Answered step by step

Verified Expert Solution

Question

1 Approved Answer

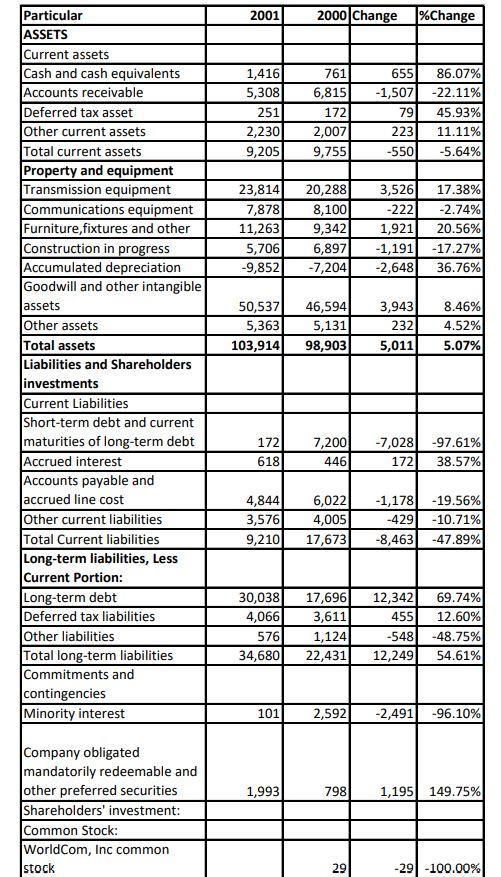

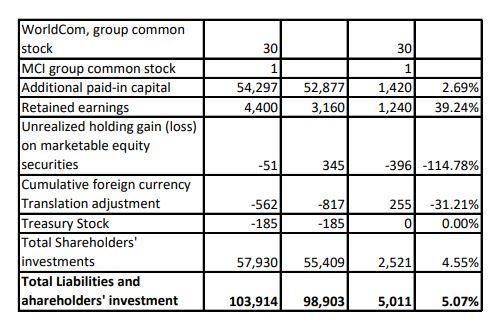

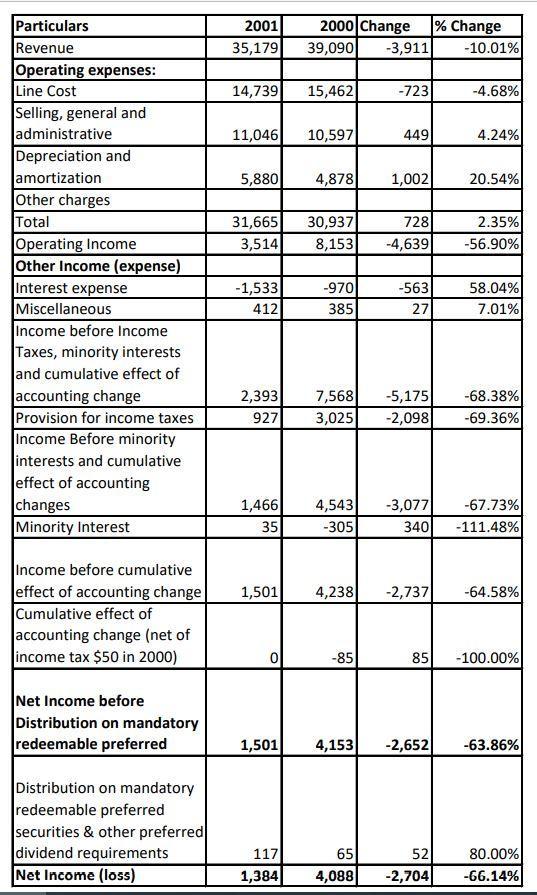

Analyse the WorldCom Consolidated Balance Sheet and Consolidated Statement of Operations1 for FY20 01 using the analytical methods below and discuss any material red flags

Analyse the WorldCom Consolidated Balance Sheet and Consolidated Statement of Operations1 for FY20 01 using the analytical methods below and discuss any material red flags identified by each analytical method. Please show all calculations. The analytical methods are:

M-scores using both the five variable and eight variable models.

Balance Sheets

Statement of Operations

Particular 2001 2000 Change %Change ASSETS Current assets Cash and cash equivalents Accounts receivable Deferred tax asset 655 1,416 5,308 251 86.07% -22.11% 45.93% 761 6,815 -1,507 172 79 2,230 9,205 2,007 9,755 Other current assets 223 11.11% Total current assets -550 -5.64% Property and equipment Transmission equipment Communications equipment Furniture,fixtures and other Construction in progress Accumulated depreciation Goodwill and other intangible 23,814 7,878 11,263 5,706 20,288 8,100 9,342 6,897 -7,204| 3,526 -222 1,921 17.38% -2.74% 20.56% -17.27% 36.76% -1,191 -2,648 -9,852 assets 50,537 5,363 103,914 46,594 5,131 98,903 3,943 8.46% 4.52% lother assets 232 Total assets 5,011 5.07% Liabilities and Shareholders investments Current Liabilities Short-term debt and current maturities of long-term debt Accrued interest Accounts payable and accrued line cost Other current liabilities Total Current liabilities Long-term liabilities, Less Current Portion: Long-term debt Deferred tax liabilities Other liabilities Total long-term liabilities Commitments and contingencies Minority interest 7,200 446 -7,028 -97.61% 38.57% 172 618 172 4,844 3,576 9,210 6,022 4,005 17,673 -1,178 -429 -19.56% -10.71% -8,463 -47.89% 69.74% 12.60% 17,696 3,611 1,124 22,431 12,342 455 30,038 4,066 -548 -48.75% 54.61% 576 34,680 12,249 101 2,592 -2,491 -96.10% Company obligated mandatorily redeemable and other preferred securities Shareholders' investment: Common Stock: WorldCom, Inc common stock 1,993 798 1,195 149.75% 29 -29 -100.00%

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

RATIO ANALYSIS Pt for the purpose of analysis of financial statements the most important tools to be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started