Answered step by step

Verified Expert Solution

Question

1 Approved Answer

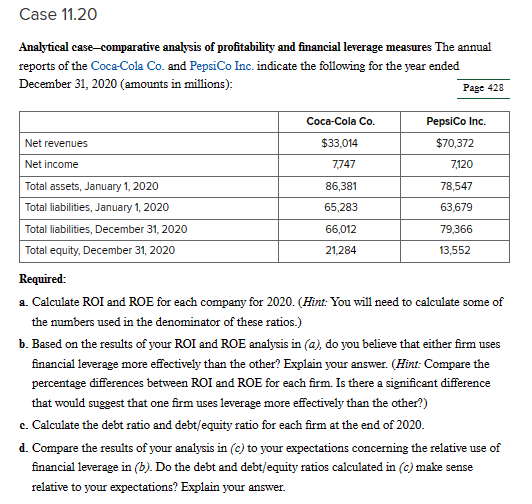

Analytical case-comparative analysis of profitability and financial leverage measures The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year

Analytical case-comparative analysis of profitability and financial leverage measures The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2020 (amounts in millions): Page 428 Required: a. Calculate ROI and ROE for each company for 2020. (Hint: You will need to calculate some of the numbers used in the denominator of these ratios.) b. Based on the results of your ROI and ROE analysis in (a), do you believe that either firm uses financial leverage more effectively than the other? Explain your answer. (Hint: Compare the percentage differences between ROI and ROE for each firm. Is there a significant difference that would suggest that one firm uses leverage more effectively than the other?) c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2020 . d. Compare the results of your analysis in (c) to your expectations concerning the relative use of financial leverage in (b). Do the debt and debt/equity ratios calculated in (c) make sense relative to your expectations? Explain your

Analytical case-comparative analysis of profitability and financial leverage measures The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2020 (amounts in millions): Page 428 Required: a. Calculate ROI and ROE for each company for 2020. (Hint: You will need to calculate some of the numbers used in the denominator of these ratios.) b. Based on the results of your ROI and ROE analysis in (a), do you believe that either firm uses financial leverage more effectively than the other? Explain your answer. (Hint: Compare the percentage differences between ROI and ROE for each firm. Is there a significant difference that would suggest that one firm uses leverage more effectively than the other?) c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2020 . d. Compare the results of your analysis in (c) to your expectations concerning the relative use of financial leverage in (b). Do the debt and debt/equity ratios calculated in (c) make sense relative to your expectations? Explain your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started