Question

Analysts following the Wildhorse Golf Company were given the following balance sheet information for the years ended June 30, 2020, and June 30, 2019: Assets

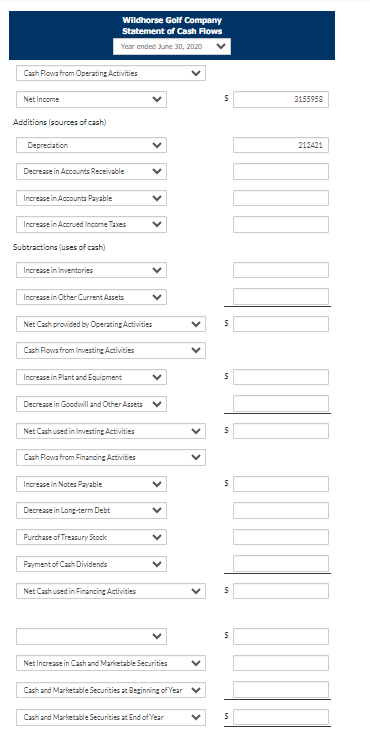

Analysts following the Wildhorse Golf Company were given the following balance sheet information for the years ended June 30, 2020, and June 30, 2019: Assets 2020 2019 Cash and marketable securities $33,521 $16,676 Accounts receivable 260,315 318,933 Inventory 423,984 352,850 Other current assets 41,416 30,022 Total current assets $759,236 $718,481 Plant and equipment 1,931,939 1,610,008 Less: Accumulated depreciation (419,209) (206,788) Net plant and equipment $1,512,730 $1,403,220 Goodwill and other assets 382,255 412,730 Total assets $2,654,221 $2,534,431 Liabilities and Equity 2020 2019 Accounts payable and accruals $378,401 $332,114 Notes payable 14,652 7,972 Accrued income taxes 21,290 16,925 Total current liabilities $414,343 $357,011 Long-term debt 680,091 793,680 Total liabilities $1,094,434 $1,150,691 Preferred stock Common stock (10,000 shares) 10,000 10,000 Additional paid-in capital 975,575 975,575 Retained earnings 587,656 398,165 Less: Treasury stock (13,444) Total common equity $1,559,787 $1,383,740 Total liabilities and equity $2,654,221 $2,534,431 In addition, it was reported that the company had a net income of $3,155,958 and that depreciation expenses were equal to $212,421 during 2020. Assume amortization expense was $0 in 2020.

Analysts following the Wildhorse Golf Company were given the following balance sheet information for the years ended June 30, 2020, and June 30, 2019: Assets 2020 2019 Cash and marketable securities $33,521 $16,676 Accounts receivable 260,315 318,933 Inventory 423,984 352,850 Other current assets 41,416 30,022 Total current assets $759,236 $718,481 Plant and equipment 1,931,939 1,610,008 Less: Accumulated depreciation (419,209) (206,788) Net plant and equipment $1,512,730 $1,403,220 Goodwill and other assets 382,255 412,730 Total assets $2,654,221 $2,534,431 Liabilities and Equity 2020 2019 Accounts payable and accruals $378,401 $332,114 Notes payable 14,652 7,972 Accrued income taxes 21,290 16,925 Total current liabilities $414,343 $357,011 Long-term debt 680,091 793,680 Total liabilities $1,094,434 $1,150,691 Preferred stock Common stock (10,000 shares) 10,000 10,000 Additional paid-in capital 975,575 975,575 Retained earnings 587,656 398,165 Less: Treasury stock (13,444) Total common equity $1,559,787 $1,383,740 Total liabilities and equity $2,654,221 $2,534,431 In addition, it was reported that the company had a net income of $3,155,958 and that depreciation expenses were equal to $212,421 during 2020. Assume amortization expense was $0 in 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started