Analysis Questions to answer for the Senior VP of Sales and Marketing.

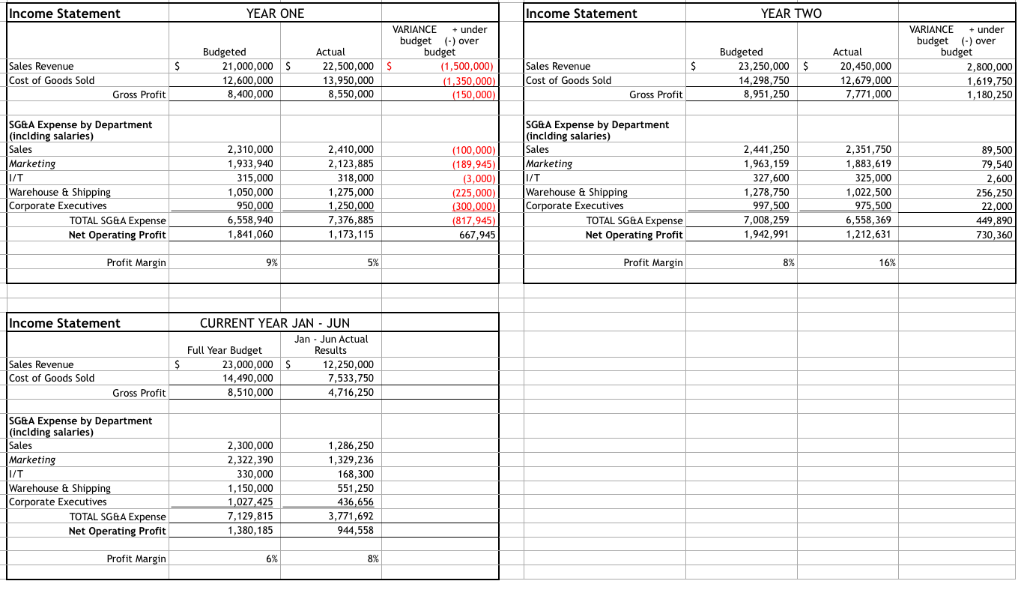

1.) In year one your department was approximately 10% over-budget. Justify why this occurred.

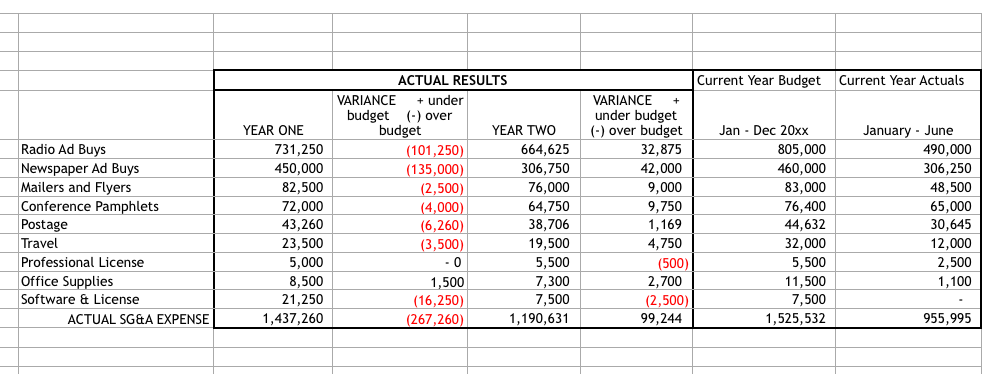

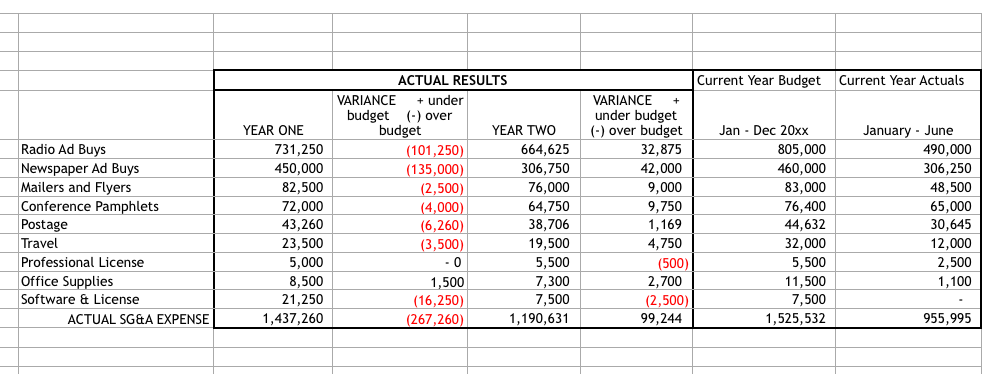

2.) Your department was over budget two consecutive years in Software and Licensing, please provide an explanation.

3.) Explain what you did in year two to hold cost down.

4.) In the current year it looks like you are going to be a little over $300,000 over budget (15% ). What are your plans to get this under control? Information for next years budget Revenue is projected to be $24,150,000 based on expanding into the West Coast A regional office is to be opened on the West Coast and the CEO expects all managers to spend time in the office as well as have a full time marketing employee at the office.

1.) Prepare next years budget based on the above information and past years experience.

2.) You must provide an explanation / justification for each line item in the budget and salaries can be considered one line item.

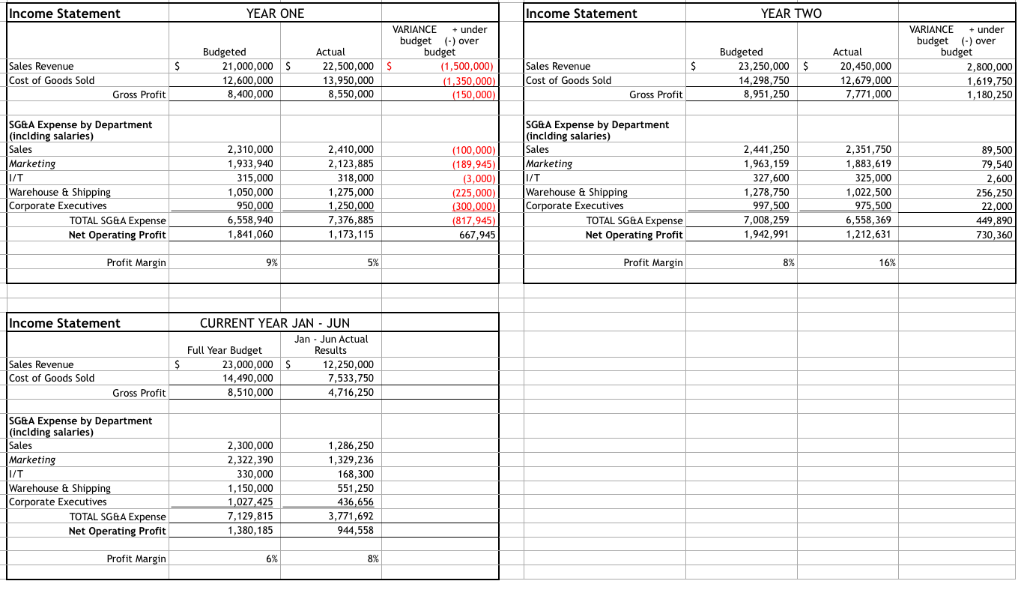

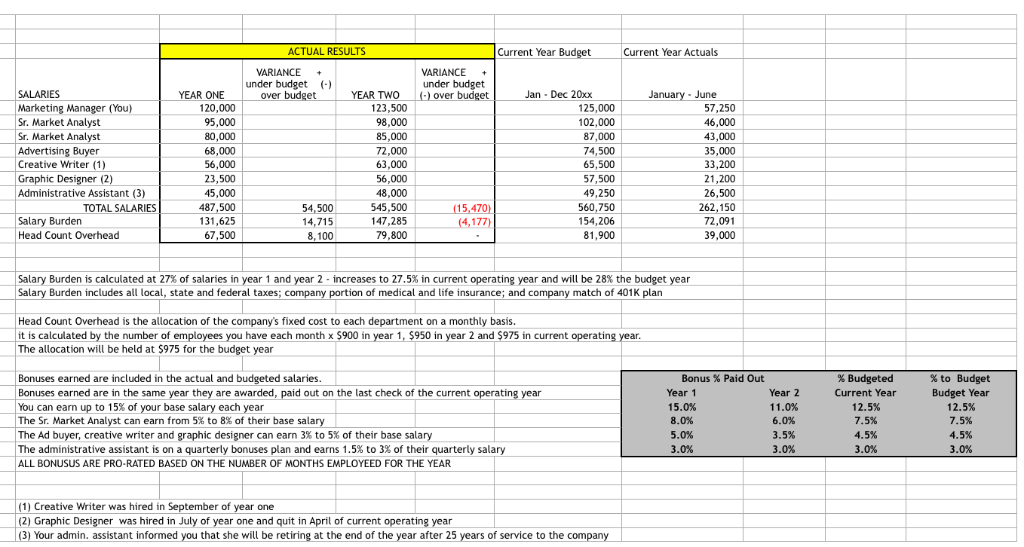

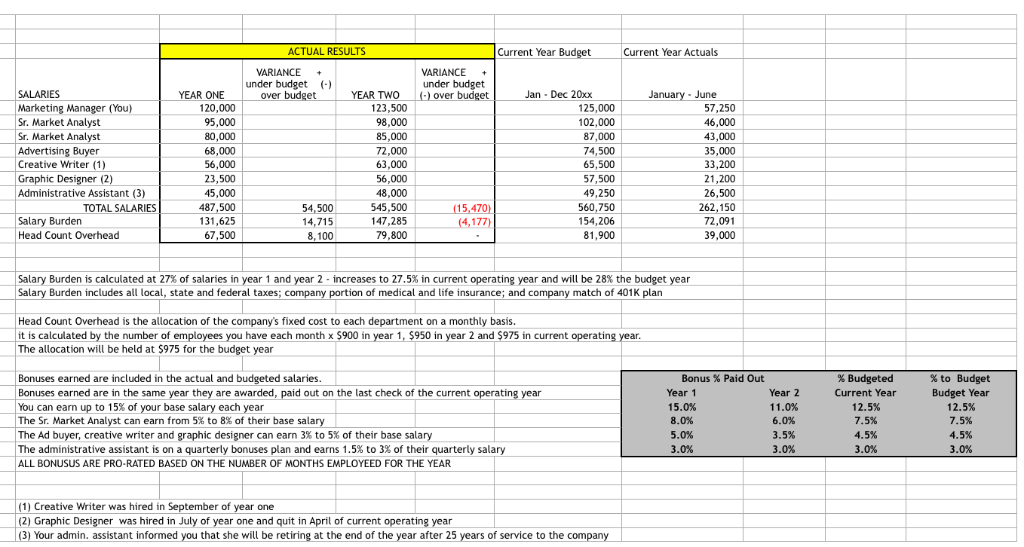

Income Statement YEAR ONE Income Statement YEAR TWo * under over Actual budget Budgeted Actual budget Sales Revenue Cost of Goods Sold 21,000,000 S 12,600,000 22,500,000 S 13,950,000 23,250,00020,450,000 12,679,000 7,771,000 (1,500,000) Sales Revenue Cost of Goods Sold 14,298,750 8,951,250 2,800,000 1,619,750 1,180,250 8,400,000 8,550,000 150,000 Gross Profit SGEA Expense by Department (inclding salaries) Sales Marketin I/T Warehouse & Shi 2,310,000 1,933,940 315,000 1,050,000 950,000 6,558,940 1,841,060 2,410,000 2,123,885 318,000 1,275,000 1.250,000 7,376,885 1,173,115 SGBA Expense by Department (inclding salaries) Sales Marketin 2,441,250 1,963,159 327,600 1,278,750 997,500 7,008,259 1,942,991 100,000) 2,351,750 1,883,619 325,000 1,022,500 975,500 6,558,369 1,212,631 89,500 79,540 (189,945 5,000) 817,945 Warehouse &Shi 256,250 22,000 449,890 730,360 TOTAL SG&A Expense Net Operating Profit TOTAL SG&A Expense Net Operating Profit 667,945 Profit Margin Profit Margin 16% ncome Statement CURRENT YEAR JAN -JUN Jan Jun Actual Results Full Year Budget Sales Revenue Cost of Goods Sold 23,000,000 14,490,000 8,510,000 12,250,000 7,533,750 4,716,250 Gross Profit SGEA Expense by Department sa Sales Marketin I/T Warehouse & Shippin 2,300,000 2,322,390 330,000 1,150,000 1,286,250 1,329,236 168,300 551,250 TOTAL SG&A Expense Net Operating Profit 7,129,815 1,380,185 3,771,697 944,558 Profit Margin 8% ACTUAL RESULTS Current Year Budget Current Year Actuals VARIANCE under budget SALARIES Marketing Manager (You) Sr.Market Analyst Sr. Market Anal Advertising Buyer Creative Writer (1) Graphic Designer (2) Administrative Assistant (3) YEAR ONE YEAR TWO over Jan Dec 20xx anuary -June 120,000 95,000 80,000 68,000 56,000 23,500 45,000 487,500 31,625 67,500 123,500 98,000 85,000 72,000 63,000 56,000 48,000 54,500147,285 125,000 102,000 87,000 74,500 65,500 57,500 49,250 560,750 154,206 81,900 57,250 46,000 43,000 35,000 33,200 21,200 26,500 262,150 72,091 39,000 TOTAL SALARIES 545,500 15,470 Salary Burden Head Count Overhead 8,100 79,800 Salary Burden is calculated at 27% of salaries in year 1 and year 2-increases to 27.5% in current operating year and will be 28% the budget year Burden includes all local, state and federal taxes tion of medical and life insurance; and co y match of 401K Head Count Overhead is the allocation of the company's fixed cost to each department on a monthly basis. it is calculated by the number of employees you have each month x $900 in year 1, $950 in year 2 and $975 in current operating The allocation will be held at $975 for the budget year Bonuses earned are included in the actual and budgeted salaries Bonuses earned are in the same year they are awarded, paid out on the last check of the current operating year You can earn up to 15% of your base salary each year The Sr. Market Analyst can earn from 5% to 8% of their base salary The Ad buyer, creative writer and graphic designer can earn 3% to 5% of their base salary The administrative assistant is on a quarterly bonuses plan and earns 1.5% to 3% of their quarterly salary ALL BONUSUS ARE PRO-RATED BASED ON THE NUMBER OF MONTHS EMPLOYEED FOR THE YEAR Bonus % Paid Out Year 1 15.0% 8.0% 5.0% 3.0% % Budgeted Current Year 12.5% 15% 4.5% 3.0% Year 2 11.0% 6.0% Year 12.5% 15% 4.5% 3.0% 3.0% (1) Creative Writer was hired in September of year one (2) Graphic Designer was hired in July of year one and quit in April of current operating year (3) Your admin. assistant informed you that she will be retiring at the end of the year after 25 years of service to the comp ACTUAL RESULTS Current Year Budget Current Year Actuals VARIANCE under budget () over budget VARIANCE + under budget (-) over budget 32,875 42,000 9,000 9,750 1,169 4,750 500 2,700 YEAR ONE YEAR TWO Jan - Dec 20xx January - June Radio Ad Buys Newspaper Ad Buys Mailers and Flyers Conference Pamphlets Postage Travel ProfessionalLicense Office Supplies Software &License 731,250 450,000 82,500 72,000 43,260 23,500 5,000 8,500 21,250 1,437,260 (101,250) (135,000) 2,500 4,000 (6,260) 3,500 664,625 306,750 76,000 64,750 38,706 19,500 5,500 7,300 7,500 1,190,631 805,000 460,000 83,000 76,400 44,632 32,000 5,500 11,500 7,500 1,525,532 490,000 306,250 48,500 65,000 30,645 12,000 2,500 1,100 1,500 (16,250) (267,260) (2,500) ACTUAL SG&A EXPENSE 99,244 955,995