Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze and critically comment on the company performance and trend based on any three Financial Leverage ratios of the selected company for the past two

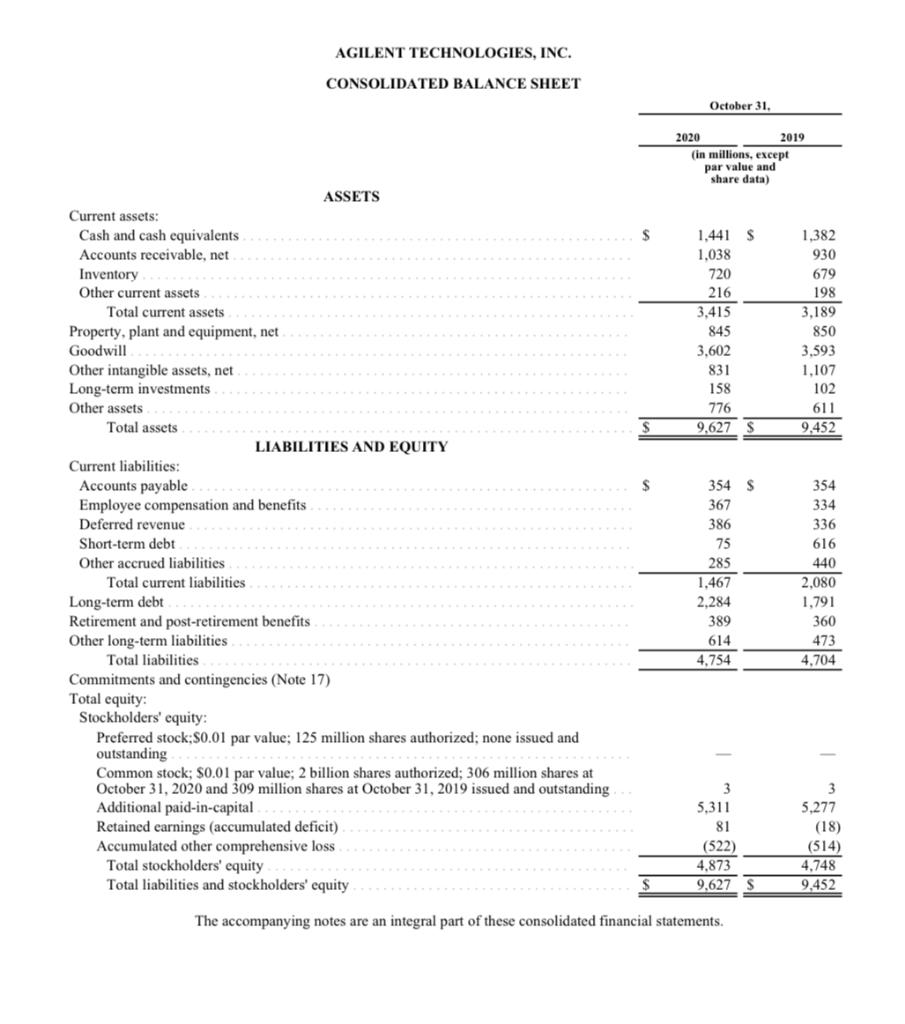

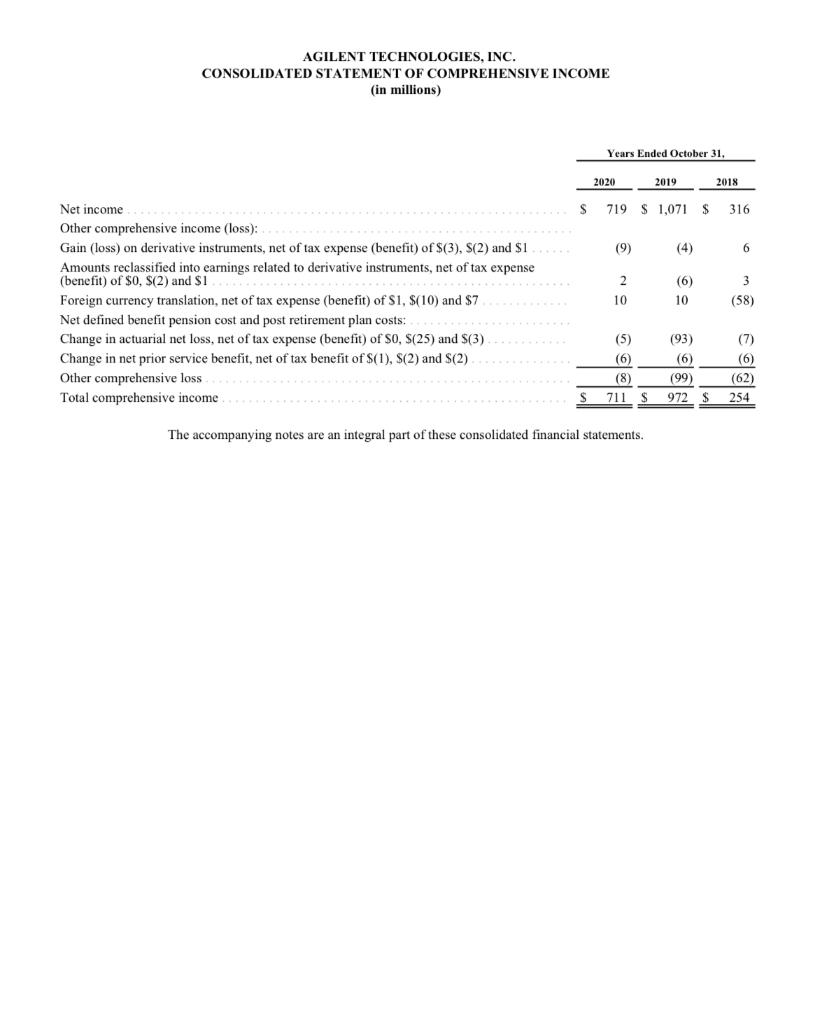

Analyze and critically comment on the company performance and trend based on any three Financial Leverage ratios of the selected company for the past two years (2019 and 2020).

Note: Comment on the company performance and trend thoroughly.

AGILENT TECHNOLOGIES, INC. CONSOLIDATED BALANCE SHEET October 31, 2020 2019 (in millions, except par value and share data) S 1,441 $ 1,038 720 216 3,415 845 3,602 831 158 776 9.627 $ 1,382 930 679 198 3,189 850 3,593 1.107 102 611 9,452 354 334 336 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventory Other current assets Total current assets Property, plant and equipment, net Goodwill Other intangible assets, net Long-term investments Other assets Total assets LIABILITIES AND EQUITY Current liabilities: Accounts payable Employee compensation and benefits Deferred revenue Short-term debt Other accrued liabilities Total current liabilities Long-term debt Retirement and post-retirement benefits Other long-term liabilities Total liabilities Commitments and contingencies (Note 17) Total equity: Stockholders' equity: Preferred stock:$0.01 par value: 125 million shares authorized: none issued and outstanding Common stock; $0.01 par value; 2 billion shares authorized; 306 million shares at October 31, 2020 and 309 million shares at October 31, 2019 issued and outstanding Additional paid-in-capital Retained earnings (accumulated deficit) Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity 354 S 367 386 75 285 1,467 2.284 389 614 616 440 2.080 1.791 360 473 4,704 4,754 3 5,311 81 (522) 4.873 9.627 S 3 5,277 (18) (514) 4,748 9,452 The accompanying notes are an integral part of these consolidated financial statements. AGILENT TECHNOLOGIES, INC. CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (in millions) Years Ended October 31, 2020 2019 2018 S 719 $ 1,071 $ 316 (9) 6 Net income Other comprehensive income (loss): Gain (loss) on derivative instruments, net of tax expense (benefit) of $(3), S(2) and $1 Amounts reclassified into earnings related to derivative instruments, net of tax expense (benefit) of $0, $(2) and SI Foreign currency translation, net of tax expense (benefit) of S1, $(10) and $7 Net defined benefit pension cost and post retirement plan costs: Change in actuarial net loss, net of tax expense (benefit) of SO, S(25) and S(3) Change in net prior service benefit, net of tax benefit of $(1), S(2) and S(2) Other comprehensive loss Total comprehensive income 2 10 (6) 10 3 (58) (93) (7) (5) (6) (6) (6) (8 711 (99) 972 $ (62) 254 S The accompanying notes are an integral part of these consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started