Question

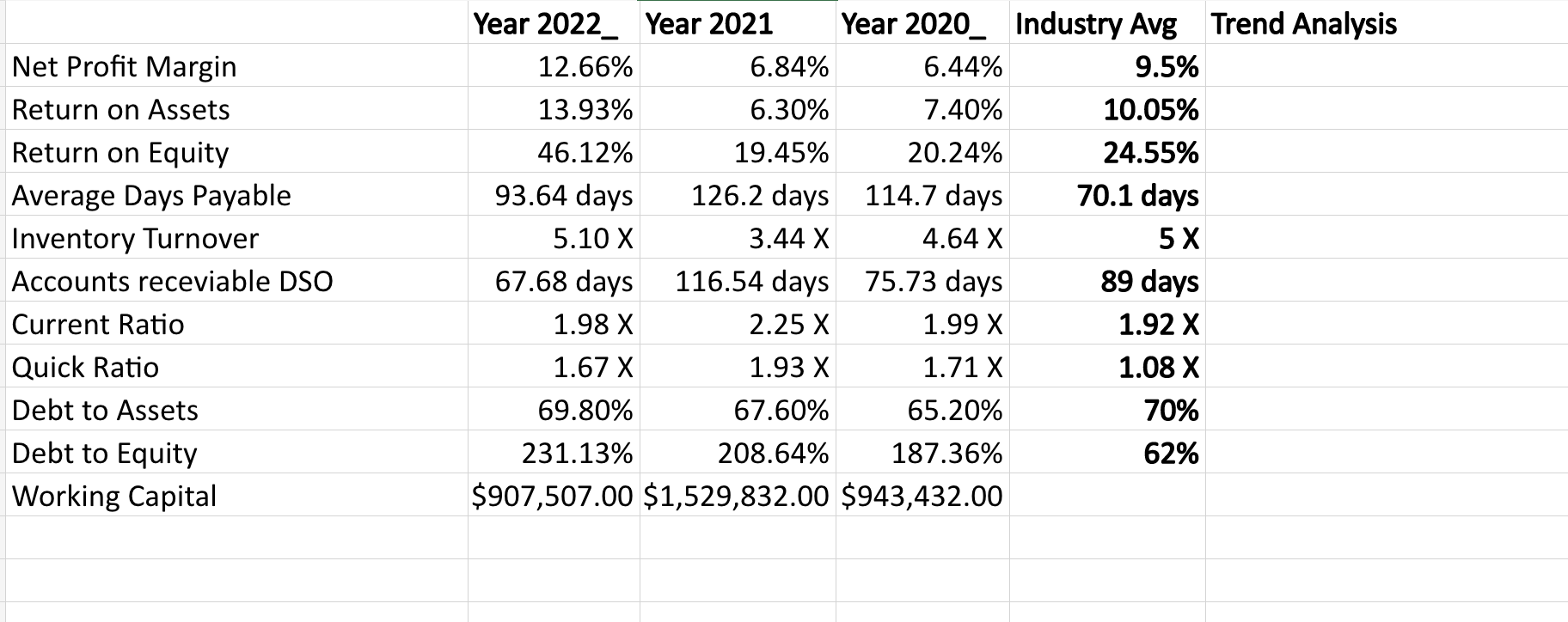

analysis Trend with explanation. Year 2022_ Year 2021 Year 2020 Net Profit Margin Return on Assets Return on Equity Year 2022 Year 2021 12.66% Year

analysis Trend with explanation. Year 2022_ Year 2021 Year 2020

Net Profit Margin Return on Assets Return on Equity Year 2022 Year 2021 12.66% Year 2020 Industry Avg Trend Analysis 6.84% 6.44% 13.93% 6.30% 7.40% 46.12% 19.45% 20.24% 9.5% 10.05% 24.55% Average Days Payable 93.64 days 126.2 days 114.7 days 70.1 days Inventory Turnover 5.10 X 3.44 X 4.64 X 5 X Accounts receviable DSO 67.68 days 116.54 days 75.73 days 89 days Current Ratio 1.98 X 2.25 X 1.99 X 1.92 X Quick Ratio Debt to Assets Debt to Equity Working Capital $907,507.00 $1,529,832.00 $943,432.00 1.67 X 1.93 X 1.71 X 1.08 X 69.80% 67.60% 65.20% 70% 231.13% 208.64% 187.36% 62%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance

Authors: Chad Zutter, Scott Smart

16th Global Edition

1292400641, 978-1292400648

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App