Question

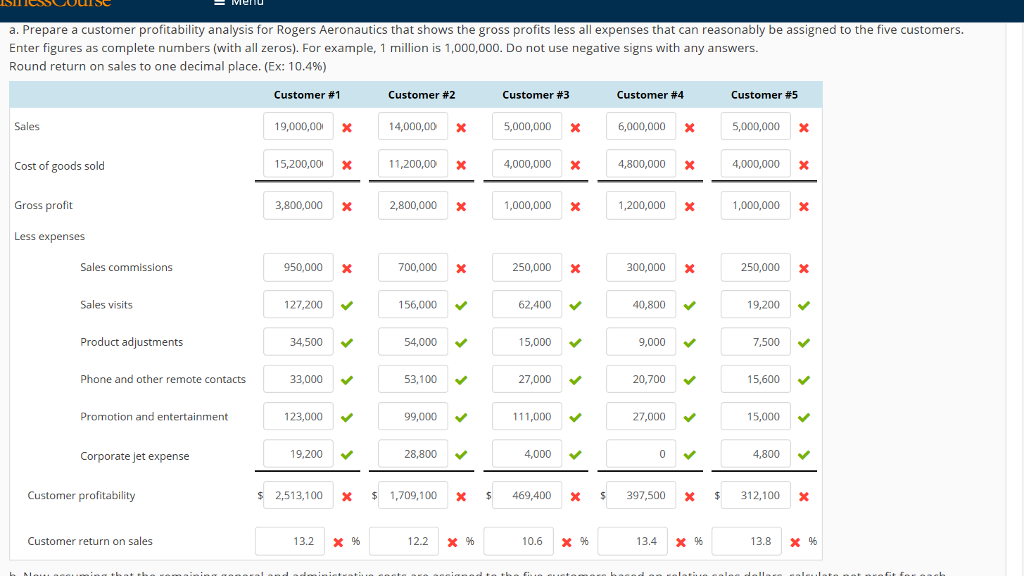

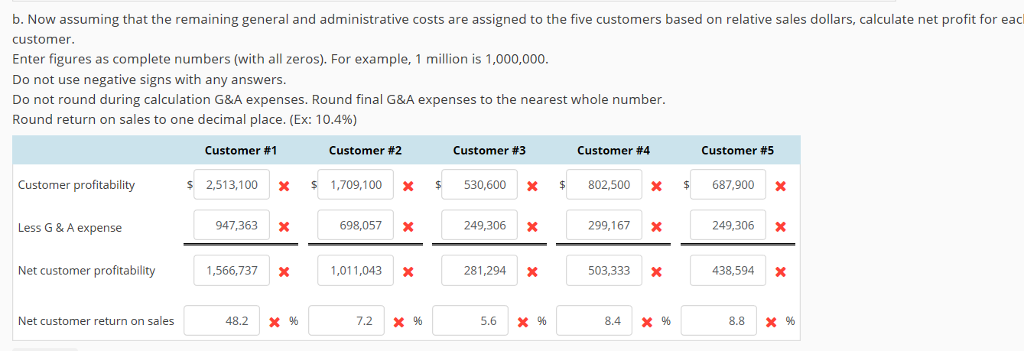

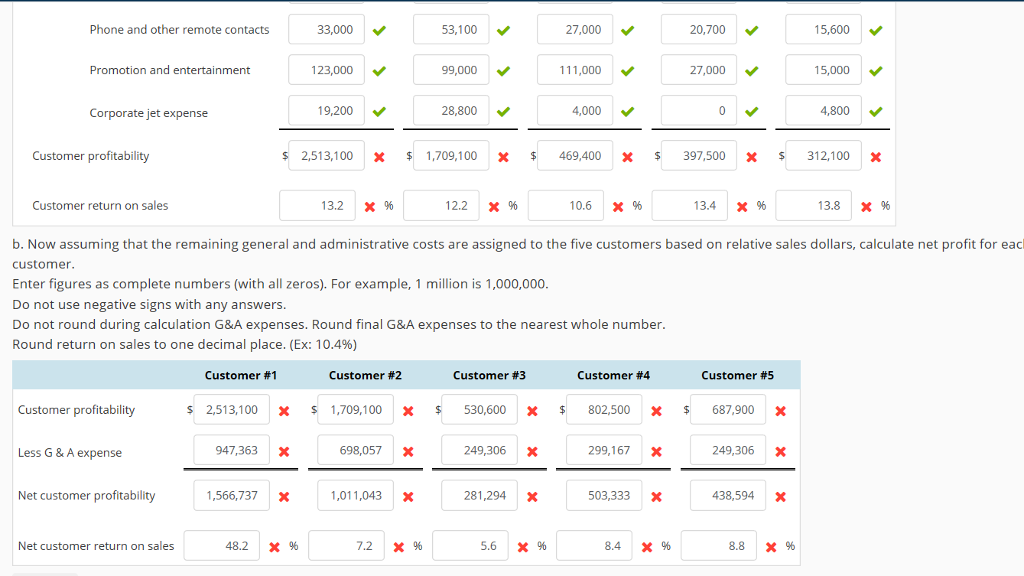

Analysis Rogers Aeronautics, LTD, Is A British Aeronautics Subcontract ... Question: Customer Profitability Analysis Rogers Aeronautics, LTD, is a British aeronautics su... Customer Profitability Analysis

Analysis Rogers Aeronautics, LTD, Is A British Aeronautics Subcontract ... Question: Customer Profitability Analysis Rogers Aeronautics, LTD, is a British aeronautics su... Customer Profitability Analysis Rogers Aeronautics, LTD, is a British aeronautics subcontract company that designs and manufactures electronic control systems for commercial airlines. The vast majority of all commercial aircraft are manufactured by Boeing in the U.S. and Airbus in Europe; however, there is a relatively small group of companies that manufacture narrow-body commercial jets. Assume for this exercise that Rogers does contract work for the two major manufacturers plus three companies in the second tier. Because competition is intense in the industry, Rogers has always operated on a fairly thin 20% gross profit margin; hence, it is crucial that it manage non-manufacturing overhead costs effectively in order to achieve an acceptable net profit margin. With declining profit margins in recent years, Rogers Aeronautics' CEO, Len Rogers, has become concerned that the cost of obtaining contracts and maintaining relations with its five major customers may be getting out of hand. You have been hired to conduct a customer profitability analysis. Rogers Aeronautics' non-manufacturing overhead consists of $2.5 million of general and administrative (G&A) expense, (including, among other expenses, the CEO's salary and bonus and the cost of operating the company's corporate jet) and selling and customer support expenses of $3 million (including 5% sales commissions and $1,050,000 of additional costs). The accounting staff determined that the $1,050,000 of additional selling and customer support expenses related to the following four activity cost pools:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started