Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analytical Procedures.Perform horizontal analysis on the financial statements. Required: Required: study the data and perform HORIZONTAL ANALYSIS to discern relationship that rise question about possible

Analytical Procedures.Perform horizontal analysis on the financial statements. Required:

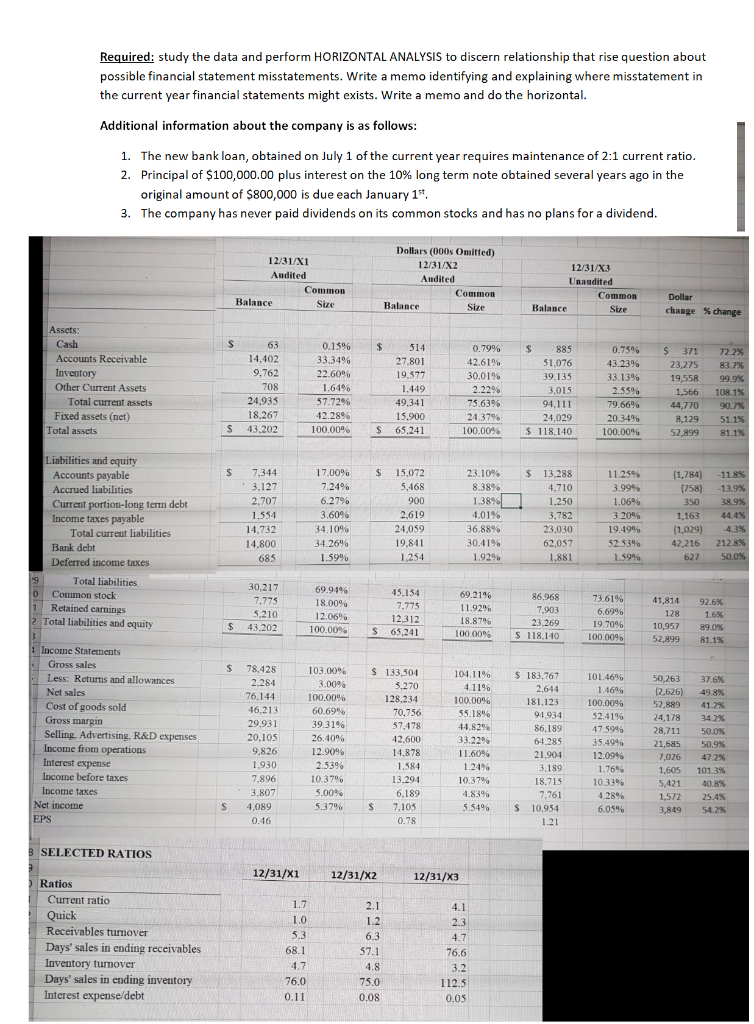

Required: study the data and perform HORIZONTAL ANALYSIS to discern relationship that rise question about possible financial statement misstatements. Write a memo identifying and explaining where misstatement in the current year financial statements might exists. Write a memo and do the horizontal. Additional information about the company is as follows: 1. The new bank loan, obtained on July 1 of the current year requires maintenance of 2:1 current ratio. 2. Principal of $100,000.00 plus interest on the 10% long term note obtained several years ago in the original amount of $800,000 is due each January 15, 3. The company has never paid dividends on its common stocks and has no plans for a dividend. 12/31/X1 Audited 12/31/X3 Dollars (000s Omitted) 12/31/X2 Audited Common Balance Size Unaudited Balance Common Size Common Stre Balance Dollar change % change $ Assets: Cash Accounts Receivable Inventory Other Current Assets Total current assets Fixed assets (net) Total assets 63 14.402 9,762 708 24,935 18,267 43.202 0.15% 33.34% 22.60% 1.64% 57.72% 42.28% 100.00 514 27.801 19.577 1.449 49.341 15.900 65.241 0.79% 42.61% 30.01% 2.22% 75.63% 24.37% 100.00% $ 885 51,076 39.135 3.015 94.111 24,029 $ 118.140 0.75% 43.23% 33.13% 2.35% 79.66% 20.34% 100.00% $ 371 23,275 19,558 1,566 44,770 8,129 52.899 72.2% 83.7% 99.9% 108.1% 90.7% 51.1% 81.1% $ $ $ $ $ Liabilities and equity Accounts payable Accrued liabilities Current portion-long term debt Income taxes payable Total current liabilities Bank debt Deferred income taxes Total liabilities 0 Common stock 1 Retained earnings 2 Total liabilities and equity 7,344 3,127 2,707 1,554 14,732 14,800 685 17.00% 7.24% 6.27% 3.60% 34.10% 34.26% 1.500 15,072 5.468 900 2.619 24,059 19,841 1.254 23.10% 8.38% 1.38% 4.01% 36.88% 30.41% 1.92% 13,288 4,710 1.250 3,782 23.030 62,057 1.881 11.25% 3.99% 1.06% 3.20% 19.49% 52.53% 1.5996 (1,784) (758) 350 1,163 (1.029) 42,216 627 -118% -13.9% 38.9% 44.4% 4.3% 212.8% 50.0% 45.154 30,217 7.775 5210 43.202 69.94% 18.00% 12.06% 100.00% 69.21% 11.929 18.879 100.000 12.312 86,968 7,903 23.269 S 118.140 73.61% 6.69% 19.70% 100.00% 41,814 128 10,957 52.899 92.6% 1.6% 89.08 81.1% $ S 65.241 $ 1 Income Statements Gross sales Less: Returns and allowances Net sales Cost of goods sold Gross margin Selling. Advertising, R&D expenses Income from operations Interest expense Income before taxes Income taxes Net income EPS 78,428 2.284 76,144 46.213 29,931 20.105 9,826 1.930 7.896 3.807 4,089 0.46 103.00% 3.00% 100.00% 60.69% 39.31% 26.40% 12.90% 2.53% 10.37% 5.00% 5.37% $ 133,504 5.270 128.234 70.756 57,478 42.600 14.878 1.584 13.294 6.189 7.105 0.78 104.11% 4.119 100.00% 55.18% 44.82% 33.22% 11.60% 1.24% 10.37% 4.83% 5.54% $ 183,767 2.644 181,123 01.934 86.189 64,285 21.904 3,189 18,715 7.761 $ 10,954 1.21 101.46% 1.46% 100.00% 52.41% 47.59% 35.49% 12.09% 1.76% 10.33% 4.28% 6.05% 50,263 12,626) 52,889 24,178 28,711 21,685 7,026 1,605 5,421 1,572 37.6% 49.8% 41.2% 34.2% 50.0% 50.9% 47.2% 101.3% 40.8% 25.4% 54.2% 3,849 8 SELECTED RATIOS 12/31/X1 12/31/X2 12/31/X3 1.7 2.1 4.1 1.0 Ratios Current ratio Quick Receivables turnover Days' sales in ending receivables Inventory tumover Days' sales in ending inventory Interest expense/debt 68.1 4.7 6.3 57.1 4.8 75.0 0.08 2.3 4.7 76.6 3.2 112.5 0.05 76.0 0.11 Required: study the data and perform HORIZONTAL ANALYSIS to discern relationship that rise question about possible financial statement misstatements. Write a memo identifying and explaining where misstatement in the current year financial statements might exists. Write a memo and do the horizontal. Additional information about the company is as follows: 1. The new bank loan, obtained on July 1 of the current year requires maintenance of 2:1 current ratio. 2. Principal of $100,000.00 plus interest on the 10% long term note obtained several years ago in the original amount of $800,000 is due each January 15, 3. The company has never paid dividends on its common stocks and has no plans for a dividend. 12/31/X1 Audited 12/31/X3 Dollars (000s Omitted) 12/31/X2 Audited Common Balance Size Unaudited Balance Common Size Common Stre Balance Dollar change % change $ Assets: Cash Accounts Receivable Inventory Other Current Assets Total current assets Fixed assets (net) Total assets 63 14.402 9,762 708 24,935 18,267 43.202 0.15% 33.34% 22.60% 1.64% 57.72% 42.28% 100.00 514 27.801 19.577 1.449 49.341 15.900 65.241 0.79% 42.61% 30.01% 2.22% 75.63% 24.37% 100.00% $ 885 51,076 39.135 3.015 94.111 24,029 $ 118.140 0.75% 43.23% 33.13% 2.35% 79.66% 20.34% 100.00% $ 371 23,275 19,558 1,566 44,770 8,129 52.899 72.2% 83.7% 99.9% 108.1% 90.7% 51.1% 81.1% $ $ $ $ $ Liabilities and equity Accounts payable Accrued liabilities Current portion-long term debt Income taxes payable Total current liabilities Bank debt Deferred income taxes Total liabilities 0 Common stock 1 Retained earnings 2 Total liabilities and equity 7,344 3,127 2,707 1,554 14,732 14,800 685 17.00% 7.24% 6.27% 3.60% 34.10% 34.26% 1.500 15,072 5.468 900 2.619 24,059 19,841 1.254 23.10% 8.38% 1.38% 4.01% 36.88% 30.41% 1.92% 13,288 4,710 1.250 3,782 23.030 62,057 1.881 11.25% 3.99% 1.06% 3.20% 19.49% 52.53% 1.5996 (1,784) (758) 350 1,163 (1.029) 42,216 627 -118% -13.9% 38.9% 44.4% 4.3% 212.8% 50.0% 45.154 30,217 7.775 5210 43.202 69.94% 18.00% 12.06% 100.00% 69.21% 11.929 18.879 100.000 12.312 86,968 7,903 23.269 S 118.140 73.61% 6.69% 19.70% 100.00% 41,814 128 10,957 52.899 92.6% 1.6% 89.08 81.1% $ S 65.241 $ 1 Income Statements Gross sales Less: Returns and allowances Net sales Cost of goods sold Gross margin Selling. Advertising, R&D expenses Income from operations Interest expense Income before taxes Income taxes Net income EPS 78,428 2.284 76,144 46.213 29,931 20.105 9,826 1.930 7.896 3.807 4,089 0.46 103.00% 3.00% 100.00% 60.69% 39.31% 26.40% 12.90% 2.53% 10.37% 5.00% 5.37% $ 133,504 5.270 128.234 70.756 57,478 42.600 14.878 1.584 13.294 6.189 7.105 0.78 104.11% 4.119 100.00% 55.18% 44.82% 33.22% 11.60% 1.24% 10.37% 4.83% 5.54% $ 183,767 2.644 181,123 01.934 86.189 64,285 21.904 3,189 18,715 7.761 $ 10,954 1.21 101.46% 1.46% 100.00% 52.41% 47.59% 35.49% 12.09% 1.76% 10.33% 4.28% 6.05% 50,263 12,626) 52,889 24,178 28,711 21,685 7,026 1,605 5,421 1,572 37.6% 49.8% 41.2% 34.2% 50.0% 50.9% 47.2% 101.3% 40.8% 25.4% 54.2% 3,849 8 SELECTED RATIOS 12/31/X1 12/31/X2 12/31/X3 1.7 2.1 4.1 1.0 Ratios Current ratio Quick Receivables turnover Days' sales in ending receivables Inventory tumover Days' sales in ending inventory Interest expense/debt 68.1 4.7 6.3 57.1 4.8 75.0 0.08 2.3 4.7 76.6 3.2 112.5 0.05 76.0 0.11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started