Question

ANALYSIS WRITING 3. Compose a financial analysis based on your evaluation of the ratios. For EACH of the five (5) classifications of ratios, write a

ANALYSIS WRITING

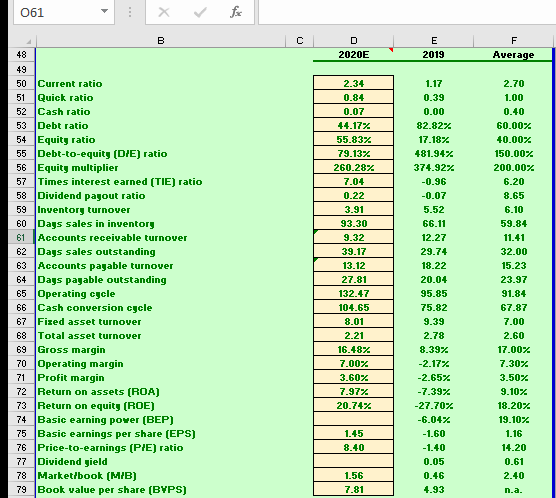

3. Compose a financial analysis based on your evaluation of the ratios. For EACH of the five (5) classifications of ratios, write a two-paragraph analysis, which answers the following two questions (one paragraph for each question) (40 points in total):

3A. Comparison between 2019 and 2020E ratios - (1) What happened? Did each of the ratios increase, decrease, or not change? (2) What had caused the movement or non-movement for each ratio? and (3) Is this a good thing or a bad thing for the company?

3B. Comparison between 2020E ratios and industry averages - (1) Are the 2020E ratios above, below, or equal to the industry averages? (2) Is this a good thing or a bad thing for the company? and (3) What can be done to improve the weak ratios or to maintain the strong ones?

061 X fi E 2019 F Average 2020E B 48 49 50 Current ratio 51 Quick ratio 52 Cash ratio 53 Debt ratio 54 Equity ratio 55 Debt-to-equity (D/E) ratio 56 Equity multiplier 57 Times interest earned (TIE) ratio 58 Dividend payout ratio 59 Inventory turnover 60 Dags sales in inventory 61 Accounts receivable turnover 62 Dags sales outstanding 63 Accounts payable turnover 64 Days payable outstanding 65 Operating cycle 66 Cash conversion cycle 67 Fized asset turnover 68 Total asset turnover 69 Gross margin 70 Operating margin 71 Profit margin 72 Return on assets (ROA) 73 Return on equity (ROE) 74 Basic earning power (BEP) 75 Basic earnings per share (EPS) 76 Price-to-earnings (P/E) ratio 77 Dividend yield 78 Marketibook (MIB) 79 Book value per share (BVPS) 2.34 0.84 0.07 44.17% 55.83% 79.13% 260.28% 7.04 0.22 3.91 93.30 9.32 39.17 13.12 27.81 132.47 104.65 8.01 2.21 16.18% 7.00% 3.60% 1.17 0.39 0.00 82.82% 17.18% 481.94% 374.92% -0.96 -0.07 5.52 66.11 12.27 29.74 18.22 20.04 95.85 75.82 2.70 1.00 0.40 60.00% 40.00% 150.00% 200.00% 6.20 8.65 6.10 59.84 11.41 32.00 15.23 23.97 91.84 67.87 7.00 2.60 17.00% 7.30% 3.50% 9.10% 18.20% 19.10% 1.16 14.20 0.61 2.40 9.39 7.97% 20.74% 2.78 8.39% -2.17% -2.65% -7.39% -27.70% -6.04% -1.60 -1.40 0.05 0.46 4.93 1.45 8.40 1.56 7.81 n.aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started