Answered step by step

Verified Expert Solution

Question

1 Approved Answer

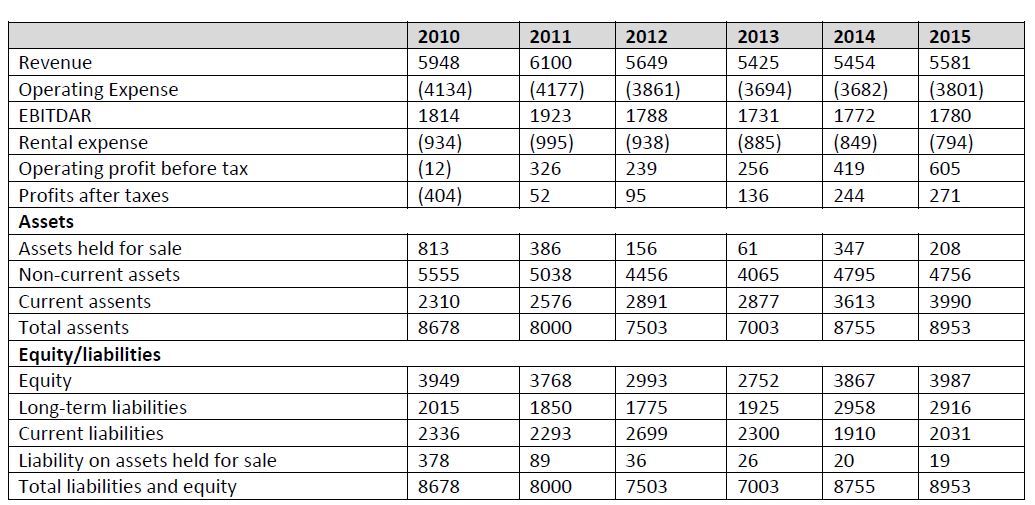

Analyse Accor's financial performance by conducting an appropriate financial ratio analysis based on the information provided in the case study exhibits. Clearly illustrate your formulas

Analyse Accor's financial performance by conducting an appropriate financial ratio analysis based on the information provided in the case study exhibits. Clearly illustrate your formulas and calculations to justify your conclusions.

2010 2011 2012 2013 2014 2015 Revenue 5948 6100 5649 5425 5454 5581 Operating Expense (4134) (4177) (3861) (3694) (3682) (3801) EBITDAR 1814 1923 1788 1731 1772 1780 Rental expense (934) (995) (938) (885) (849) (794) Operating profit before tax (12) 326 239 256 419 605 Profits after taxes (404) 52 95 136 244 271 Assets Assets held for sale Non-current assets Current assents Total assents 813 386 156 61 347 208 5555 5038 4456 4065 4795 4756 2310 2576 2891 2877 3613 3990 8678 8000 7503 7003 8755 8953 Equity/liabilities Equity 3949 3768 2993 2752 3867 3987 Long-term liabilities 2015 1850 1775 1925 2958 2916 Current liabilities 2336 2293 2699 2300 1910 2031 Liability on assets held for sale 378 89 36 26 20 19 Total liabilities and equity 8678 8000 7503 7003 8755 8953

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started