Analyse the three most recent year common-size balance sheet of McDonald and indicate the following:

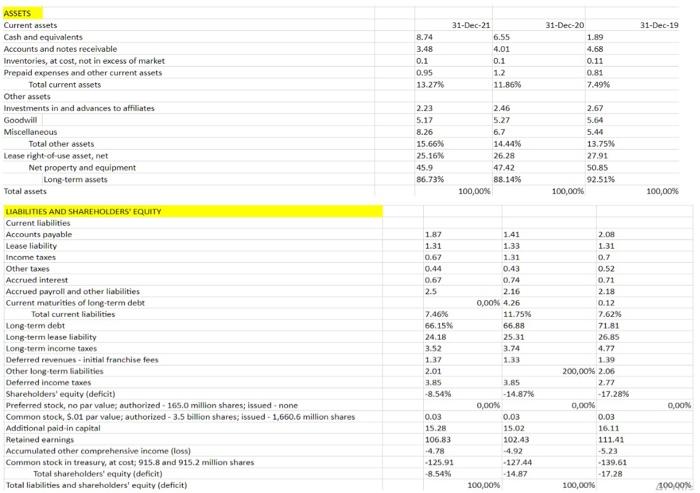

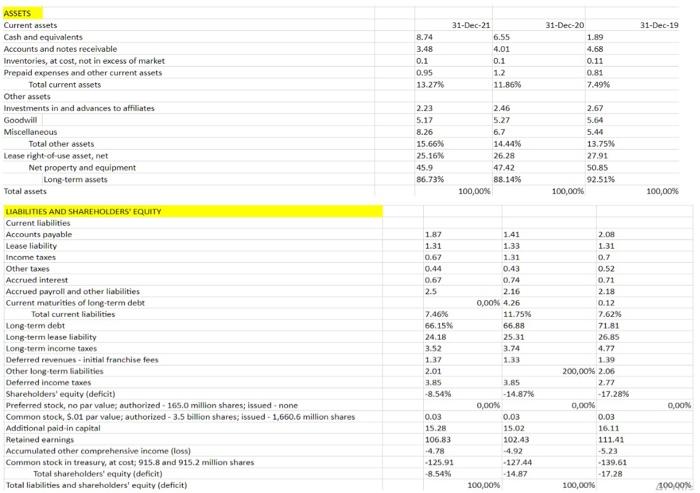

ASSETS Current assets Cash and equivalents Accounts and notes receivable Inventories, at cost, not in excess of market Prepaid expenses and other current assets Total current assets Other assets Investments in and advances to affiliates Goodwill Miscellaneous Total other assets. Lease right-of-use asset, net Net property and equipment Long-term assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Lease liability Income taxes Other taxes Accrued interest Accrued payroll and other liabilities Current maturities of long-term debt Total current liabilities Long-term debt Long-term lease liability Long-term income taxes Deferred revenues-initial franchise fees Other long-term liabilities Deferred income taxes Shareholders' equity (deficit) Preferred stock, no par value; authorized - 165.0 million shares; issued-none Common stock, $.01 par value; authorized-3.5 billion shares; issued-1,660.6 million shares Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Common stock in treasury, at cost; 915.8 and 915.2 million shares Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 31-Dec-21 8.74 3.48 0.1 0.95 13.27% 2.23 5.17 8.26 15.66% 25.16% 45.9 86.73% 1.87 1.31 0.67 0.44 0.67 2.5 7.46% 66.15% 24.18 3.52 1.37 2.01 3.85 -8.54% 0.03 15.28 106.83 -4.78 -125.91 -8.54% 6.55 4.01 0.1 1.2 11.86% 2.46 5.27 6.7 14.44% 26.28 47.42 88.14% 1.41 1.33 1.31 0.43 0.74 2.16 0,00% 4.26 100,00% 0,00% 100,00% 11.75% 66.88 25.31 3.74 1.33 3.85 -14.87% 0.03 15.02 102.43 -4.92 -127,44 -14.87 31-Dec-20 1.89 4.68 0.11 0.81 7.49% 2.67 5.64 5.44 13.75% 27.91 50.85 92.51% 2.08 1.31 0.7 0.52 0.71 2.18 0.12 7.62% 71.81 26.85 4.77 1.39 200,00% 2.06 2.77 -17.28% 0,00% 0.03 16.11 111.41 -5.23 -139.61 -17.28 100,00% 100,00% 31-Dec-19 100,00% 0,00% 100,00% and indicate the following: o The amount of total current assets; o The amount of total non-current assets; The amount of total current liabilities; o o The amount of total non-current liabilities; o The amount of total stockholders' equity. Note whether this was an increase, a decrease, or no change from the previous year's income statement for each area. Besides, you should better compare it with the industry average or its direct competitor