Answered step by step

Verified Expert Solution

Question

1 Approved Answer

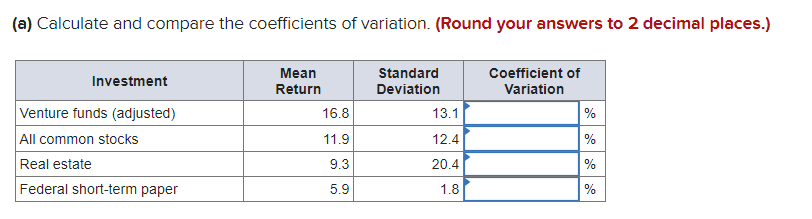

Analysis of investment portfolio returns over a 2 0 - year period showed the statistics below. ( a ) Calculate and compare the coefficients of

Analysis of investment portfolio returns over a year period showed the statistics below.

a Calculate and compare the coefficients of variation. Round your answers to decimal places.

See attached chart.

b Why would we use a coefficient of variation, and why not just compare the standard deviations?

multiple choice

The standard deviations are relative and not absolute measures of dispersion.

The standard deviations are an "absolute", not relative, measure of dispersion. It is best to use the CV when comparing across variables that have different means.

Standard deviation can only be compared when the variables have different units of measure.

c What do the data tell you about risk and return at that time period?

multiple choice choose

Federal shortterm paper has the lowest standard deviation and hence the greatest risk; real estate, the lowest risk.

Venture funds have greater risk and lower return than common stocks based on the CV

Venture funds have lower risk and greater return than common stocks based on the CV

Federal shortterm paper has the lowest CV and hence the greatest risk; real estate, the lowest risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started