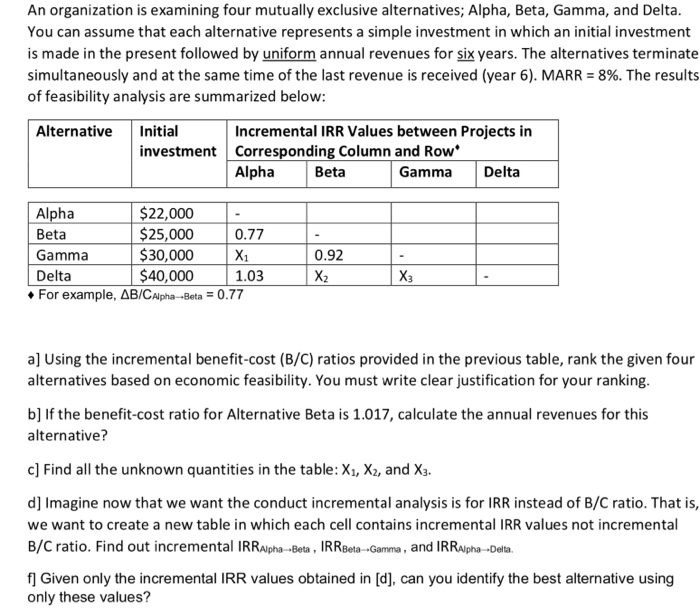

An organization is examining four mutually exclusive alternatives; Alpha, Beta, Gamma, and Delta You can assume that each alternative represents a simple investment in which an initial investment is made in the present followed by uniform annual revenues for six years. The alternatives terminate simultaneously and at the same time of the last revenue is received (year 6). MARR-896. The results of feasibility analysis are summarized below Alternative nitial Incremental IRR Values between Projects in investment Corresponding Column and Row Alpha Beta mma Delta $22,000 $25,000 0.77 30,000 X 40,000 1.03 Alpha Beta 0.92 Gamma Delta X2 X3 For example,AB/Capha-Beta-0.77 a] Using the incremental benefit-cost (B/C) ratios provided in the previous table, rank the given four alternatives based on economic feasibility. You must write clear justification for your ranking b] If the benefit-cost ratio for Alternative Beta is 1.017, calculate the annual revenues for this alternative? c] Find all the unknown quantities in the table: Xi, X, and X3. d] Imagine now that we want the conduct incremental analysis is for IRR instead of B/C ratio. That is, we want to create a new table in which each cell contains incremental IRR values not incremental B/C ratio. Find out incremental IRRAlpha Beta , IRRBeta Gamm, and IRRApha Deita. f Given only the incremental IRR values obtained in [d], can you identify the best alternative using only these values? An organization is examining four mutually exclusive alternatives; Alpha, Beta, Gamma, and Delta You can assume that each alternative represents a simple investment in which an initial investment is made in the present followed by uniform annual revenues for six years. The alternatives terminate simultaneously and at the same time of the last revenue is received (year 6). MARR-896. The results of feasibility analysis are summarized below Alternative nitial Incremental IRR Values between Projects in investment Corresponding Column and Row Alpha Beta mma Delta $22,000 $25,000 0.77 30,000 X 40,000 1.03 Alpha Beta 0.92 Gamma Delta X2 X3 For example,AB/Capha-Beta-0.77 a] Using the incremental benefit-cost (B/C) ratios provided in the previous table, rank the given four alternatives based on economic feasibility. You must write clear justification for your ranking b] If the benefit-cost ratio for Alternative Beta is 1.017, calculate the annual revenues for this alternative? c] Find all the unknown quantities in the table: Xi, X, and X3. d] Imagine now that we want the conduct incremental analysis is for IRR instead of B/C ratio. That is, we want to create a new table in which each cell contains incremental IRR values not incremental B/C ratio. Find out incremental IRRAlpha Beta , IRRBeta Gamm, and IRRApha Deita. f Given only the incremental IRR values obtained in [d], can you identify the best alternative using only these values