Analysis: (use Excel to complete this section) - BASE ANSWERS OFF OF HERBALIFE LTD. FINANCIAL ARE IN LINKS BELOW.

http://files.shareholder.com/downloads/ABEA-48ZAJ9/4985684436x0x934637/C9BD5EDF-7322-42E6-8E38-DC51D20BEFF2/Herbalife_Ltd_2016_Annual_Report.pdf

http://files.shareholder.com/downloads/ABEA-48ZAJ9/4985684436x0x882574/93BF84C9-495D-4D9A-A06A-3C20F9294252/Herbalife_Ltd_2015_Annual_Report.pdf

Provide common-size analysis of your companys income statement and balance sheet for the 2 most recent years (must be done using Excel with formulas).

Provide horizontal analysis of your companys income statement and balance sheet, showing the dollar amount and percent of change using the 2 most recent years (you must use an Excel spreadsheet with formulas).

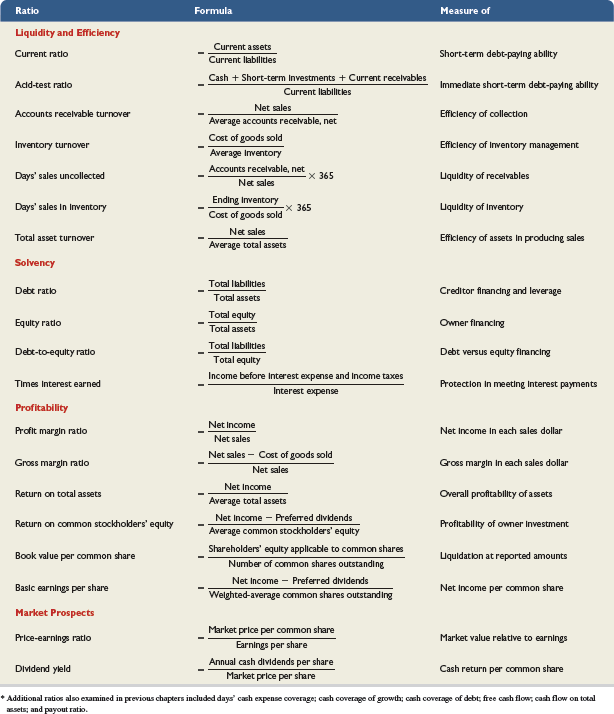

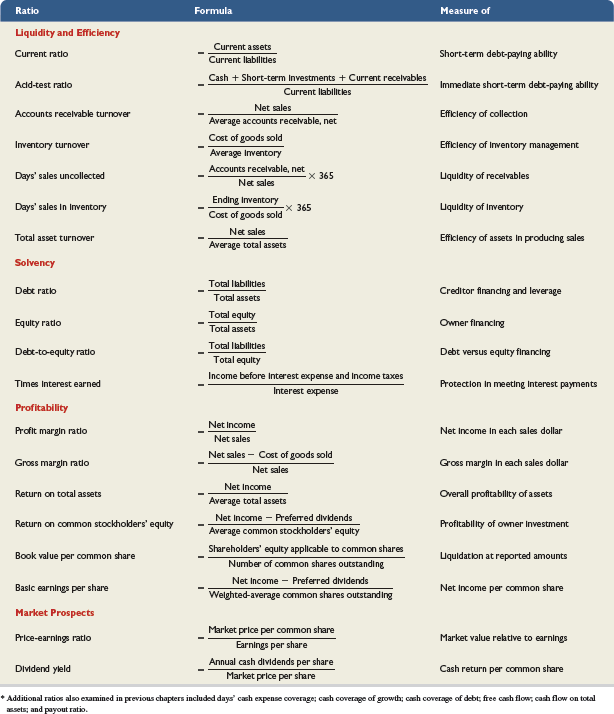

Perform ratio analysis on your company using the ratios listed in Exhibit 13.16 on page 529 of your text (SHOWN BELOW) (these must be in an Excel spreadsheet, using formulas to calculate the ratios). You should present them in a similar format as the text: group by category, list name of ratio, formula in words, and the ratio calculation. Give a short explanation of your conclusions about your company after each category of ratios (i.e. How liquid is your company? How efficiently is it using its assets? etc.).

Ratio Liquidity and Efficiency Current ratlo Formula Measure of Current assets Current llablitles Short-term debt-paying ablity Immedlate short-term debt-paylng ablity Efficlency of collection Efficlency of Inventory management LIquidlty of recelvables LIquidity of Inventory Efficlency of assets In producing sales Cash +Short-term Investments+ Current recelvables Current llablitles Acld-test ratlo Net sales Accounts recelvable turnover Average accounts recetvable, net Cost of goods sold Average Inventory Accounts recelvable, net Inventory turnover Days' sales uncollected Days' sales In Inventory x 365 Net sales Ending Inventory Cost of goods sold Net sales Average total assets x 365 Total asset turnover Solvenc)y Total Iabllitles Debt ratlo Creditor financing and leverage Total assets Total equity Total assets Total Iabllitles Equlty rato Owner financing Debt-to-equlty ratlo Debt versus equlty financing Total equlty Income before Interest expense and Income taxes Times Interest earned Protection In meeting Interest payments Interest expense Profitability Net Income Net sales Profit margin ratio Net Income In each sales dollar Net sales-Cost of goods sold Net sales Gross margin ratlo Gross margin In each sales dollar Overall profitablity of assets ProfltablIty of owner Investment Net Income Return on total assets Average total assets Net Income Preferred divldends Average common stockholders' equlty Return on common stockholders' equlty - Shareholders' equity applicable to common shares Number of common shares outstanding Book value per common share LIquidatlon at reported amounts Net Income Preferred dividends Welghted-average common shares outstanding Baslc earnings per share Market Prospects Price-earnings ratlo Dividend yleld Net Income per common share Market prlce per common share Earnings per share Annual cash dividends per share Market prlce per share Market value relative to earnings Cash return per common share *Additional ratios also e ammed in previous apers included days' cash expense coverage; cash coverage of growth; h coverage of debt; ree cash flow: cash flow on total asets and payout ratio. Ratio Liquidity and Efficiency Current ratlo Formula Measure of Current assets Current llablitles Short-term debt-paying ablity Immedlate short-term debt-paylng ablity Efficlency of collection Efficlency of Inventory management LIquidlty of recelvables LIquidity of Inventory Efficlency of assets In producing sales Cash +Short-term Investments+ Current recelvables Current llablitles Acld-test ratlo Net sales Accounts recelvable turnover Average accounts recetvable, net Cost of goods sold Average Inventory Accounts recelvable, net Inventory turnover Days' sales uncollected Days' sales In Inventory x 365 Net sales Ending Inventory Cost of goods sold Net sales Average total assets x 365 Total asset turnover Solvenc)y Total Iabllitles Debt ratlo Creditor financing and leverage Total assets Total equity Total assets Total Iabllitles Equlty rato Owner financing Debt-to-equlty ratlo Debt versus equlty financing Total equlty Income before Interest expense and Income taxes Times Interest earned Protection In meeting Interest payments Interest expense Profitability Net Income Net sales Profit margin ratio Net Income In each sales dollar Net sales-Cost of goods sold Net sales Gross margin ratlo Gross margin In each sales dollar Overall profitablity of assets ProfltablIty of owner Investment Net Income Return on total assets Average total assets Net Income Preferred divldends Average common stockholders' equlty Return on common stockholders' equlty - Shareholders' equity applicable to common shares Number of common shares outstanding Book value per common share LIquidatlon at reported amounts Net Income Preferred dividends Welghted-average common shares outstanding Baslc earnings per share Market Prospects Price-earnings ratlo Dividend yleld Net Income per common share Market prlce per common share Earnings per share Annual cash dividends per share Market prlce per share Market value relative to earnings Cash return per common share *Additional ratios also e ammed in previous apers included days' cash expense coverage; cash coverage of growth; h coverage of debt; ree cash flow: cash flow on total asets and payout ratio