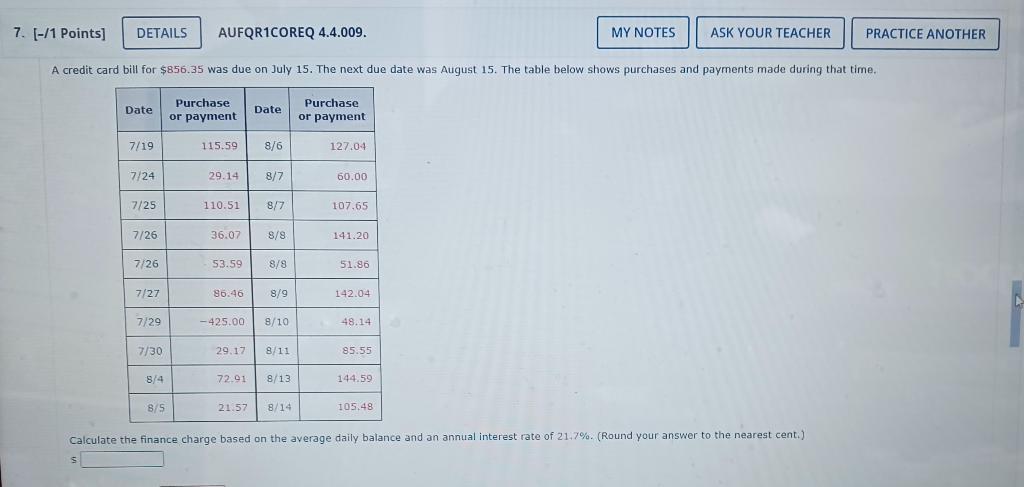

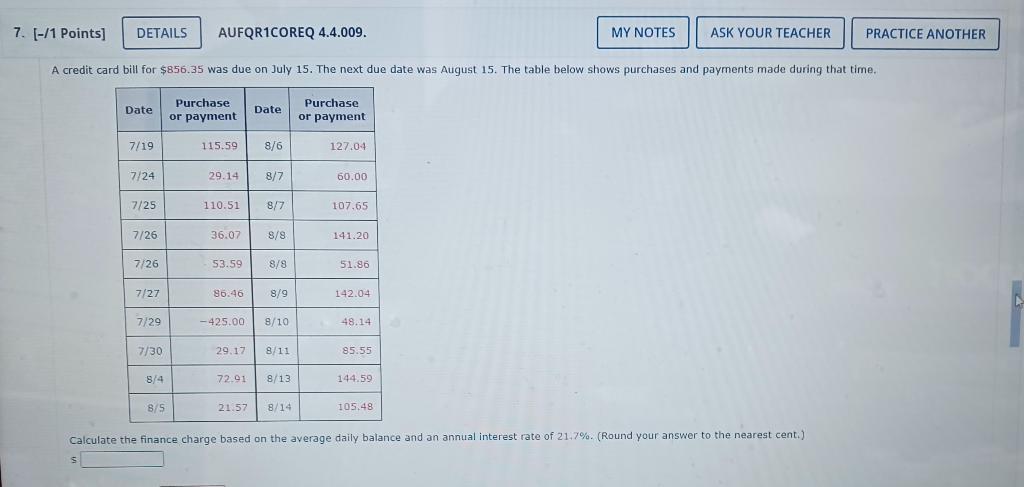

An unpaid credit card bill for $878.25 had a due date of February 10. Purchases of $187.67 were made on February 15,$404.58 on February 16 , $11.80 on February 18 , and $63.21 was charged on February 25. A payment of $355 was made on March 2. The annual interest on the average daily balance is 18.6%. Find the finance charge (in dollars) on the March 10 bill. Assume it is a non-leap year. (Round your answer to the nearest cent.) AUFQR1COREQ 4.4.007. A landscape architect accrued $7,869.57 in credit card debt. If the architect makes a monthly payment of $600 (and makes no additional charges on the account), how many months will it take to repay the debt if the annual interest rate on the credit card is 18.2% ? (Round your answer up to the nearest month.) months A career counselor decides to make monthly payments of $150 on credit card debt of $3,503.58 and discontinue using that credit card. Assuming the monthly interest rate is 1.65%, it will take the counselor approximately 30 months to repay the debt. How many fewer months would it take to repay the debt if the counselor makes monthly payments of $200 ? (Round your answer to the nearest month.) months AUFQR1COREQ 4.4.009. A credit card bill for $856.35 was due on July 15 . The next due date was August 15 . The table below shows purchases and payments made durin Calculate the finance charge based on the average daily balance and an annual interest rate of 21,7%. (Round your answer to the nearest cent.) answer to the nearest cent.) Suppose Olivia has $6,660 in credit card debt on the VB credit card which has annual interest rate of 18.4%. Olivia is considering transferring her debt to the LA credit card that offers 0% interest for 18 months. (a) If Olivia makes a payment of $370 per month on the VB credit card, what will her balance be at the end of 18 months? Assume that no additional charges are made the card. (Suggestion: You are trying to find the future value of a debt that has a present value of $6,660. Use the formula for the future value of an ordinary annuity. Round your answer to the nearest cent.) $ (b) If Olivia makes a payment of $370 per month on the LA credit card, what will her balance be at the end of 18 months? Assume that no additional charges are made to the card. (Suggestion: None of the payment goes to interest on the debt. Round your answer to the nearest cent.) (c) How much lower is the balance due after 18 months on the LA credit card? Note: Some credit card companies may charge a transfer fee which will affect the benefit of a 0% introductory rate. Assume that there is not a transfer fee. (Round your answer to the nearest cent.) after 1 year if he takes advantage of this option? Assume he makes no other purchases with the card. (Round your answer to the nearest cent.) An unpaid credit card bill for $878.25 had a due date of February 10. Purchases of $187.67 were made on February 15,$404.58 on February 16 , $11.80 on February 18 , and $63.21 was charged on February 25. A payment of $355 was made on March 2. The annual interest on the average daily balance is 18.6%. Find the finance charge (in dollars) on the March 10 bill. Assume it is a non-leap year. (Round your answer to the nearest cent.) AUFQR1COREQ 4.4.007. A landscape architect accrued $7,869.57 in credit card debt. If the architect makes a monthly payment of $600 (and makes no additional charges on the account), how many months will it take to repay the debt if the annual interest rate on the credit card is 18.2% ? (Round your answer up to the nearest month.) months A career counselor decides to make monthly payments of $150 on credit card debt of $3,503.58 and discontinue using that credit card. Assuming the monthly interest rate is 1.65%, it will take the counselor approximately 30 months to repay the debt. How many fewer months would it take to repay the debt if the counselor makes monthly payments of $200 ? (Round your answer to the nearest month.) months AUFQR1COREQ 4.4.009. A credit card bill for $856.35 was due on July 15 . The next due date was August 15 . The table below shows purchases and payments made durin Calculate the finance charge based on the average daily balance and an annual interest rate of 21,7%. (Round your answer to the nearest cent.) answer to the nearest cent.) Suppose Olivia has $6,660 in credit card debt on the VB credit card which has annual interest rate of 18.4%. Olivia is considering transferring her debt to the LA credit card that offers 0% interest for 18 months. (a) If Olivia makes a payment of $370 per month on the VB credit card, what will her balance be at the end of 18 months? Assume that no additional charges are made the card. (Suggestion: You are trying to find the future value of a debt that has a present value of $6,660. Use the formula for the future value of an ordinary annuity. Round your answer to the nearest cent.) $ (b) If Olivia makes a payment of $370 per month on the LA credit card, what will her balance be at the end of 18 months? Assume that no additional charges are made to the card. (Suggestion: None of the payment goes to interest on the debt. Round your answer to the nearest cent.) (c) How much lower is the balance due after 18 months on the LA credit card? Note: Some credit card companies may charge a transfer fee which will affect the benefit of a 0% introductory rate. Assume that there is not a transfer fee. (Round your answer to the nearest cent.) after 1 year if he takes advantage of this option? Assume he makes no other purchases with the card. (Round your answer to the nearest cent.)