Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analysis f. You want to compare Deere's operations for fiscal 2012 to those of an international competitor, CNH Global, headquartered in the Netherlands. In particular,

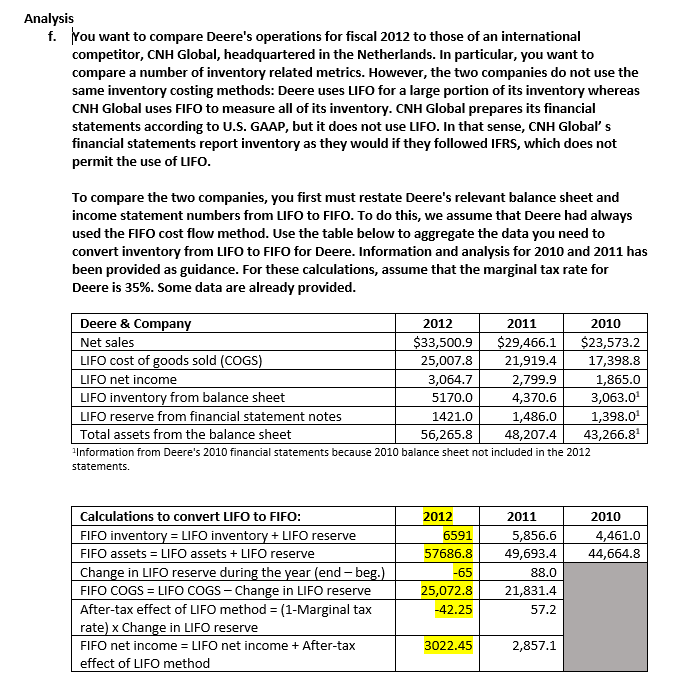

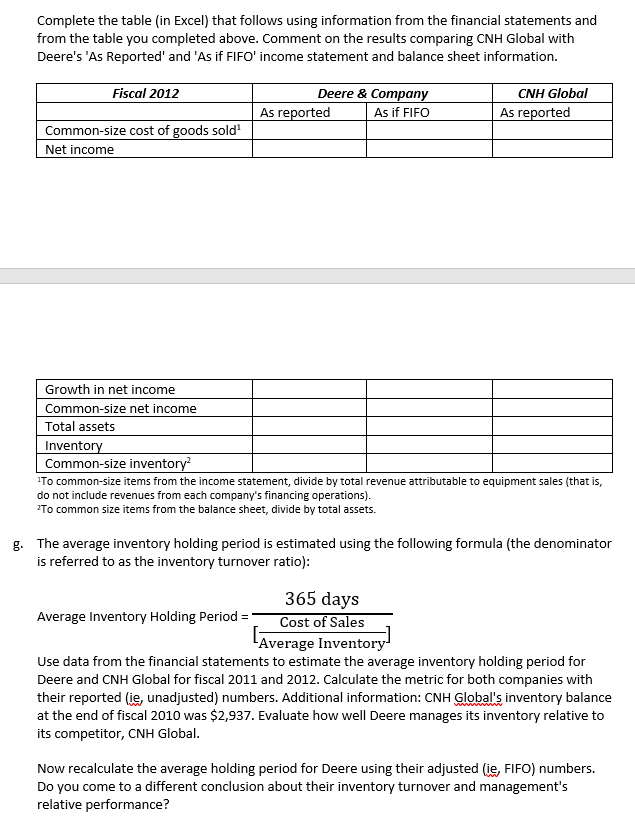

Analysis f. You want to compare Deere's operations for fiscal 2012 to those of an international competitor, CNH Global, headquartered in the Netherlands. In particular, you want to compare a number of inventory related metrics. However, the two companies do not use the same inventory costing methods: Deere uses LIFO for a large portion of its inventory whereas CNH Global uses FIFO to measure all of its inventory. CNH Global prepares its financial statements according to U.S. GAAP, but it does not use LIFO. In that sense, CNH Global's financial statements report inventory as they would if they followed IFRS, which does not permit the use of LIFO. To compare the two companies, you first must restate Deere's relevant balance sheet and income statement numbers from LIFO to FIFO. To do this, we assume that Deere had always used the FIFO cost flow method. Use the table below to aggregate the data you need to convert inventory from LIFO to FIFO for Deere. Information and analysis for 2010 and 2011 has been provided as guidance. For these calculations, assume that the marginal tax rate for Deere is 35%. Some data are already provided. Deere & Company 2012 2011 2010 Net sales $33,500.9 $29,466.1 $23,573.2 LIFO cost of goods sold (COGS) 25,007.8 21,919.4 17,398.8 LIFO net income 3,064.7 2,799.9 1,865.0 LIFO inventory from balance sheet 5170.0 4,370.6 3,063.0 LIFO reserve from financial statement notes 1421.0 1,486.0 1,398.01 Total assets from the balance sheet 56,265.8 48,207.4 43,266.81 Information from Deere's 2010 financial statements because 2010 balance sheet not included in the 2012 statements. 2010 4,461.0 44,664.8 Calculations to convert LIFO to FIFO: FIFO inventory = LIFO inventory + LIFO reserve FIFO assets = LIFO assets + LIFO reserve Change in LIFO reserve during the year (end - beg.) FIFO COGS = LIFO COGS - Change in LIFO reserve After-tax effect of LIFO method = (1-Marginal tax rate) x Change in LIFO reserve FIFO net income = LIFO net income + After-tax effect of LIFO method 2012 6591 57686.8 -65 25,072.8 -42.25 2011 5,856.6 49,693.4 88.0 21,831.4 57.2 3022.45 2,857.1 Complete the table (in Excel) that follows using information from the financial statements and from the table you completed above. Comment on the results comparing CNH Global with Deere's 'As Reported' and 'As if FIFO' income statement and balance sheet information. Fiscal 2012 Deere & Company As reported As if FIFO CNH Global As reported Common-size cost of goods sold Net income Growth in net income Common-size net income Total assets Inventory Common-size inventory? To common-size items from the income statement, divide by total revenue attributable to equipment sales (that is, do not include revenues from each company's financing operations). ?To common size items from the balance sheet, divide by total assets. g. The average inventory holding period is estimated using the following formula (the denominator is referred to as the inventory turnover ratio): 365 days Average Inventory Holding Period = Cost of Sales Average Inventory Use data from the financial statements to estimate the average inventory holding period for Deere and CNH Global for fiscal 2011 and 2012. Calculate the metric for both companies with their reported (ie, unadjusted) numbers. Additional information: CNH Global's inventory balance at the end of fiscal 2010 was $2,937. Evaluate how well Deere manages its inventory relative to its competitor, CNH Global. Now recalculate the average holding period for Deere using their adjusted (ie, FIFO) numbers. Do you come to a different conclusion about their inventory turnover and management's relative performance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started