Question

Analyze AMAZON'S company's treatment of Intangible Assets. Using their financial statement, your analysis should include the horizontal and vertical analysis of the balance sheet and

Analyze AMAZON'S company's treatment of Intangible Assets.

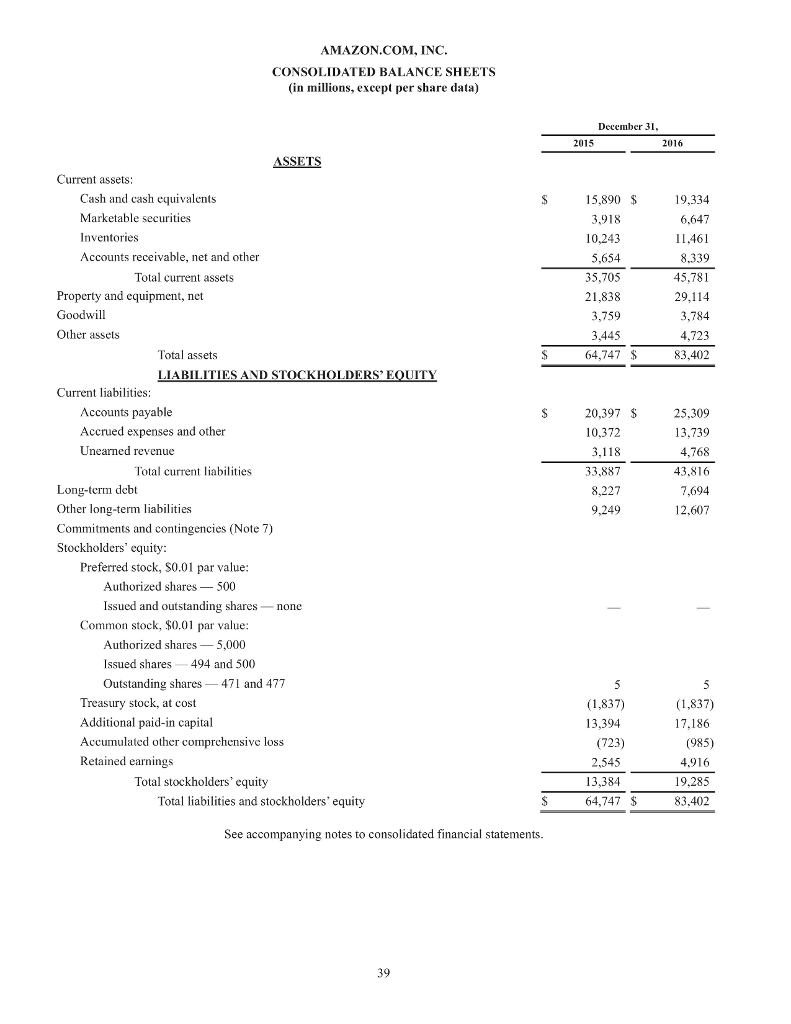

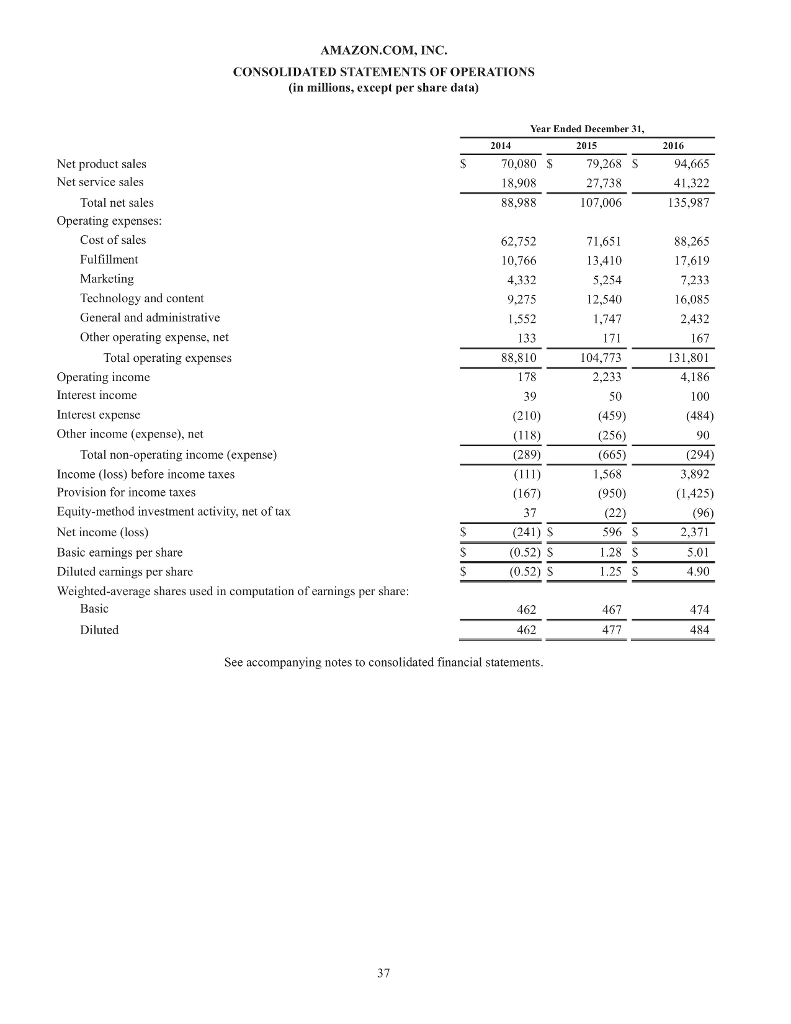

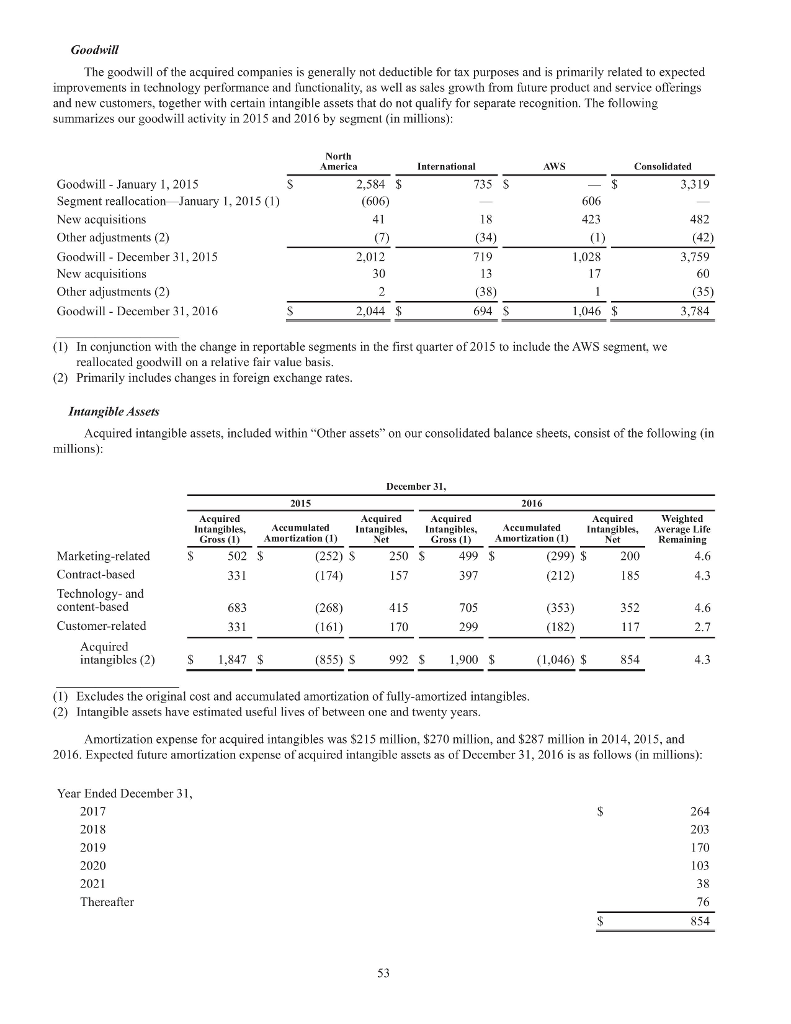

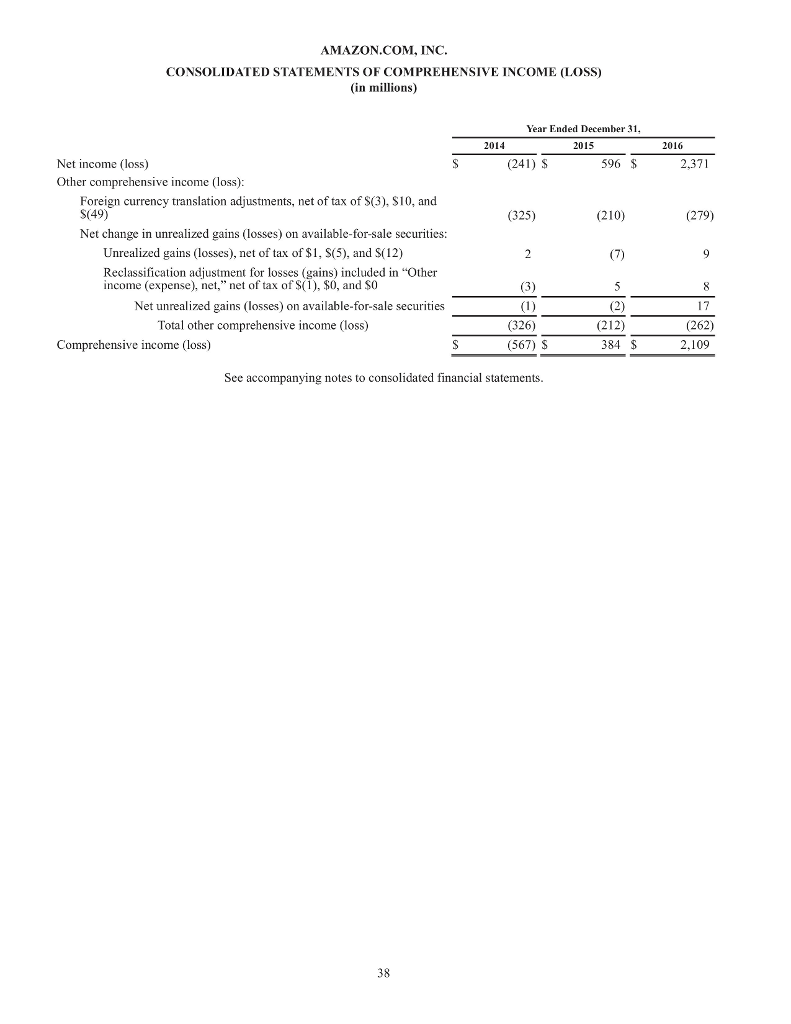

Using their financial statement, your analysis should include the horizontal and vertical analysis of the balance sheet and income statement for the two most recent fiscal years. Discuss any solvency and profitability analysis using at least two measures which are relevant to the Intagible Assets. Identify (by name) the method used by AMAZON to account for their Intagible Assets (if applicable) and how they treat their Intagible Assets in relation to their financial statements. Indicate significant increases/decreases between the two years and suggest probable reasons for those changes. Include each type of solvency and profitability measure used, the reason you used it, the calculation, and what it tells you about AMAZON'S Intangible Assets and any other relevant information that will strengthen your analysis.

(2015 & 2016 balance sheet, income (operating) statement and intangible assets reports are attached).

Subject Accounting 1105 (Wild 22nd edition chapter 17)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started