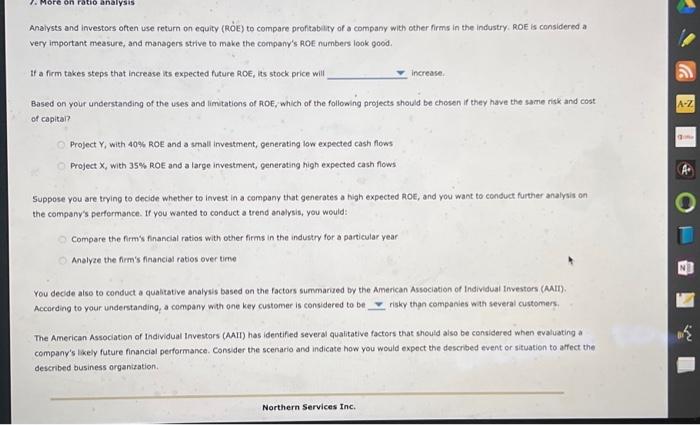

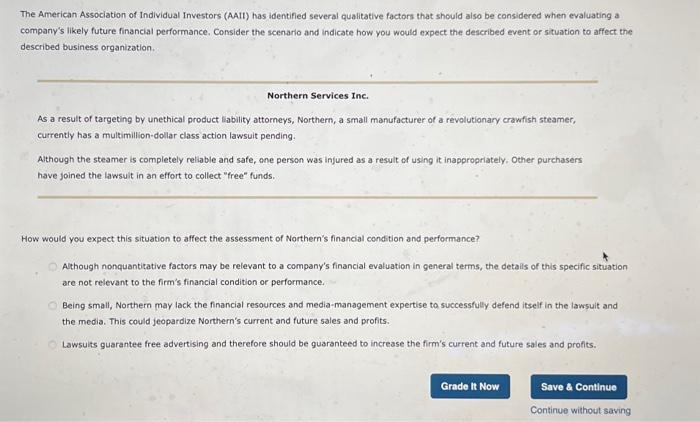

Analysts and investors often use return on equity (ROE)) to compare profitabity of a company with other firms in the industry, ROE is considered a very important measure, and managers strive to make the company's Rot numbers look good. If a firm takes steps that increase its expected future ROE, its stock price will increase. Based on your understanding of the uses and limitations of ROE; which of the folloning projects should be chosen if they have the same risk and cost of capital? Project Y, with 40% ROE and a small investment, generating low expected cash flows Project X, with 35% ROE and a large investment, generating high expected cash flows Suppose you are trying to decide whether to invest in a company that generates a high expected hot, and you want to conduct further analysis on the company's performance. If you wanted to conduct a trend analysis, you would: Compare the firm's financial ratios with other firms in the industry for a particular year Malyze the firm's financial ratios over time You decide also to conduct a qualitative analysis based on the factors summarzed by the American Association of tndividual Investors (AMII). According to your understanding, a company wh one key customer is considered to be risky than companies with several customers. The American-Association of Individual Investors (AAII) has identifed several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. The American Association of Individual Investors (AAII) has identifled several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. Northern Services Inc. As a result of targeting by unethical product liability attorneys, Northern, a small manufacturer of a revolutionary crawfish steamer, currently has a multimillion-dollar class action lawsuit pending. Although the steamer is completely reliable and safe, one person was infured as a result of using it inappropriately, Other purchasers have joined the lawsuit in an effort to collect "free" funds. How would you expect this situation to affect the assessment of Northern's financial condition and performance? Athough nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firm's financial condition or performance. Being small, Northern may lack the financial resources and media-management expertise to successfully defend itself in the lawsuit and the media. This could jeopardize Northern's current and future sales and profits. Lawsuits guarantee free advertising and therefore should be guaranteed to increase the firm's current and future sales and profits