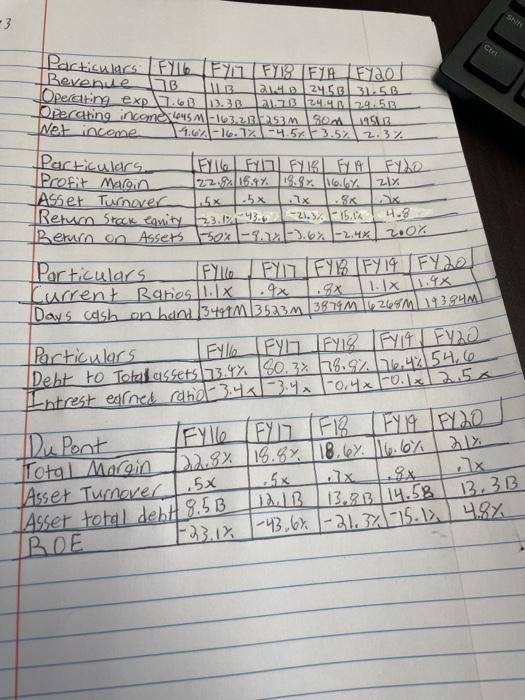

Analysis about Tesla, Inc. I need help with the 1. Five year net sales, operating expenses, operating income Balance Sheet and net income analysis. Once calculations are complete, interpret the resulting data and comment on the significance of the trend results. 2. Five year total profit margin, asset turnover, return on assets and return on stockholder equity analysis. Once calculations are complete, interpret the resulting data and evaluate the company's profitability. 3. Five year return on assets ratio, return on equity, management efficiency ratios, current ratio, days cash on hand and working capital analysis. Once calculations are complete, interpret the resulting data and evaluate the company's liquidity 4. Five year debt ratio & times interest earned ratio analysis. Once calculations are complete, interpret the resulting data and comment on the company's long term solvency 5. Complete a Du Pont Analysis for each of the five most recent years. Once calculations are complete, interpret the resulting data and comment on the company's individual Du Pont characteristics (eg, Total Margin, Total Asset Turnover & Equity Multiplier) and trends across the analysis period 6. What is the name of the company's independent auditors? What type of opinion did the independent auditors issue on the financial statements (unqualified, qualified, adverse or disclaimer)? What does this opinion mean? - 3 CTEE Particulars [FY lle F70 FY13 F99Fyao! Revenue B 113 a24.5 31.5.B Operating exp7.63 13.30 La 24.48129.5.3. Operating income, 1045M-163.2.5253 M SOM ASL3 Net income 16A-16.124.543.5% 2.3% particulars Profit_Marcon [22.82 16.97. 18.8%. 16.6% 21% Asset Turnover .5 x .Ix Return stack canity 23.23. 21.30 - 15.62 4.8 Return on Assets -50% -8.5-3.6% -2.4x 200% Particulars Lurrent Ratios 1.IX x Fylle Fyn (FYRIFY 14 FY20 1.1x1.9% Days cash on hand 13497m 13523m 3979m 162689 19384m) Particulars Fylla FYLT FY2FyIFV22 Debt to Total assets 73.4%. 80.3% 78.9% 76,4% 54,6 Intrest earned ratio -3.4 -3.4 -0,4 -0.1x12.5x Du Pont IFYIK FYN (F 18 Fylg FAQ Total Marein 122.8% 18.87 18.67. 16.6% Asset Turnover 1.5x 12,1 B 13.33 14.58 Asser total debtl 8.53 F23.18 -43,6% -21.30 -15.1 4.8% 13, 3B Analysis about Tesla, Inc. I need help with the 1. Five year net sales, operating expenses, operating income Balance Sheet and net income analysis. Once calculations are complete, interpret the resulting data and comment on the significance of the trend results. 2. Five year total profit margin, asset turnover, return on assets and return on stockholder equity analysis. Once calculations are complete, interpret the resulting data and evaluate the company's profitability. 3. Five year return on assets ratio, return on equity, management efficiency ratios, current ratio, days cash on hand and working capital analysis. Once calculations are complete, interpret the resulting data and evaluate the company's liquidity 4. Five year debt ratio & times interest earned ratio analysis. Once calculations are complete, interpret the resulting data and comment on the company's long term solvency 5. Complete a Du Pont Analysis for each of the five most recent years. Once calculations are complete, interpret the resulting data and comment on the company's individual Du Pont characteristics (eg, Total Margin, Total Asset Turnover & Equity Multiplier) and trends across the analysis period 6. What is the name of the company's independent auditors? What type of opinion did the independent auditors issue on the financial statements (unqualified, qualified, adverse or disclaimer)? What does this opinion mean? - 3 CTEE Particulars [FY lle F70 FY13 F99Fyao! Revenue B 113 a24.5 31.5.B Operating exp7.63 13.30 La 24.48129.5.3. Operating income, 1045M-163.2.5253 M SOM ASL3 Net income 16A-16.124.543.5% 2.3% particulars Profit_Marcon [22.82 16.97. 18.8%. 16.6% 21% Asset Turnover .5 x .Ix Return stack canity 23.23. 21.30 - 15.62 4.8 Return on Assets -50% -8.5-3.6% -2.4x 200% Particulars Lurrent Ratios 1.IX x Fylle Fyn (FYRIFY 14 FY20 1.1x1.9% Days cash on hand 13497m 13523m 3979m 162689 19384m) Particulars Fylla FYLT FY2FyIFV22 Debt to Total assets 73.4%. 80.3% 78.9% 76,4% 54,6 Intrest earned ratio -3.4 -3.4 -0,4 -0.1x12.5x Du Pont IFYIK FYN (F 18 Fylg FAQ Total Marein 122.8% 18.87 18.67. 16.6% Asset Turnover 1.5x 12,1 B 13.33 14.58 Asser total debtl 8.53 F23.18 -43,6% -21.30 -15.1 4.8% 13, 3B