Question

Analysis: (use Excel to complete this section) - BASE ANSWERS OFF OF HERBALIFE LTD. THE FINANCIALS ARE IN THE LINKS BELOW. or can be found

Analysis: (use Excel to complete this section) - BASE ANSWERS OFF OF HERBALIFE LTD.

THE FINANCIALS ARE IN THE LINKS BELOW. or can be found through Google: Herbalife Annual Reports 2015 & 2016

please show me the formulas to use as well so that I can complete this in Excel.

http://files.shareholder.com/downloads/ABEA-48ZAJ9/4985684436x0x934637/C9BD5EDF-7322-42E6-8E38-DC51D20BEFF2/Herbalife_Ltd_2016_Annual_Report.pdf

http://files.shareholder.com/downloads/ABEA-48ZAJ9/4985684436x0x882574/93BF84C9-495D-4D9A-A06A-3C20F9294252/Herbalife_Ltd_2015_Annual_Report.pdf

Provide common-size analysis of your companys income statement and balance sheet for the 2 most recent years (must be done using Excel with formulas).

Provide horizontal analysis of your companys income statement and balance sheet, showing the dollar amount and percent of change using the 2 most recent years (you must use an Excel spreadsheet with formulas).

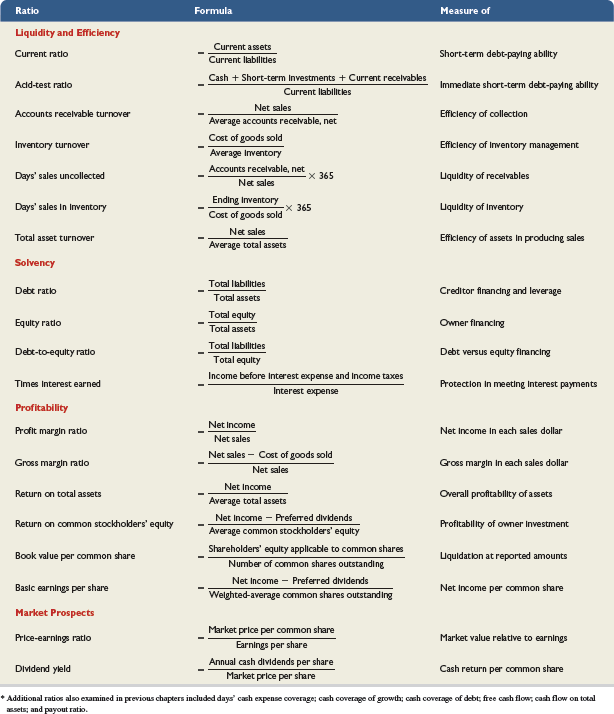

Perform ratio analysis on your company using the ratios listed in Exhibit 13.16 on page 529 of your text (SHOWN BELOW) (these must be in an Excel spreadsheet, using formulas to calculate the ratios). You should present them in a similar format as the text: group by category, list name of ratio, formula in words, and the ratio calculation. Give a short explanation of your conclusions about your company after each category of ratios (i.e. How liquid is your company? How efficiently is it using its assets? etc.).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started