Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze and compare Amazon.com, Best Buy, and Walmart Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy Co.,

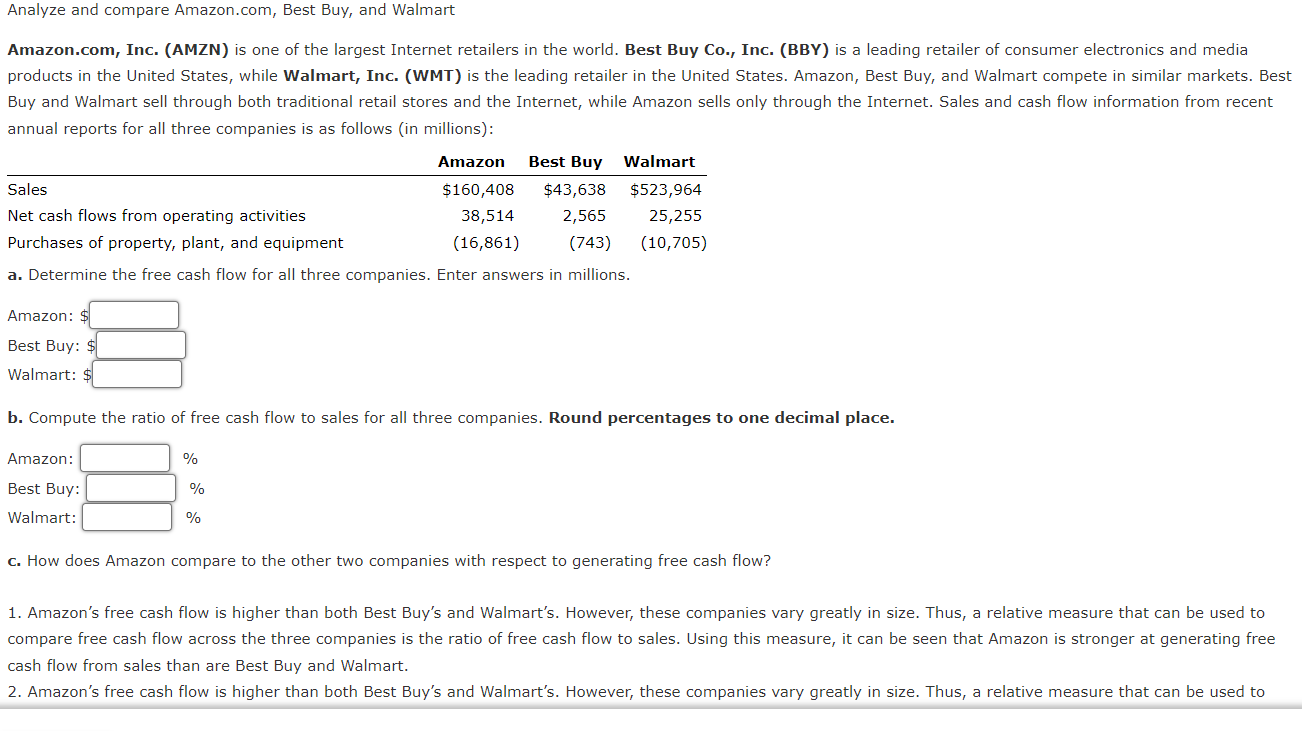

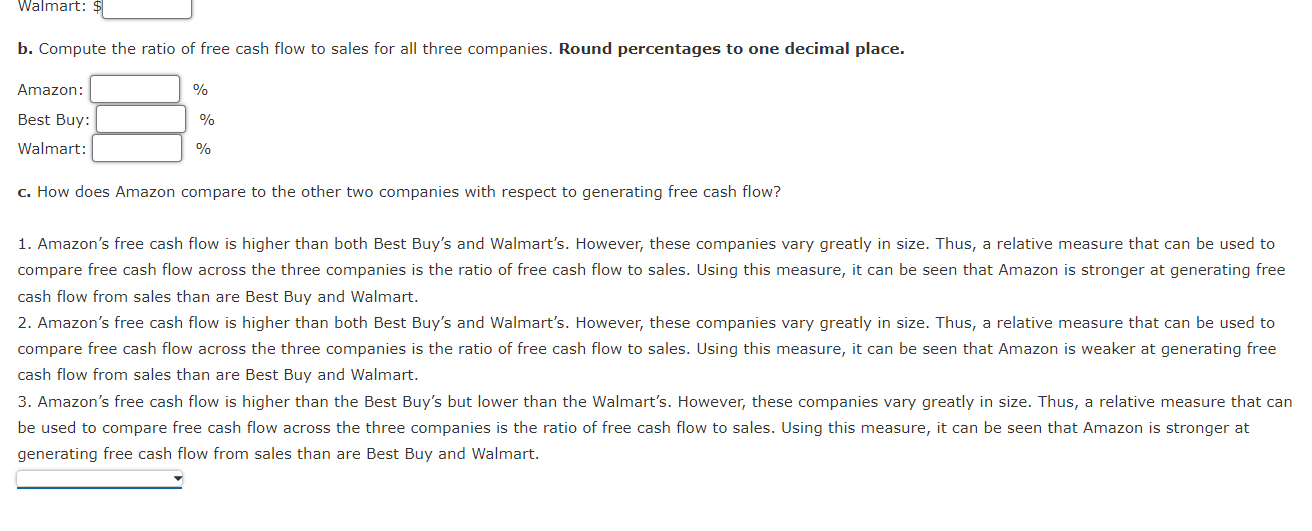

Analyze and compare Amazon.com, Best Buy, and Walmart Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy Co., Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States, while Walmart, Inc. (WMT) is the leading retailer in the United States. Amazon, Best Buy, and Walmart compete in similar markets. Best Buy and Walmart sell through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Sales and cash flow information from recent annual reports for all three companies is as follows (in millions): Sales Net cash flows from operating activities Purchases of property, plant, and equipment Amazon Best Buy Walmart $160,408 38,514 (16,861) $43,638 2,565 25,255 (743) (10,705) $523,964 a. Determine the free cash flow for all three companies. Enter answers in millions. Amazon: Best Buy: $ Walmart: $ b. Compute the ratio of free cash flow to sales for all three companies. Round percentages to one decimal place. Amazon: Best Buy: Walmart: % % % c. How does Amazon compare to the other two companies with respect to generating free cash flow? 1. Amazon's free cash flow is higher than both Best Buy's and Walmart's. However, these companies vary greatly in size. Thus, a relative measure that can be used to compare free cash flow across the three companies is the ratio of free cash flow to sales. Using this measure, it can be seen that Amazon is stronger at generating free cash flow from sales than are Best Buy and Walmart. 2. Amazon's free cash flow is higher than both Best Buy's and Walmart's. However, these companies vary greatly in size. Thus, a relative measure that can be used to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started