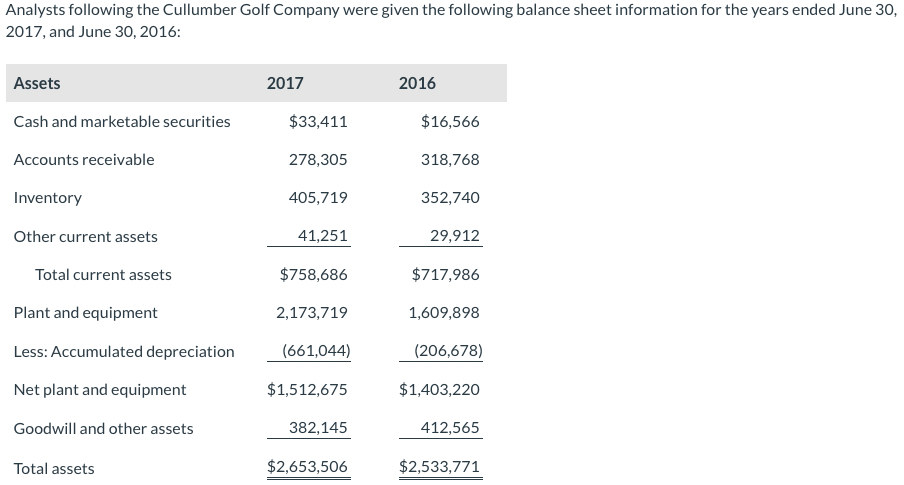

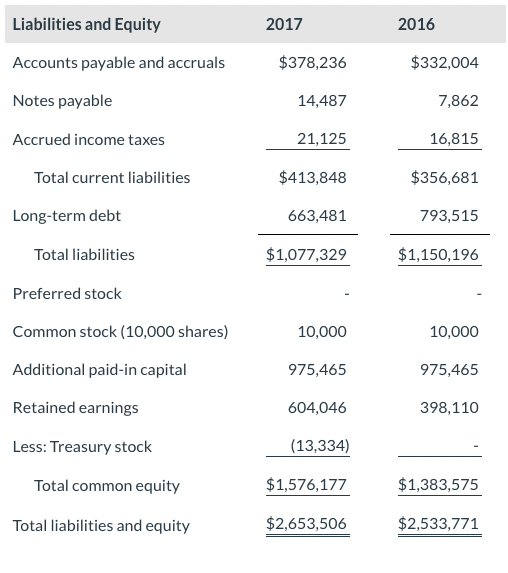

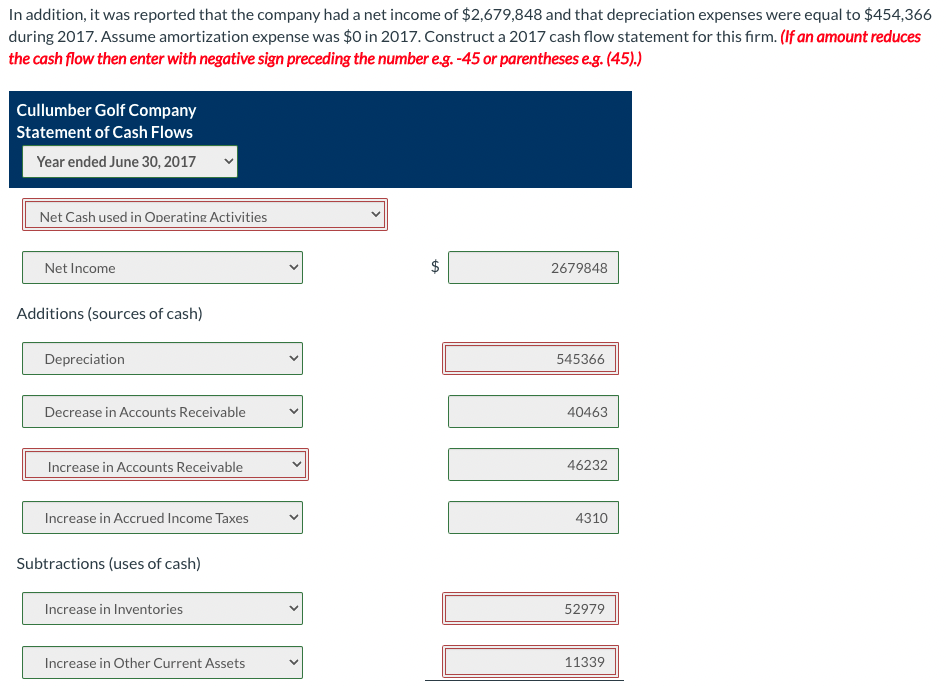

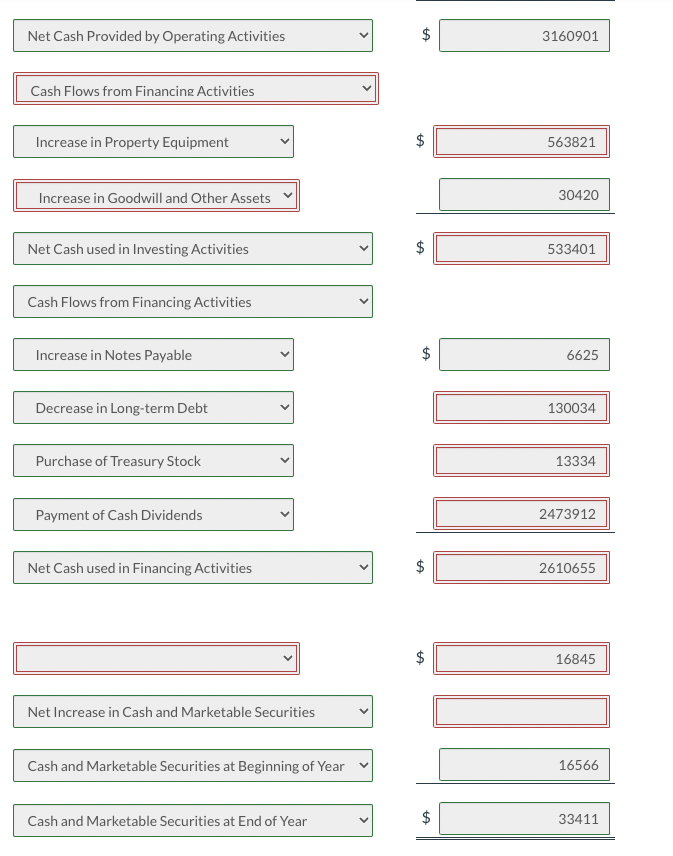

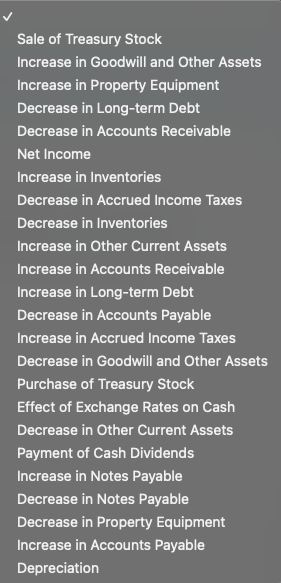

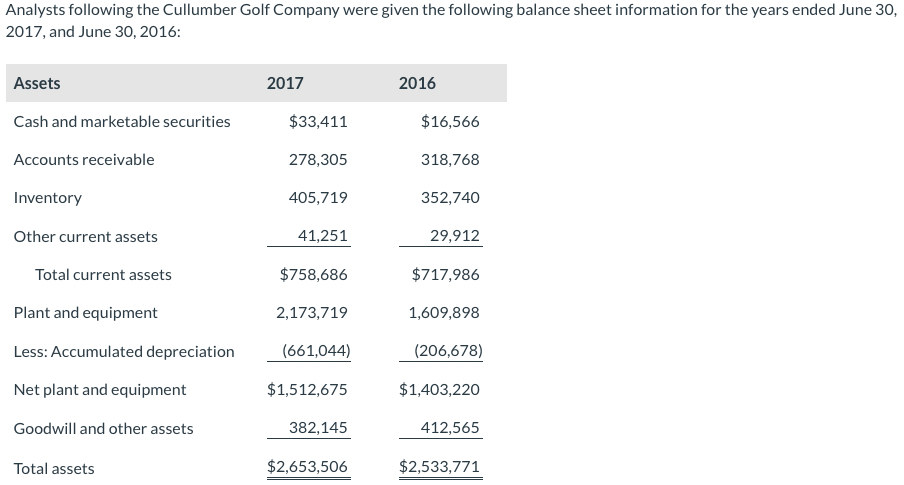

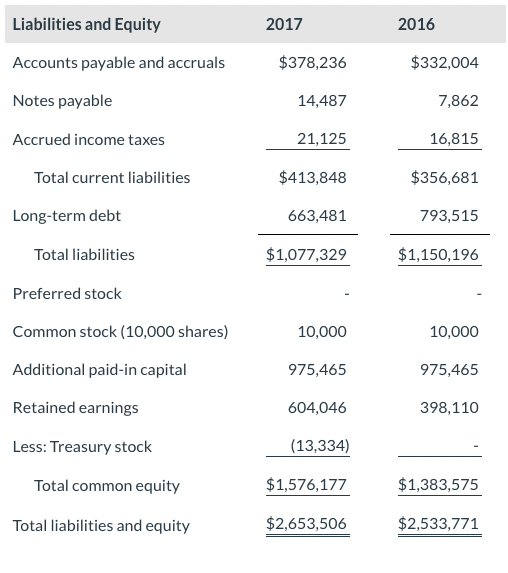

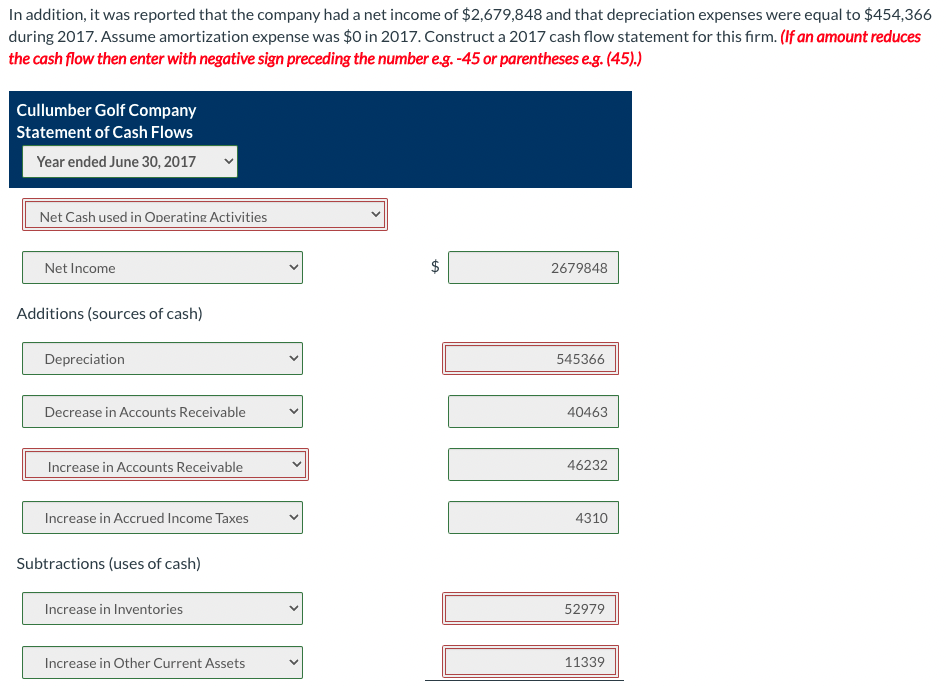

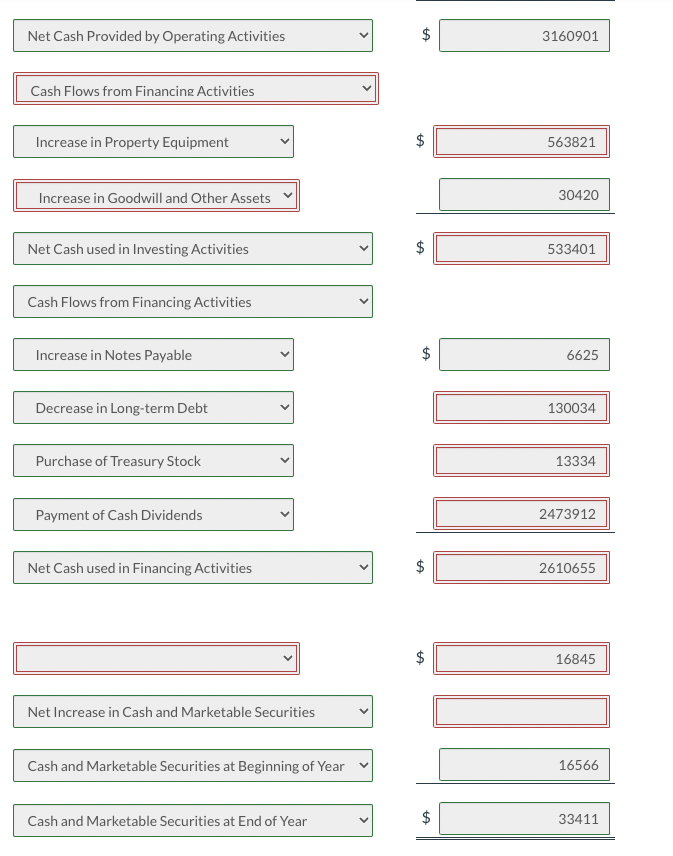

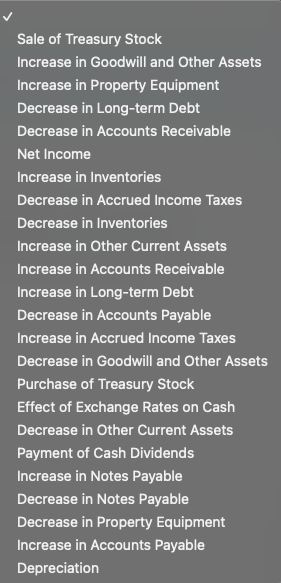

Analysts following the Cullumber Golf Company were given the following balance sheet information for the years ended June 30, 2017, and June 30, 2016: Assets 2017 2016 Cash and marketable securities $33,411 $16,566 Accounts receivable 278,305 318,768 Inventory 405,719 352,740 Other current assets 41,251 29,912 Total current assets $758,686 $717,986 Plant and equipment 2,173,719 1,609,898 Less: Accumulated depreciation (661,044) (206,678) Net plant and equipment $1,512,675 $1,403,220 Goodwill and other assets 382,145 412,565 Total assets $2,653,506 $2,533,771 Liabilities and Equity 2017 2016 Accounts payable and accruals $378,236 $332,004 Notes payable 14,487 7,862 Accrued income taxes 21,125 16,815 Total current liabilities $413,848 $356,681 Long-term debt 663,481 793,515 Total liabilities $1,077,329 $1,150,196 Preferred stock Common stock (10,000 shares) 10,000 10,000 Additional paid-in capital 975,465 975,465 Retained earnings 604,046 398,110 Less: Treasury stock (13,334) Total common equity $1,576, 177 $1,383,575 Total liabilities and equity $2,653,506 $2,533,771 In addition, it was reported that the company had a net income of $2,679,848 and that depreciation expenses were equal to $454,366 during 2017. Assume amortization expense was $0 in 2017. Construct a 2017 cash flow statement for this firm. (If an amount reduces the cash flow then enter with negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cullumber Golf Company Statement of Cash Flows Year ended June 30, 2017 Net Cash used in Operating Activities Net Income $ 2679848 Additions (sources of cash) Depreciation 545366 Decrease in Accounts Receivable 40463 Increase in Accounts Receivable 46232 Increase in Accrued Income Taxes 4310 Subtractions (uses of cash) Increase in Inventories 52979 Increase in Other Current Assets 11339 Net Cash Provided by Operating Activities $ 3160901 Cash Flows from Financing Activities Increase in Property Equipment $ 563821 Increase in Goodwill and Other Assets 30420 Net Cash used in Investing Activities $ 533401 Cash Flows from Financing Activities Increase in Notes Payable $ 6625 Decrease in Long-term Debt 130034 Purchase of Treasury Stock 13334 Payment of Cash Dividends 2473912 Net Cash used in Financing Activities $ 2610655 $ 16845 Net Increase in Cash and Marketable Securities Cash and Marketable Securities at Beginning of Year 16566 Cash and Marketable Securities at End of Year $ 33411 Cash Flows from Investing Activities Net Cash used in Operating Activities Net Decrease in Cash and Marketable Securities Net Cash Provided by Investing Activities Net Increase in Cash and Marketable Securities Net Cash Provided by Financing Activities Net Cash Provided by Operating Activities Cash Flows from Operating Activities Cash and Marketable Securities at Beginning of Year Cash and Marketable Securities at End of Year Cash Flows from Financing Activities Net Cash used in Investing Activities Net Cash used in Financing Activities Sale of Treasury Stock Increase in Goodwill and Other Assets Increase in Property Equipment Decrease in Long-term Debt Decrease in Accounts Receivable Net Income Increase in Inventories Decrease in Accrued Income Taxes Decrease in Inventories Increase in Other Current Assets Increase in Accounts Receivable Increase in Long-term Debt Decrease in Accounts Payable Increase in Accrued Income Taxes Decrease in Goodwill and Other Assets Purchase of Treasury Stock Effect of Exchange Rates on Cash Decrease in Other Current Assets Payment of Cash Dividends Increase in Notes Payable Decrease in Notes Payable Decrease in Property Equipment Increase in Accounts Payable Depreciation