Answered step by step

Verified Expert Solution

Question

1 Approved Answer

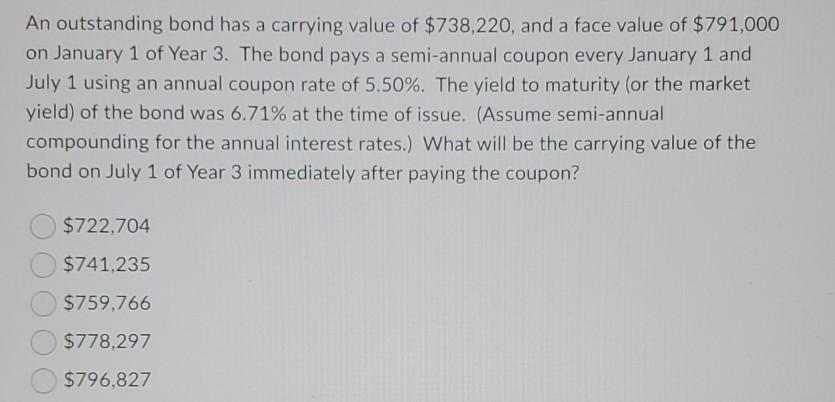

An outstanding bond has a carrying value of $738,220, and a face value of $791,000 on January 1 of Year 3. The bond pays a

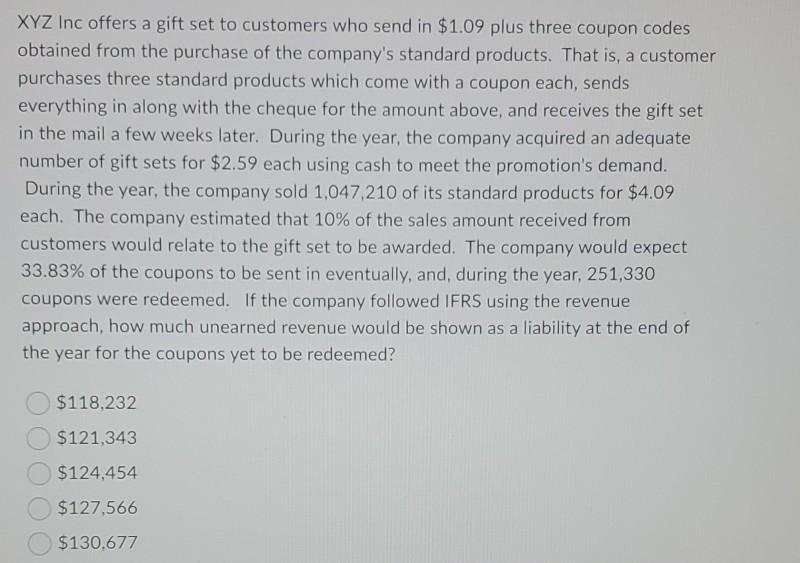

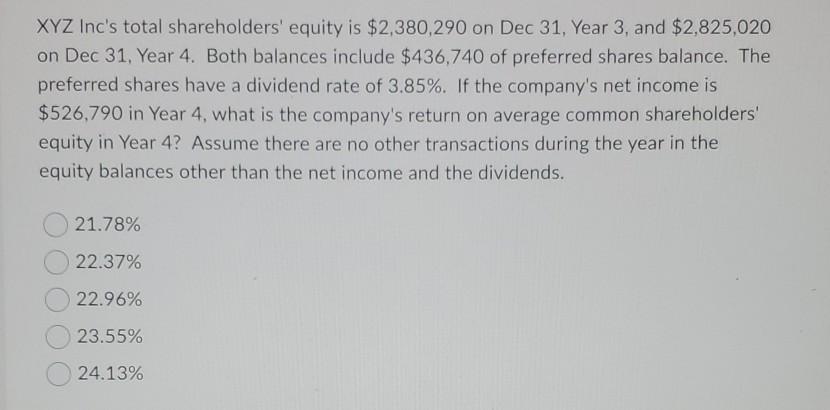

An outstanding bond has a carrying value of $738,220, and a face value of $791,000 on January 1 of Year 3. The bond pays a semi-annual coupon every January 1 and July 1 using an annual coupon rate of 5.50%. The yield to maturity (or the market yield) of the bond was 6.71% at the time of issue. (Assume semi-annual compounding for the annual interest rates.) What will be the carrying value of the bond on July 1 of Year 3 immediately after paying the coupon? $722,704 $741.235 $759.766 $778,297 $796,827 XYZ Inc offers a gift set to customers who send in $1.09 plus three coupon codes obtained from the purchase of the company's standard products. That is, a customer purchases three standard products which come with a coupon each, sends everything in along with the cheque for the amount above, and receives the gift set in the mail a few weeks later. During the year, the company acquired an adequate number of gift sets for $2.59 each using cash to meet the promotion's demand. During the year, the company sold 1,047,210 of its standard products for $4.09 each. The company estimated that 10% of the sales amount received from customers would relate to the gift set to be awarded. The company would expect 33.83% of the coupons to be sent in eventually, and during the year, 251,330 coupons were redeemed. If the company followed IFRS using the revenue approach, how much unearned revenue would be shown as a liability at the end of the year for the coupons yet to be redeemed? $118,232 $121,343 $124.454 $127,566 $130.677 XYZ Inc's total shareholders' equity is $2,380,290 on Dec 31, Year 3, and $2,825,020 on Dec 31, Year 4. Both balances include $436,740 of preferred shares balance. The preferred shares have a dividend rate of 3.85%. If the company's net income is $526,790 in Year 4. what is the company's return on average common shareholders' equity in Year 4? Assume there are no other transactions during the year in the equity balances other than the net income and the dividends. 21.78% 22.37% 22.96% 23.55% 24.13%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started