Answered step by step

Verified Expert Solution

Question

1 Approved Answer

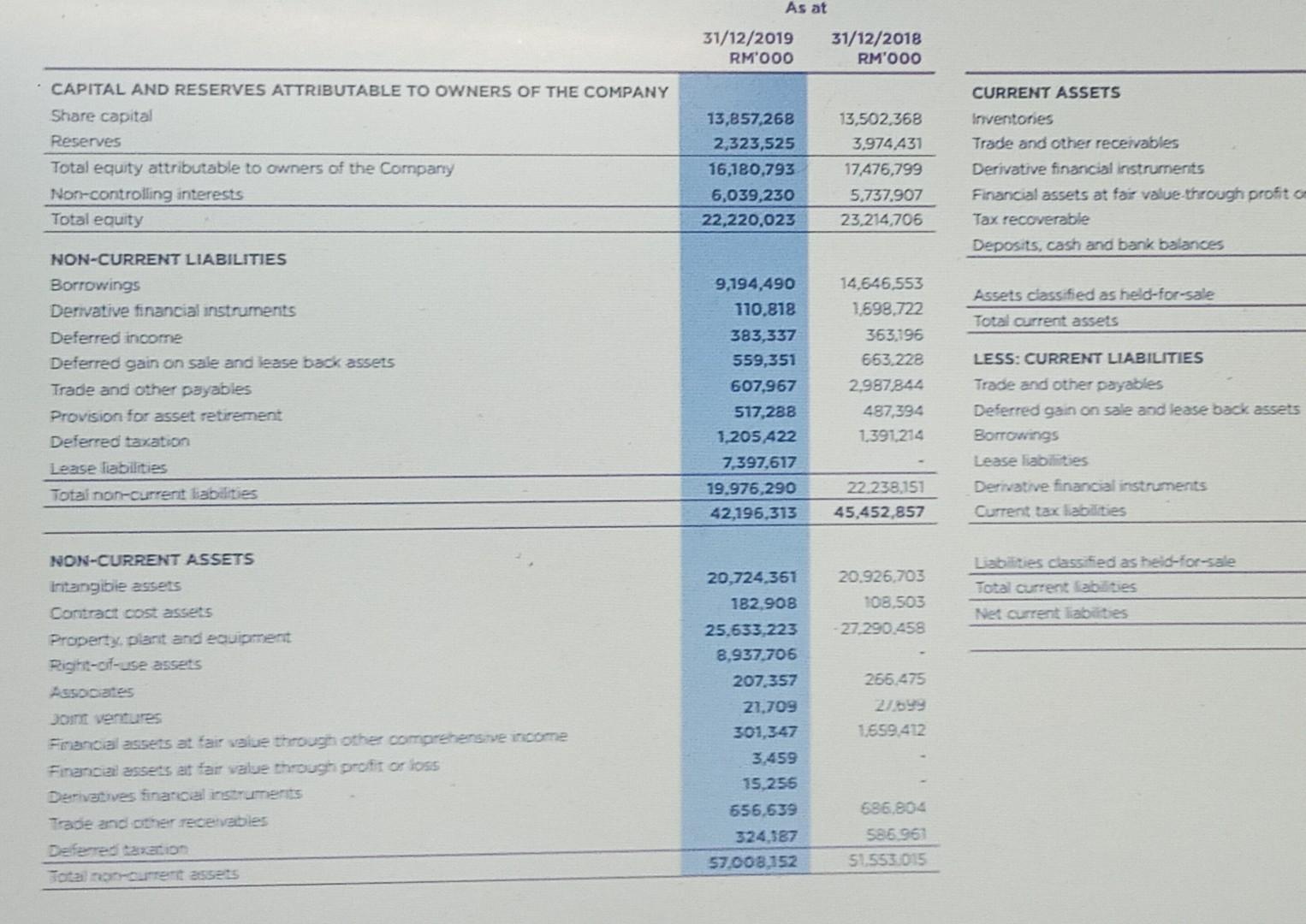

analyses the blance sheet As at 31/12/2019 RM000 31/12/2018 RM'000 CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital Reserves Total equity attributable

analyses the blance sheet

As at 31/12/2019 RM000 31/12/2018 RM'000 CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital Reserves Total equity attributable to owners of the Company Norr-controlling interests Total equity 13,857,268 2,323,525 16,180,793 6,039,230 22,220,023 13,502,368 3,974 431 17,476,799 5,737.907 23,214,706 CURRENT ASSETS Inventones Trade and other receivables Derivative financial instruments Financial assets at far value through profit Tax recoverable Deposits, cash and bank balances Assets classified as held-for-sale Total current assets NON-CURRENT LIABILITIES Borrowings Derivative financial instruments Deferred income Deferred gain on sale and lease back assets Trade and other payables Provision for asset retirement Deferred taxation Lease liabilities Total non-current liabilities 9,194,490 110.818 383,337 559,351 607,967 517,288 1,205 422 7,397,617 19.976,290 42,196,313 14,646,553 1.698.722 363.196 663.222 2,987844 487,394 1391214 LESS: CURRENT LIABILITIES Trade and other payables Deferred gain on sale and lease back assets Borrowings Lease liabilities Derivative financial instruments Current tax liabilities 22.238.151 45,452,857 20.926,703 108.503 27 290.458 Liabilities classified as heid-for-sale Total current abaties Net current liabilities NON-CURRENT ASSETS Intangible assets Contract cost assets Property, plant and equipment Right-of-use assets Pasociates Joint ventures Financial assets at fair value through other comprehensive income Financei assets at far value through profit or loss Derivatives financal instruments Trade and other receivables Deferred to Toti cument assets 20,724,361 182.908 25.633 223 8,937.706 207,357 21,709 301,347 3,459 15.255 656.639 324,587 57.008152 255,475 27.599 1559.412 686.904 586.967 51553 015 As at 31/12/2019 RM000 31/12/2018 RM'000 CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE COMPANY Share capital Reserves Total equity attributable to owners of the Company Norr-controlling interests Total equity 13,857,268 2,323,525 16,180,793 6,039,230 22,220,023 13,502,368 3,974 431 17,476,799 5,737.907 23,214,706 CURRENT ASSETS Inventones Trade and other receivables Derivative financial instruments Financial assets at far value through profit Tax recoverable Deposits, cash and bank balances Assets classified as held-for-sale Total current assets NON-CURRENT LIABILITIES Borrowings Derivative financial instruments Deferred income Deferred gain on sale and lease back assets Trade and other payables Provision for asset retirement Deferred taxation Lease liabilities Total non-current liabilities 9,194,490 110.818 383,337 559,351 607,967 517,288 1,205 422 7,397,617 19.976,290 42,196,313 14,646,553 1.698.722 363.196 663.222 2,987844 487,394 1391214 LESS: CURRENT LIABILITIES Trade and other payables Deferred gain on sale and lease back assets Borrowings Lease liabilities Derivative financial instruments Current tax liabilities 22.238.151 45,452,857 20.926,703 108.503 27 290.458 Liabilities classified as heid-for-sale Total current abaties Net current liabilities NON-CURRENT ASSETS Intangible assets Contract cost assets Property, plant and equipment Right-of-use assets Pasociates Joint ventures Financial assets at fair value through other comprehensive income Financei assets at far value through profit or loss Derivatives financal instruments Trade and other receivables Deferred to Toti cument assets 20,724,361 182.908 25.633 223 8,937.706 207,357 21,709 301,347 3,459 15.255 656.639 324,587 57.008152 255,475 27.599 1559.412 686.904 586.967 51553 015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started