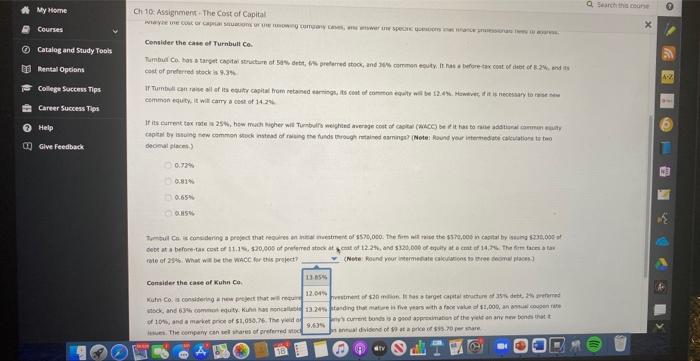

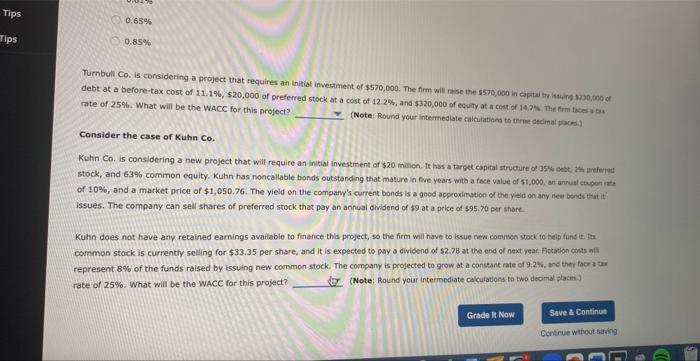

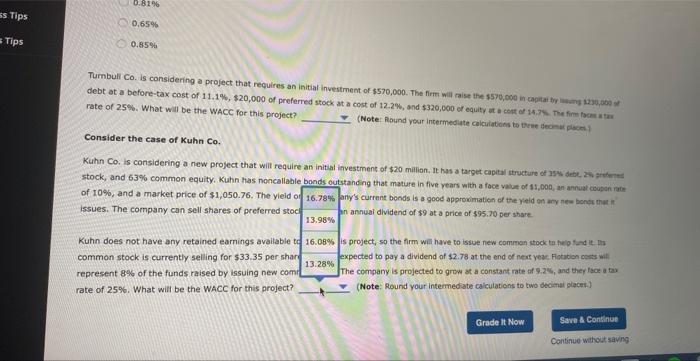

an-16-7ssignment - The Cost of Capital Consider the case elf Turnbult Co. cost of preferted sbeck is 9.3\% eemmsn equth. it wit camp. bese of 14.20. secoat piaces.) 0.72+1 Q.81* Q.654 a85\% fale of 25% : What w il be the wacc for bis proket? Consider the case of Kuhn Ca. B.6ses 0.85% Turnbuli Co. is considering a project that requires an initiaf invectment of $570,000. The firm will rase the 5570,000 in canita by itriarin trio kio of debt at a before-tax cost of 11.1%,$20,000 af preferred stock at a cost of 12.2%, and $320,000 of ecuity at a ceat of 14,74 The frmi hacs a tas rate of 25%. What will be the WACC for this project? (Note: Round your inteimediate calculatiand to thre decimal pishes) Consider the case of Kuhn Co. Kuhn Co. Is considering a new project that will require an initial investment of $20 minicn. It has a target eapital structurt of 35% sest, zes srefered stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in five years with a face value af si.000, an annui ctusen izo of 10%, and a market price of $1,050.76. The yield on the compam's current bonds is a gocd approximation or the yeld on any hee bonde that it" issues. The company can sell shares of preferred stock that pay an annual dividend of $9 at a price of $95. 70 per share. Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue riew comnson stock to telp funt it. tai common stock is currently seling for $33.35 per share, and it is expected to pay a dividend of $2.78 at the end of next year, Fiscation costs nit represent 8% of the funds raised by issuing new common. stock. The company is projected to grow at a constant rate of 9.2. rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calcuiations ta bwo deomel places.) 0,65% 0.85% debt at a before-tax cost of 11.1%,$20,000 of preferred stock at a cost of 12.2%,3 and $320,000 of equity at a cost ef 15,74 The fine fock a tin rate of 25%. What will be the WACC for this project? Consider the case of Kuhn Co. Kuhn Co, is considering-a new project that will require an initial iavestment of $20 million, it has a target capitai itructure of as\% sete. 24 sirkies stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in five years with a face vasue of 13,000 , an annual wupch rati of 10%, and a market price of $1,050.76. The yleid of 16.78% any's current bonds is a good apprownation of the yeld on any new bonde thet in issues. The company can sell shares of preferred stoc, 13.98% ph annual dividend of $9 at a price of $95,70 per share rate of 25%. What will be the WACC for this project? (Note: Round your intemedate Calculations to two decialal glaces.)