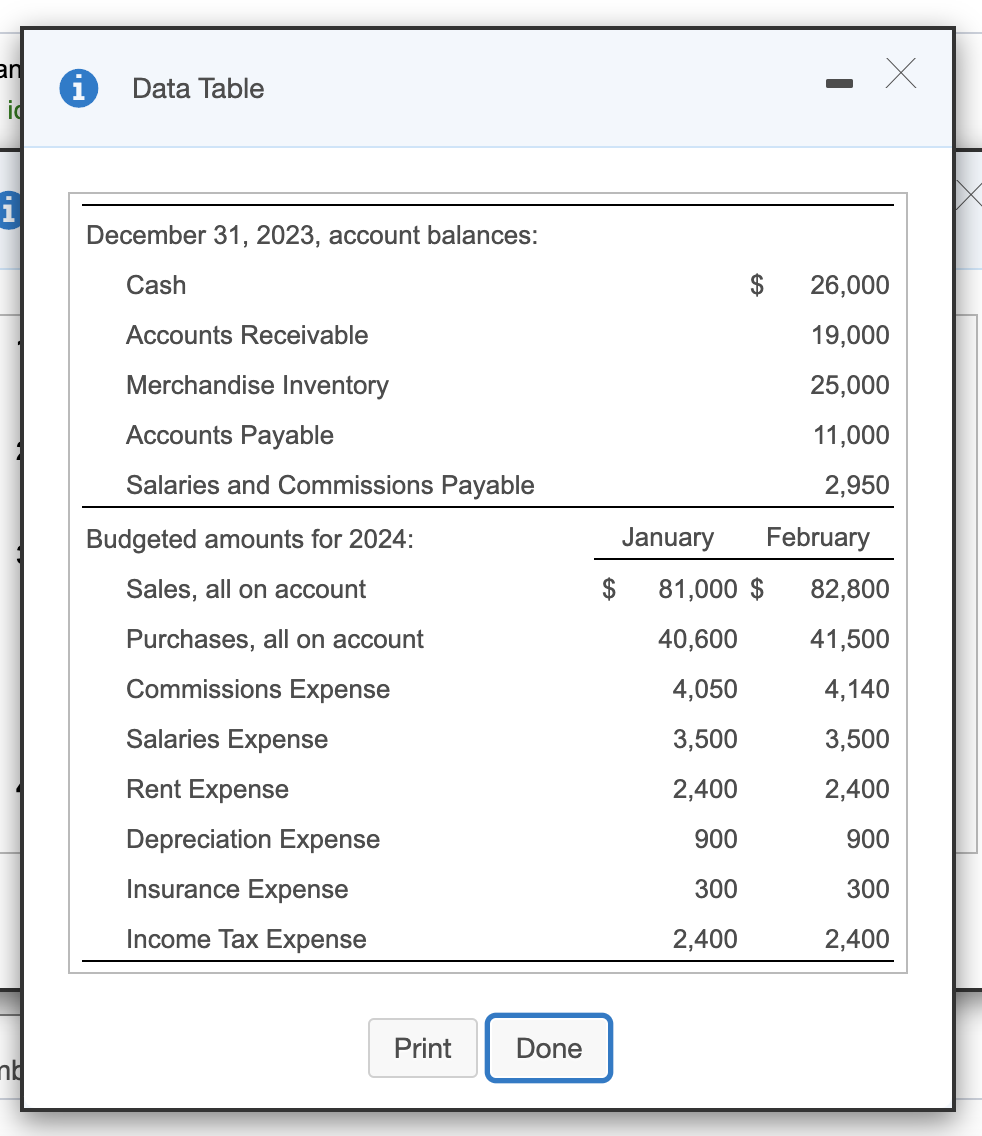

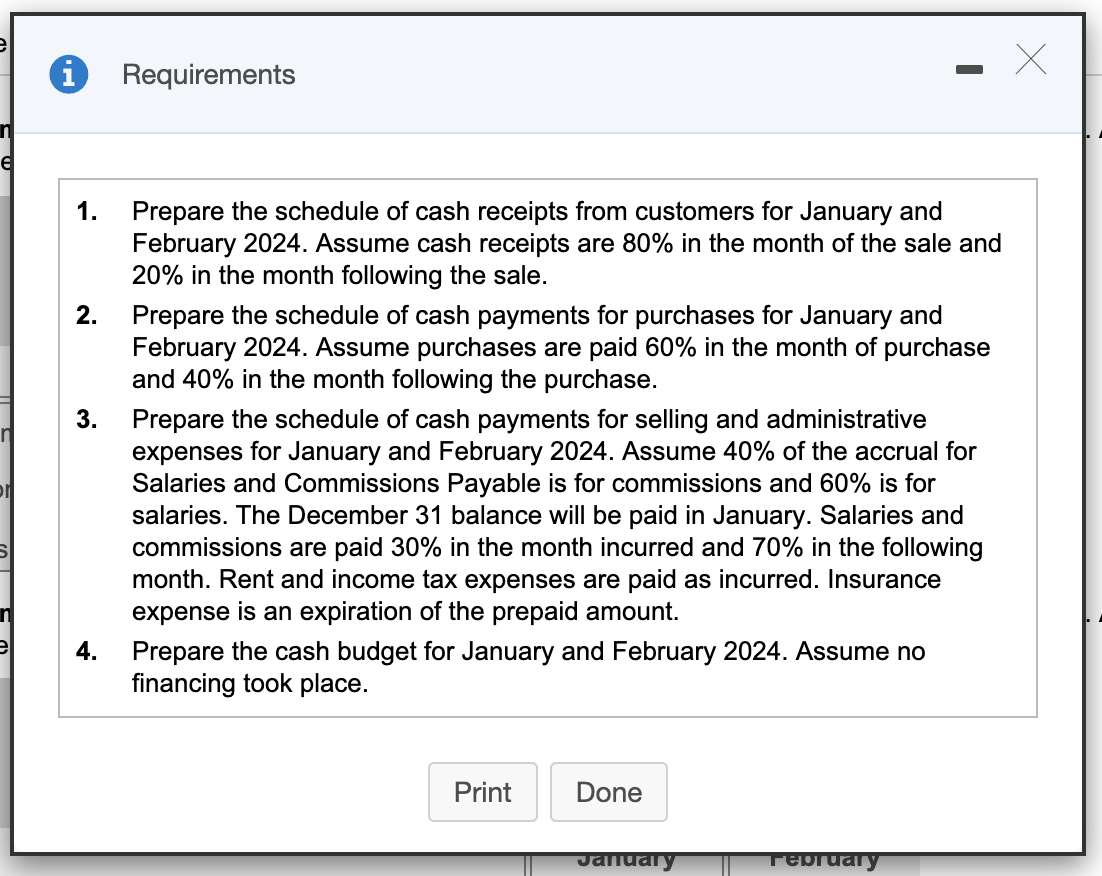

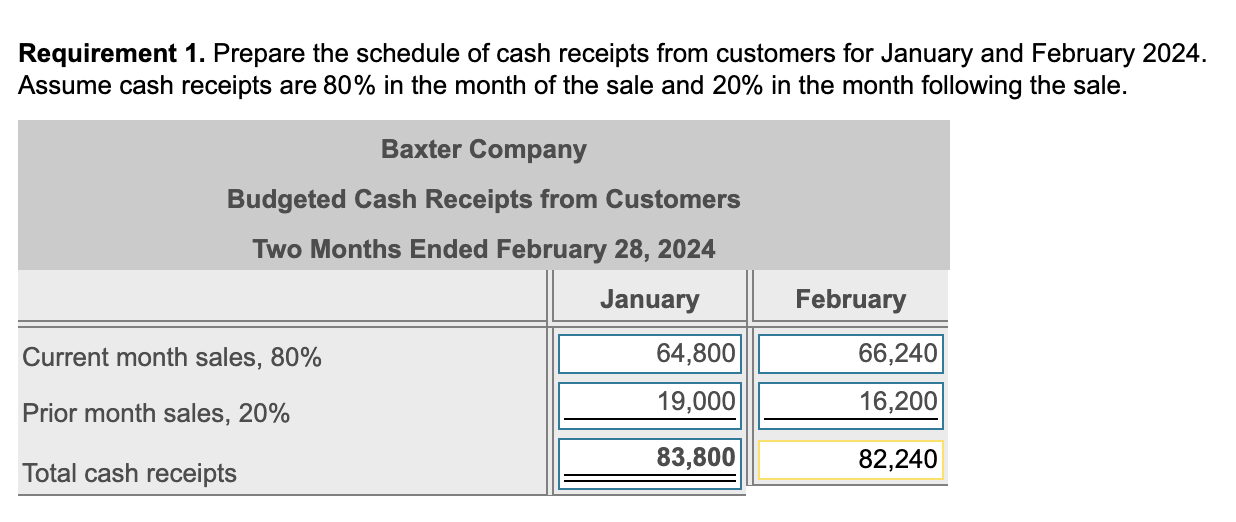

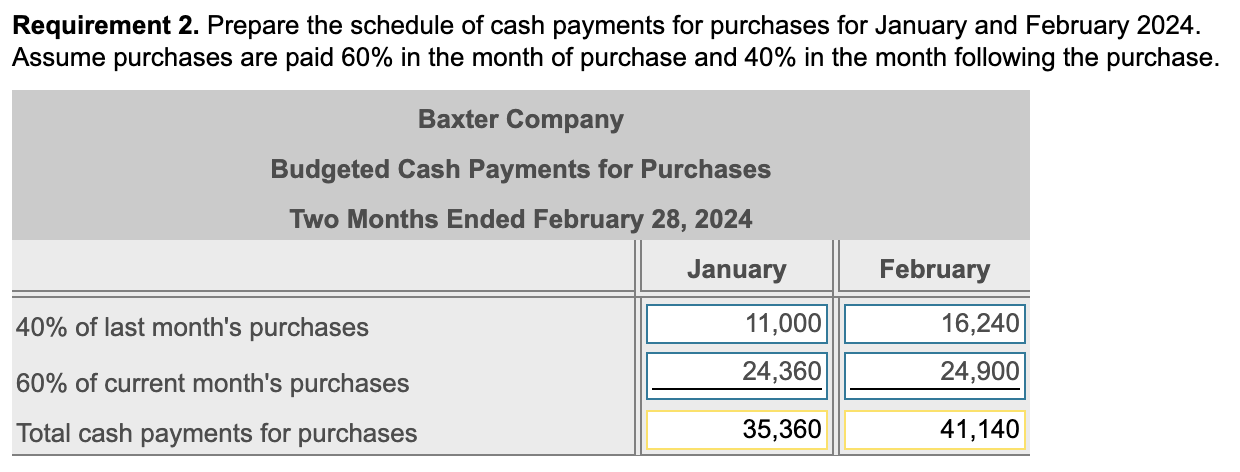

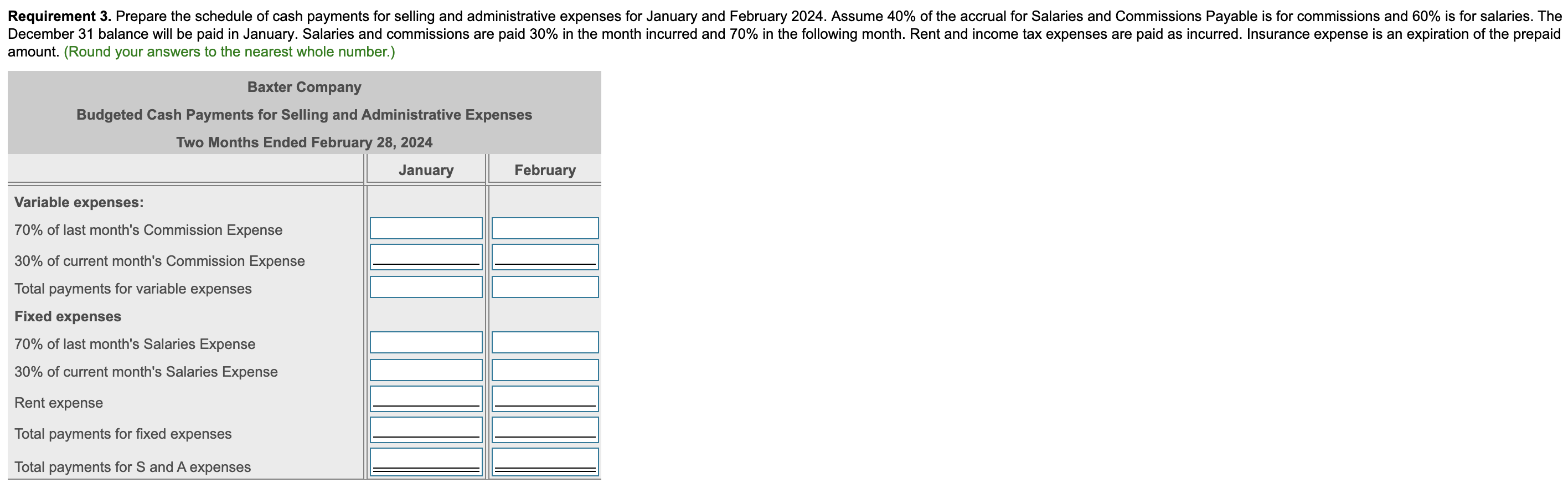

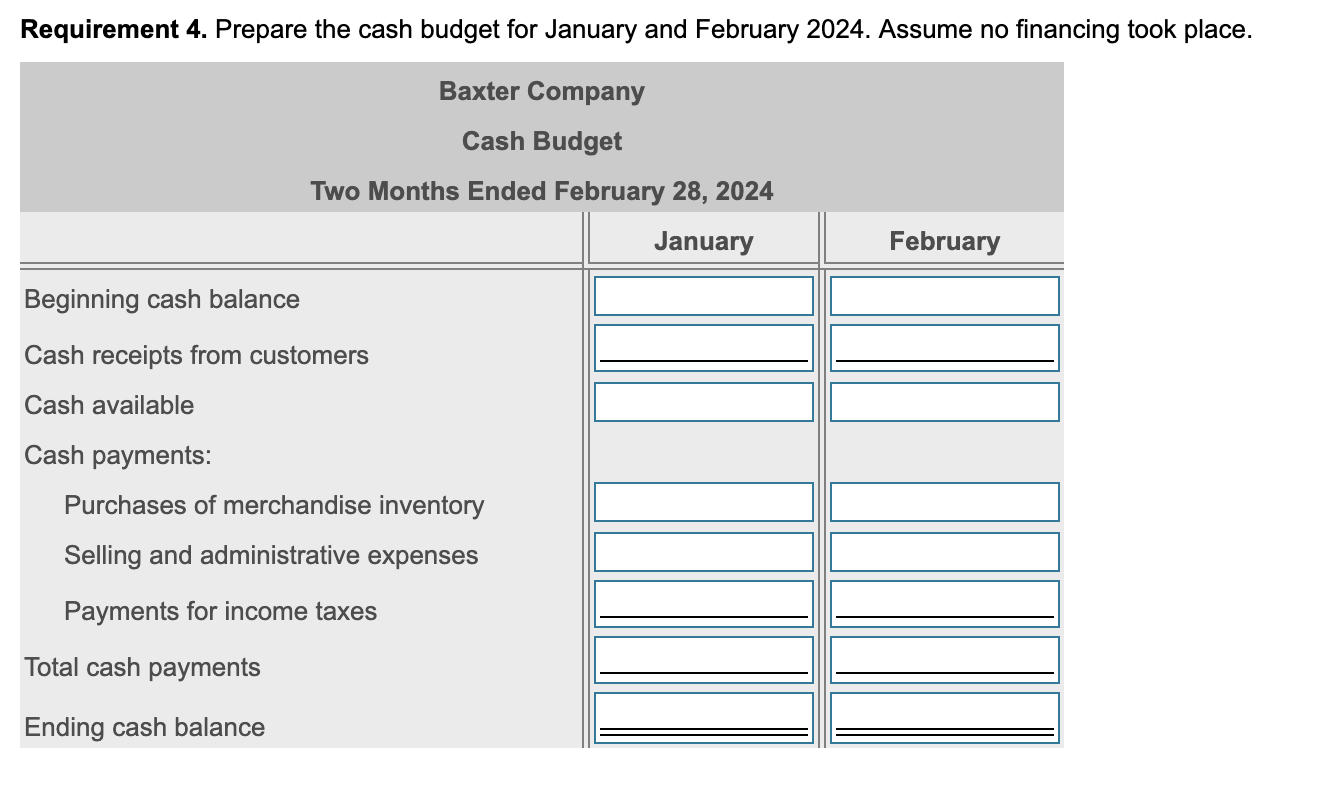

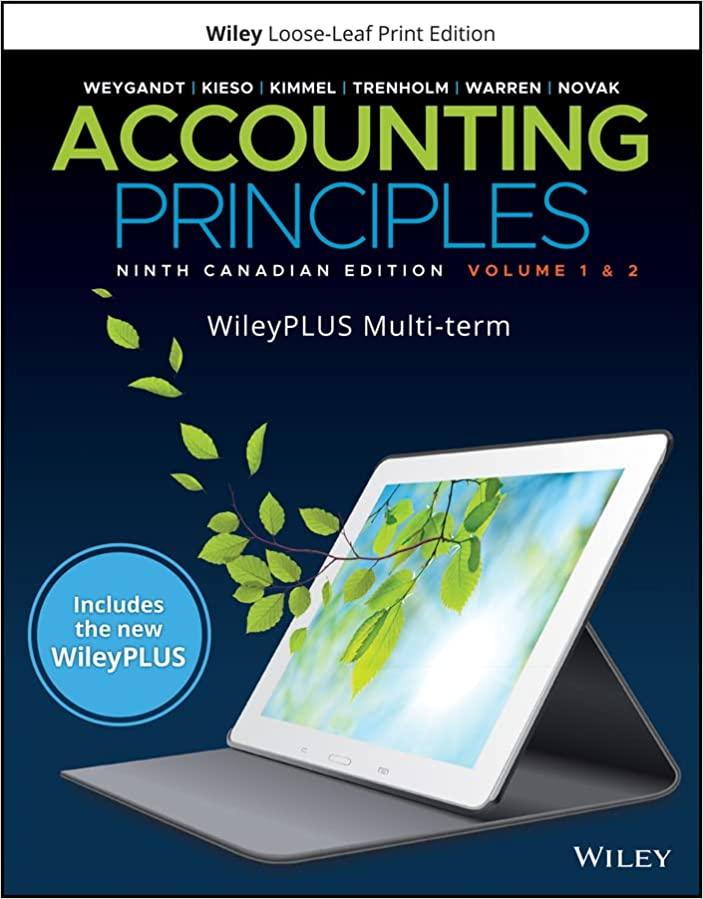

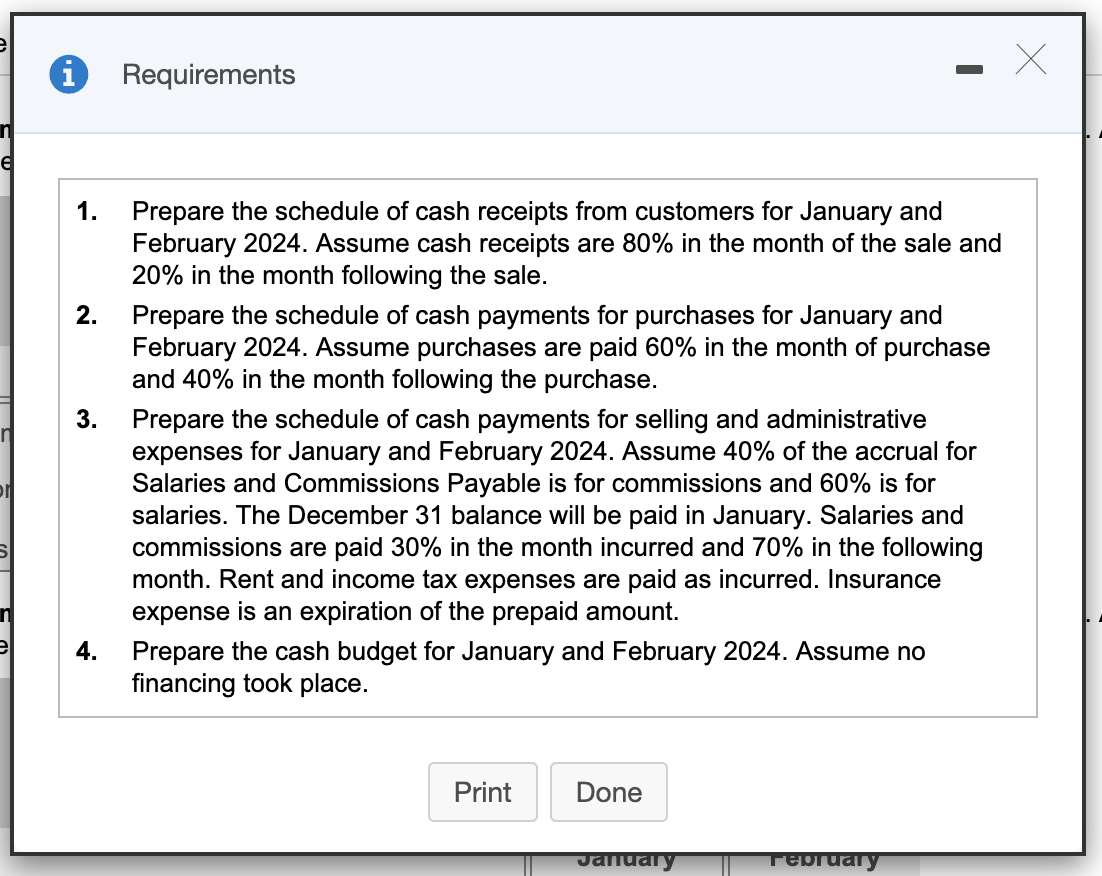

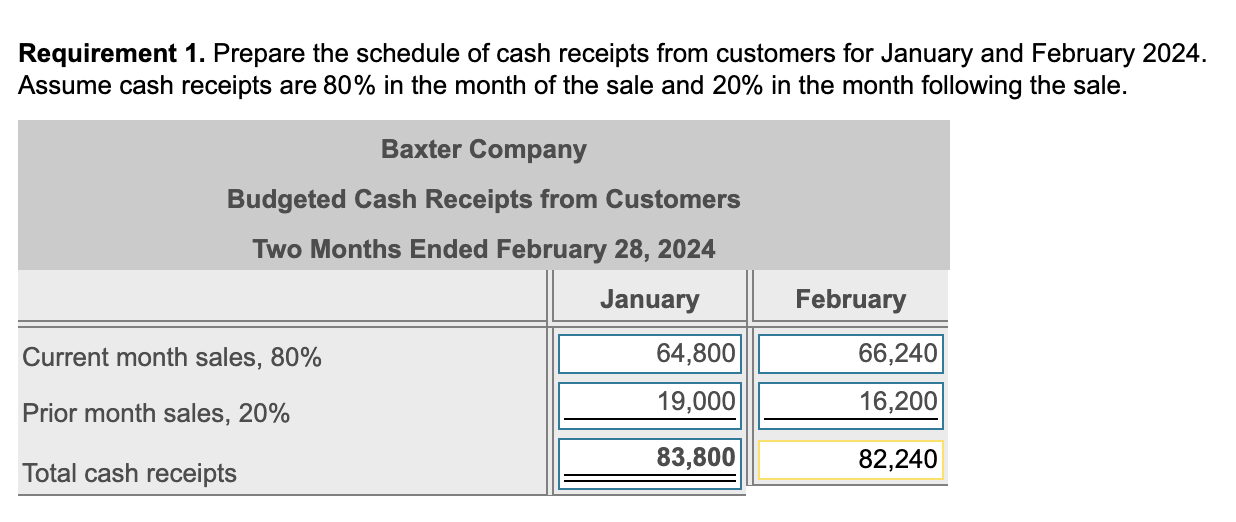

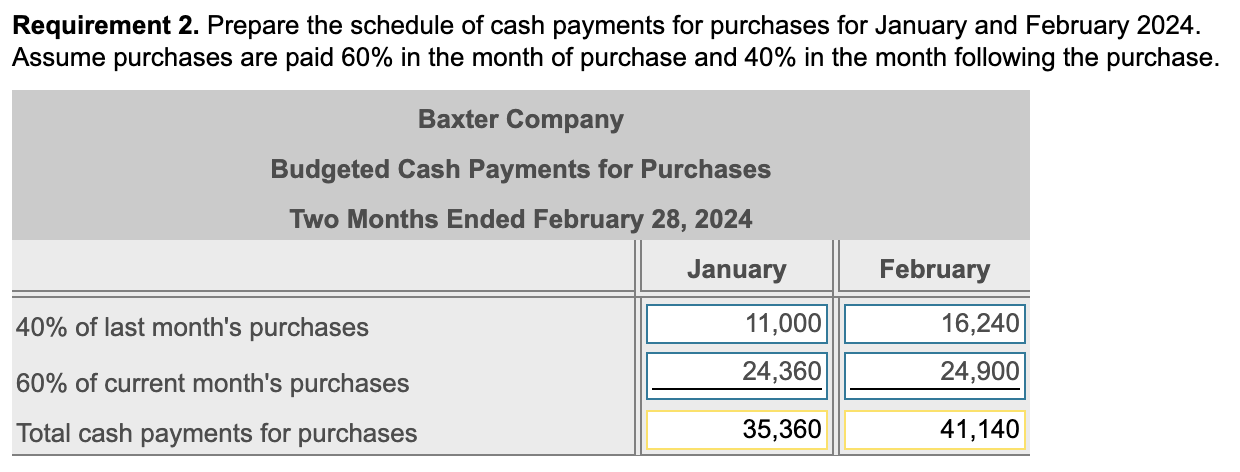

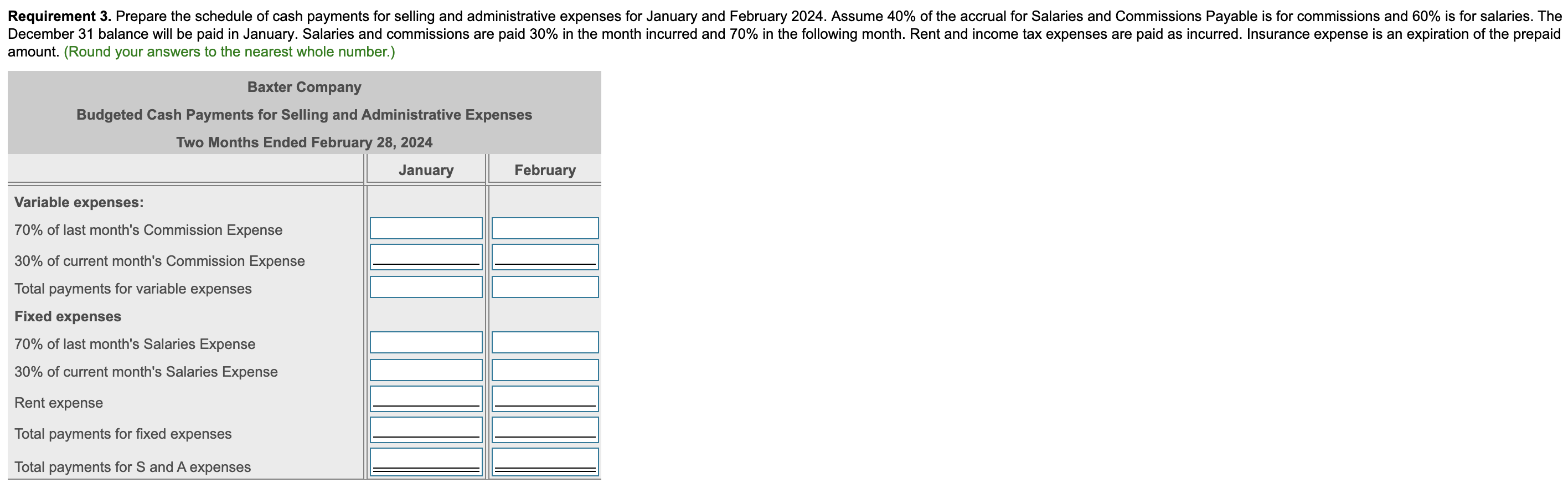

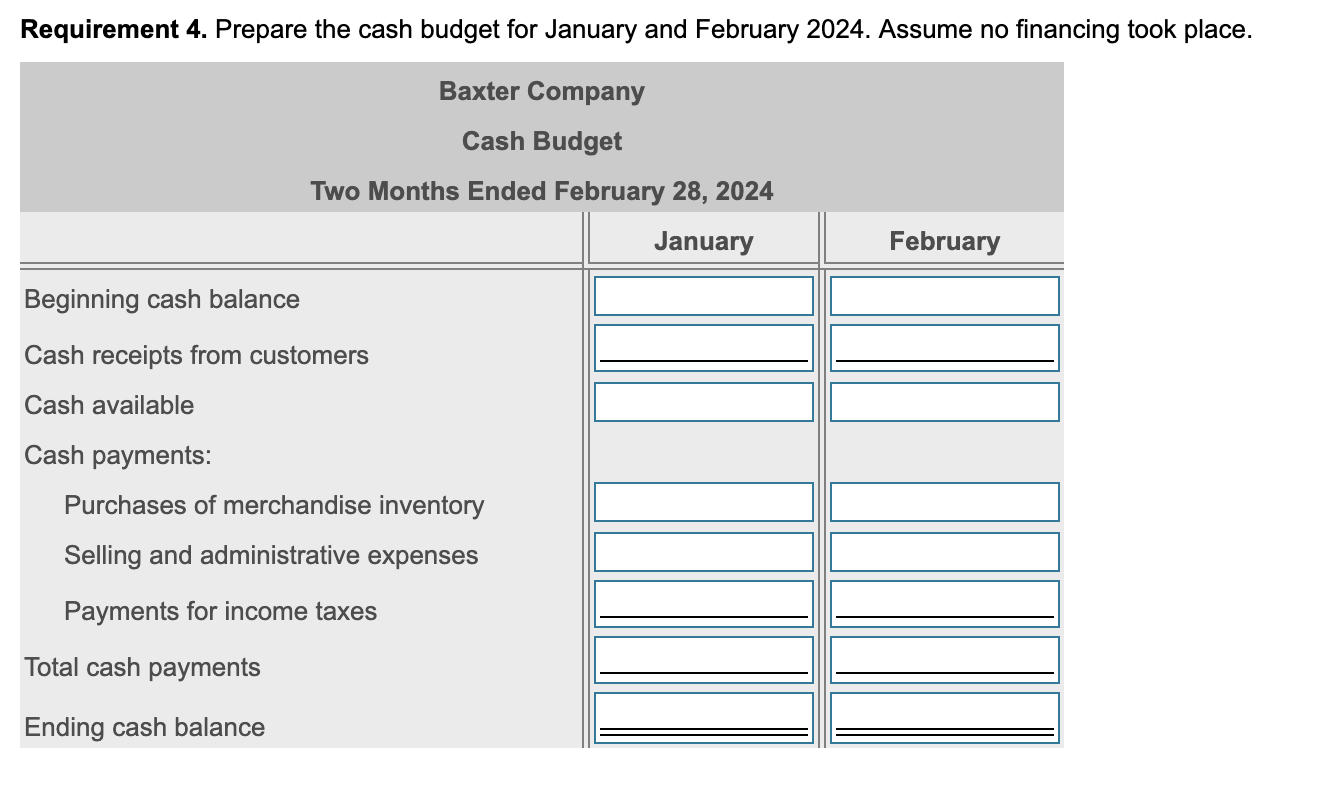

an X Data Table id 1 December 31, 2023, account balances: Cash 26,000 Accounts Receivable 19,000 25,000 Merchandise Inventory Accounts Payable 11,000 Salaries and Commissions Payable 2,950 Budgeted amounts for 2024: Sales, all on account Purchases, all on account January February $ 81,000 $ 82,800 40,600 41,500 Commissions Expense 4,050 4,140 Salaries Expense 3,500 3,500 2,400 Rent Expense 2,400 Depreciation Expense 900 900 Insurance Expense 300 300 Income Tax Expense 2,400 2,400 Print Done nd X i Requirements 1. 2. 3. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts are 80% in the month of the sale and 20% in the month following the sale. Prepare the schedule of cash payments for purchases for January and February 2024. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid amount. Prepare the cash budget for January and February 2024. Assume no financing took place. 4. Print Done January Teoruary Requirement 1. Prepare the schedule of cash receipts from customers for January and February 2024. Assume cash receipts are 80% in the month of the sale and 20% in the month following the sale. Baxter Company Budgeted Cash Receipts from Customers Two Months Ended February 28, 2024 January February Current month sales, 80% 64,800 66,240 Prior month sales, 20% 19,000 16,200 83,800 82,240 Total cash receipts Requirement 2. Prepare the schedule of cash payments for purchases for January and February 2024. Assume purchases are paid 60% in the month of purchase and 40% in the month following the purchase. Baxter Company Budgeted Cash Payments for Purchases Two Months Ended February 28, 2024 January February 40% of last month's purchases 11,000 16,240 60% of current month's purchases 24,360 24,900 Total cash payments for purchases 35,360 41,140 Requirement 3. Prepare the schedule of cash payments for selling and administrative expenses for January and February 2024. Assume 40% of the accrual for Salaries and Commissions Payable is for commissions and 60% is for salaries. The December 31 balance will be paid in January. Salaries and commissions are paid 30% in the month incurred and 70% in the following month. Rent and income tax expenses are paid as incurred. Insurance expense is an expiration of the prepaid amount. (Round your answers to the nearest whole number.) Baxter Company Budgeted Cash Payments for Selling and Administrative Expenses Two Months Ended February 28, 2024 January February Variable expenses: 70% of last month's Commission Expense 30% of current month's Commission Expense Total payments for variable expenses Fixed expenses 70% of last month's Salaries Expense 30% of current month's Salaries Expense Rent expense Total payments for fixed expenses Total payments for S and A expenses Requirement 4. Prepare the cash budget for January and February 2024. Assume no financing took place. Baxter Company Cash Budget Two Months Ended February 28, 2024 January February Beginning cash balance Cash receipts from customers Cash available Cash payments: Purchases of merchandise inventory Selling and administrative expenses Payments for income taxes Total cash payments Ending cash balance