Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anakin and Renee are married filing jointly. They sold stock that they held for 7 months for $40,000. Their basis in the stock was $2,000.

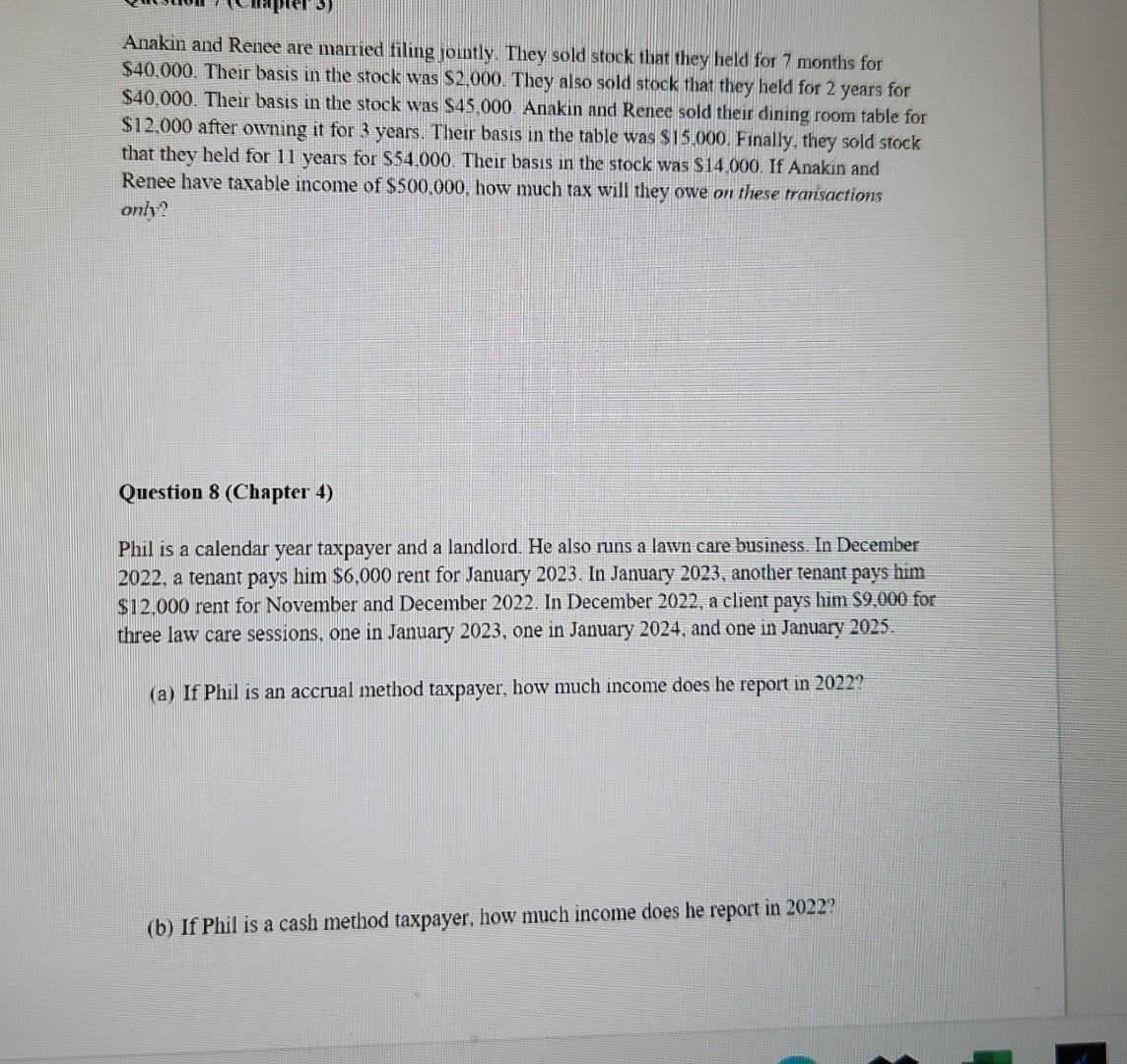

Anakin and Renee are married filing jointly. They sold stock that they held for 7 months for $40,000. Their basis in the stock was $2,000. They also sold stock that they held for 2 years for $40,000. Their basis in the stock was $45,000. Anakin and Renee sold their dining room table for $12,000 after owning it for 3 years. Their basis in the table was $15,000. Finally, they sold stock that they held for 11 years for $54,000. Their basis in the stock was $14,000. If Anakin and Renee have taxable income of $500,000. how much tax will they owe on these transactions only? Question 8 (Chapter 4) Phil is a calendar year taxpayer and a landlord. He also runs a lawn care business. In December 2022, a tenant pays him $6,000 rent for January 2023. In January 2023, another tenant pays him $12,000 rent for November and December 2022. In December 2022, a client pays him $9,000 for three law care sessions, one in January 2023, one in January 2024, and one in January 2025. (a) If Phil is an accrual method taxpayer, how much income does he report in 2022? (b) If Phil is a cash method taxpayer, how much income does he report in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started