Answered step by step

Verified Expert Solution

Question

1 Approved Answer

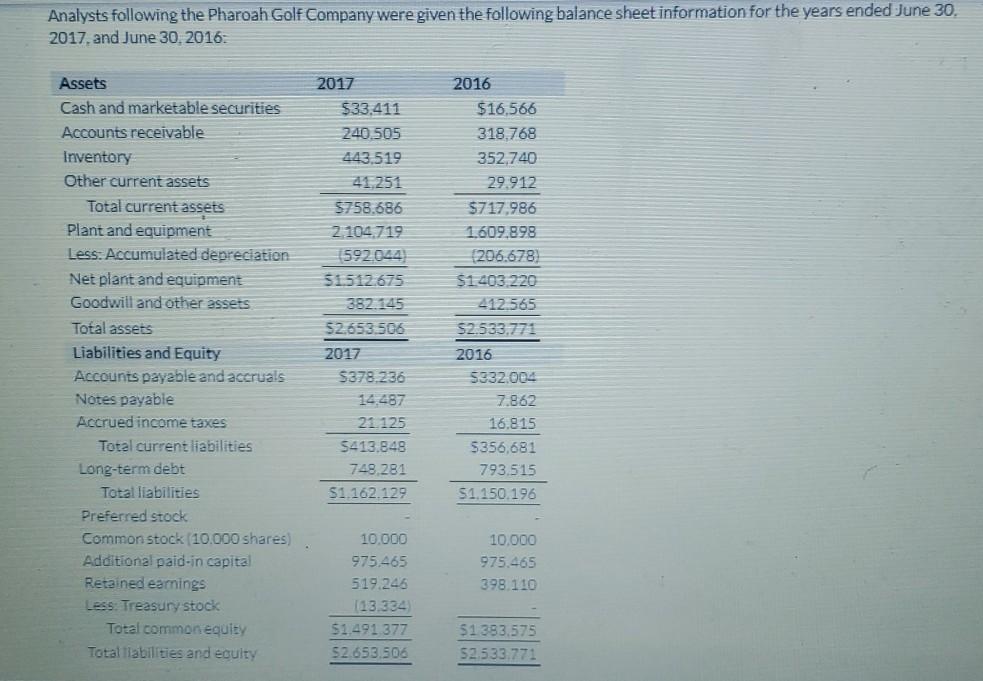

Analysts following the Pharoah Golf Company were given the following balance sheet information for the years ended June 30. 2017. and June 30, 2016: Assets

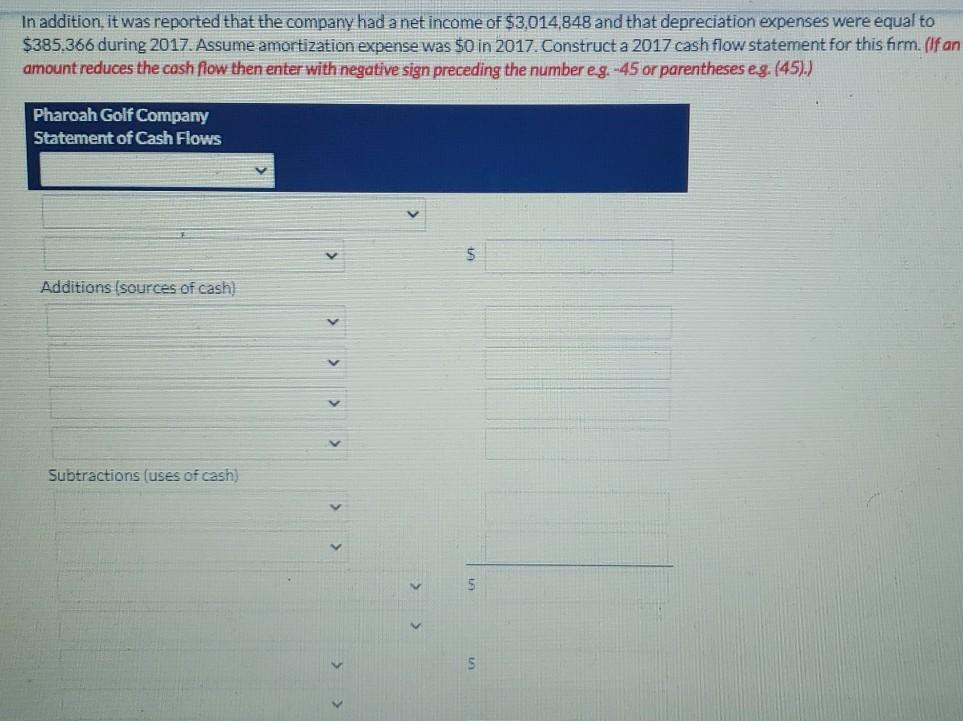

Analysts following the Pharoah Golf Company were given the following balance sheet information for the years ended June 30. 2017. and June 30, 2016: Assets Cash and marketable securities Accounts receivable Inventory Other current assets Total current assets Plant and equipment Less. Accumulated depreciation Net plant and equipment Goodwill and other assets Total assets Liabilities and Equity Accounts payable and accruals Notes payable Accrued income taxes Total current liabilities Long-term debt Total liabilities Preferred stock Common stock (10.000 shares) Additional paid-in capital Retained earnings Less Treasury stock Total common equity Total liabilities and eculty 2017 $33,411 240.505 443.519 41.251 5758.686 2.104.719 1592044 SE512.675 382.145 52.653.506 2017 $378.236 14,487 21.125 $413.848 748,281 $1.162.129 2016 $16,566 318.768 352,740 29.912 $717,986 1.609.898 206,678) $1403 220 412.565 $2.533.771 2016 5332.004 7.862 16.815 5356,681 793.515 51.150.196 10.000 975.465 398 110 10.000 975.465 519.246 (13.334 $1.491 377 52.653.506 $1383.575 52.533.771 In addition, it was reported that the company had a net income of $3,014,848 and that depreciation expenses were equal to $385.366 during 2017. Assume amortization expense was $0 in 2017. Construct a 2017 cash flow statement for this firm. (If an amount reduces the cash flow then enter with negative sign preceding the number eg.-45 or parentheses eg. (45).) Pharoah Golf Company Statement of Cash Flows 5 Additions (sources of cash) Subtractions (uses of cash) S GFA LA UFT S > > A M K >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started