Answered step by step

Verified Expert Solution

Question

1 Approved Answer

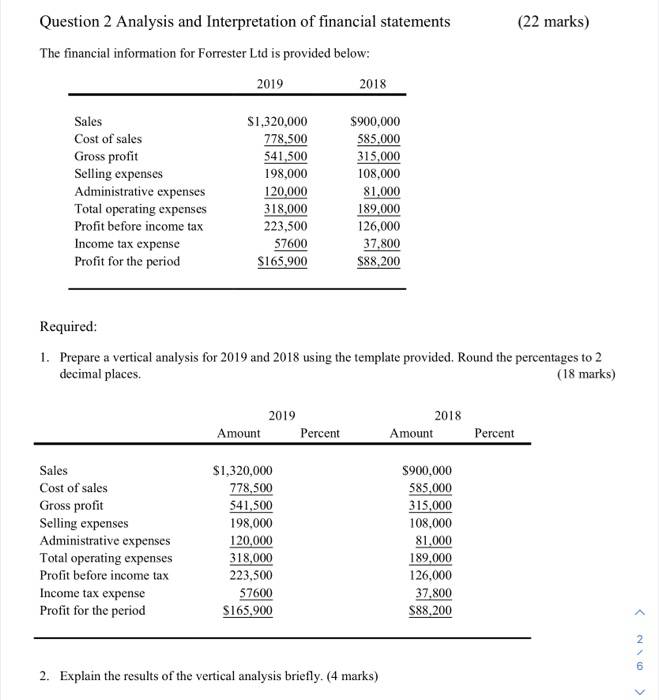

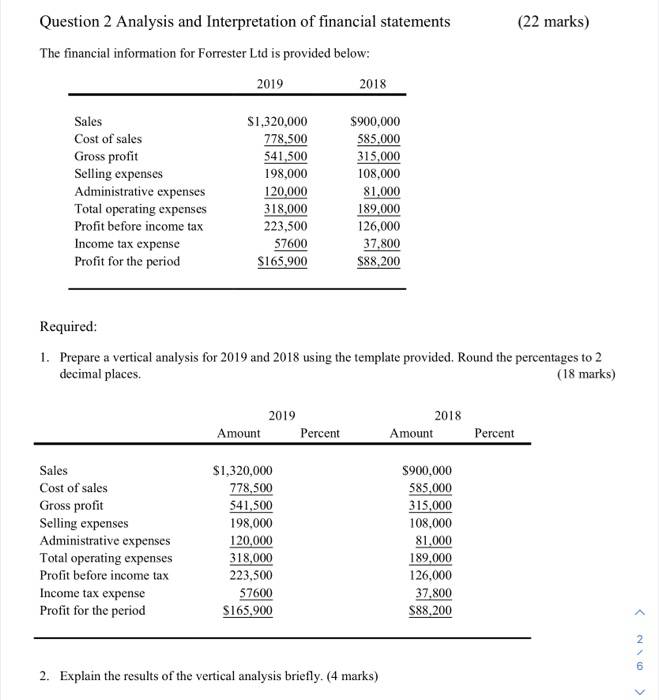

Analysis and Interpretation of financial statements (22 marks) Question 2 Analysis and Interpretation of financial statements The financial information for Forrester Ltd is provided below:

Analysis and Interpretation of financial statements

(22 marks) Question 2 Analysis and Interpretation of financial statements The financial information for Forrester Ltd is provided below: 2019 2018 Sales Cost of sales Gross profit Selling expenses Administrative expenses Total operating expenses Profit before income tax Income tax expense Profit for the period $1,320,000 778,500 541,500 198,000 120,000 318,000 223,500 57600 $165,900 $900,000 585,000 315,000 108,000 81,000 189,000 126,000 37,800 $88,200 Required: 1. Prepare a vertical analysis for 2019 and 2018 using the template provided. Round the percentages to 2 decimal places. (18 marks) Amount 2019 Percent 2018 Amount Percent Sales Cost of sales Gross profit Selling expenses Administrative expenses Total operating expenses Profit before income tax Income tax expense Profit for the period $1,320,000 778,500 541,500 198,000 120,000 318,000 223,500 57600 $165,900 $900,000 585,000 315.000 108,000 81,000 189,000 126,000 37,800 S88,200 2 2. Explain the results of the vertical analysis briefly. (4 marks) >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started