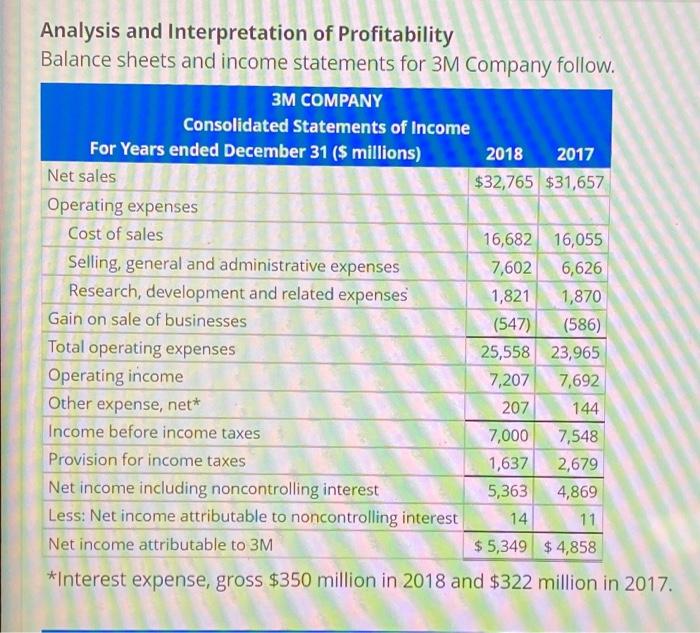

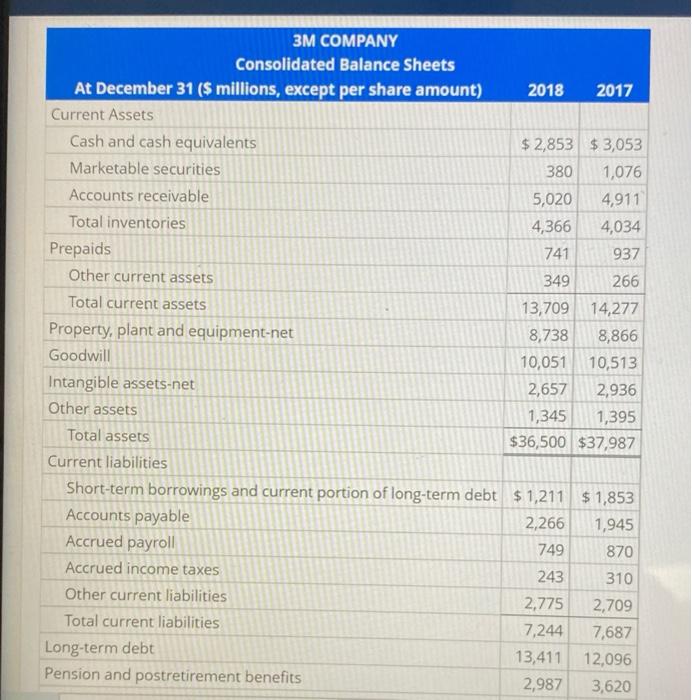

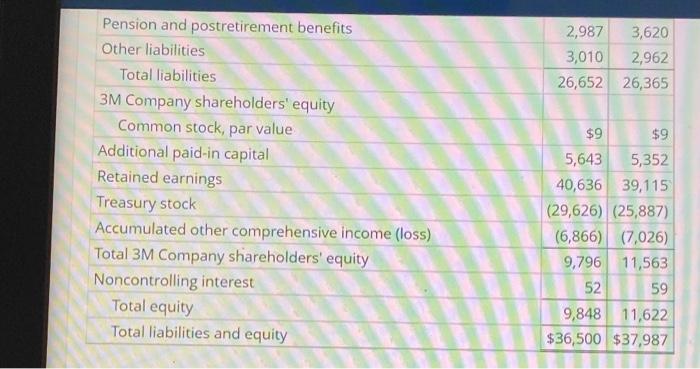

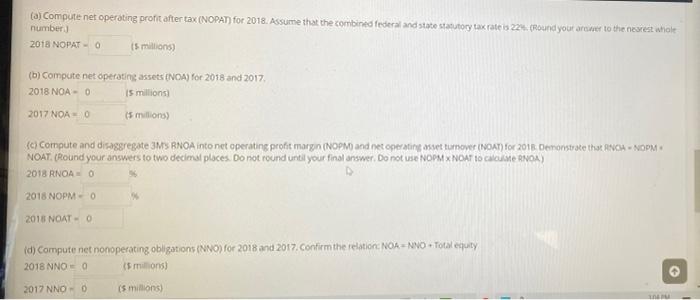

Analysis and Interpretation of Profitability Balance sheets and income statements for 3M Company follow. 3M COMPANY Consolidated Statements of Income For Years ended December 31 ($ millions) 2018 2017 Net sales $32,765 $31,657 Operating expenses Cost of sales 16,682 16,055 Selling, general and administrative expenses 7,602 6,626 Research, development and related expenses 1,821 1,870 Gain on sale of businesses (547) (586) Total operating expenses 25,558 23,965 Operating income 7,207 7,692 Other expense, net* 207 144 Income before income taxes 7,000 7,548 Provision for income taxes 1,637 2,679 Net income including noncontrolling interest 5,363 4,869 Less: Net income attributable to noncontrolling interest 14 11 Net income attributable to 3M $ 5,349 $ 4,858 *Interest expense, gross $350 million in 2018 and $322 million in 2017. 3M COMPANY Consolidated Balance Sheets At December 31 ($ millions, except per share amount) 2018 2017 Current Assets Cash and cash equivalents $ 2,853 $3,053 Marketable securities 380 1,076 Accounts receivable 5,020 4,911 Total inventories 4,366 4,034 Prepaids 741 937 Other current assets 349 266 Total current assets 13,709 14,277 Property, plant and equipment-net 8,738 8,866 Goodwill 10,051 10,513 Intangible assets-net 2,657 2,936 Other assets 1,345 1,395 Total assets $36,500 $37,987 Current liabilities Short-term borrowings and current portion of long-term debt $1,211 $1,853 Accounts payable 2,266 1,945 Accrued payroll 749 870 Accrued income taxes 243 310 Other current liabilities 2,775 2,709 Total current liabilities 7,244 7,687 Long-term debt 13,411 12,096 Pension and postretirement benefits 2,987 3,620 2,987 3,620 3,010 2,962 26,652 26,365 Pension and postretirement benefits Other liabilities Total liabilities 3M Company shareholders' equity Common stock, par value Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive income (loss) Total 3M Company shareholders' equity Noncontrolling interest Total equity Total liabilities and equity $9 $9 5,643 5,352 40,636 39,115 (29,626) (25,887) (6,866) (7,026) 9,796 11,563 52 59 9,848 11,622 $36,500 $37,987 (a) Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22. Round your are to the newest whole number 2018 NOPAT- is millions) (b) Compute net operating assets (NCA) for 2018 and 2017 2018 NOA - 0 15 millions 2017 NOA (5 millions) (c) Compute and disaggregate 3MS BNOA into net operating profit margin (OPM) and net operating asset tumovet INOAT) for 2018 Demonstrate that ANCA - NOPM NOAT, (Round your answers to two decimal places. Do not round until your final answer. Do not use NOPMX NOAT to calcune RNOA) 2018 RNOA 2018 NOPMO 2015 NOAT - 0 id) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation NOA-NNOTotal equity 2018 NNO = 0 (5 milions) 2017 NNO- is millions) (e) Compute return on equity (ROE) for 2018 (Round your answers to two decimal places. Do not round until your final answer) 2018 ROED ( What is the nonoperating return component of ROE for 2018][Round your answers to two decimal places.) 2018 nonoperating return % (9) Comment on the difference between ROE and RNOA What inference can we draw from this comparison? OROE > RNOA implies that 3M has taken on too much financial leverage, OROE> RNOA implies that 3M is able to borrow money to fund operating assets that yield a return greater than ts cost of debt, OROERNOA implies that 3M's equity has grown faster than its NOA OROERNOA imples that 3M has increased its financial leverage during the period, Check