Answered step by step

Verified Expert Solution

Question

1 Approved Answer

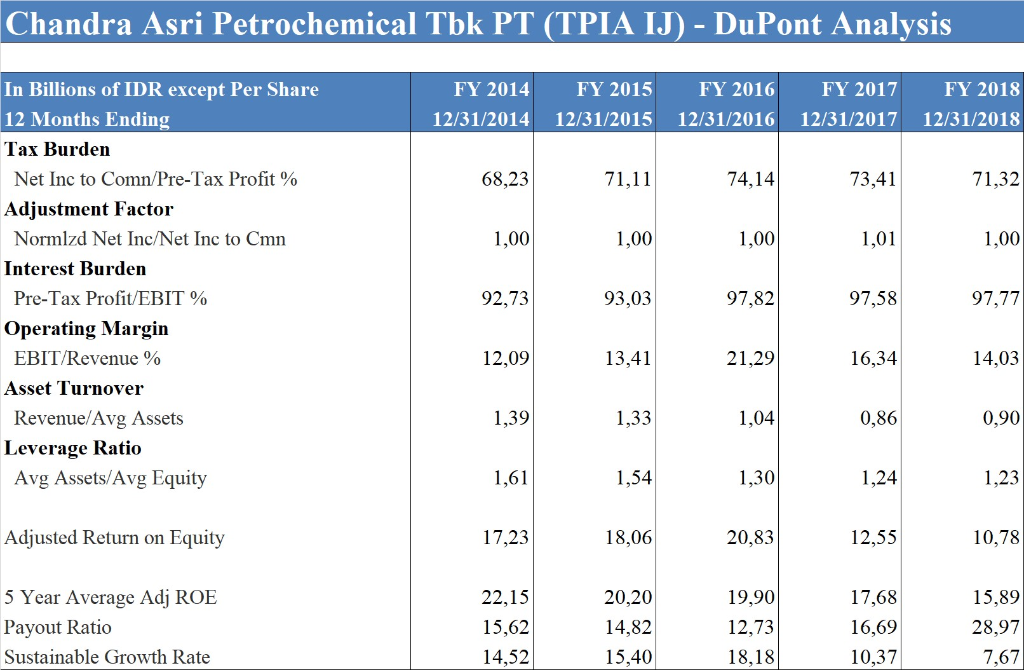

Analyze and give interpretation the above Du Pont Analysis Chandra Asri Petrochemical Tbk PT (TPIA IJ) - DuPont Analysis FY 2014 12/31/2014 FY 2015 12/31/2015

Analyze and give interpretation the above Du Pont Analysis

Chandra Asri Petrochemical Tbk PT (TPIA IJ) - DuPont Analysis FY 2014 12/31/2014 FY 2015 12/31/2015 FY 2016 12/31/2016 FY 2017 12/31/2017 FY 2018 12/31/2018 68,23 71,11 74,14 73,41 71,32 1,00 1,00 1,00 1,01 1,00 In Billions of IDR except Per Share 12 Months Ending Tax Burden Net Inc to Comn/Pre-Tax Profit % Adjustment Factor Normlzd Net Inc/Net Inc to Cmn Interest Burden Pre-Tax Profit/EBIT % Operating Margin EBIT/Revenue % Asset Turnover Revenue/Avg Assets Leverage Ratio Avg Assets/Avg Equity 92,73 93,03 97.82 97,58 97,77 12,09 13,41 21,29 16,34 14,03 1,39 1,04 0,86 0,90 1,61 1,54 1,30 1,24 1,23 Adjusted Return on Equity 17,23 18,06 20,83 12,55 10,78 5 Year Average Adj ROE Payout Ratio Sustainable Growth Rate 22,15 15,62 14,52 20,20 14,82 15,40 19,90 12,73 18,18 17,68 16,69 10,37 15,89 28,97 7,67 Chandra Asri Petrochemical Tbk PT (TPIA IJ) - DuPont Analysis FY 2014 12/31/2014 FY 2015 12/31/2015 FY 2016 12/31/2016 FY 2017 12/31/2017 FY 2018 12/31/2018 68,23 71,11 74,14 73,41 71,32 1,00 1,00 1,00 1,01 1,00 In Billions of IDR except Per Share 12 Months Ending Tax Burden Net Inc to Comn/Pre-Tax Profit % Adjustment Factor Normlzd Net Inc/Net Inc to Cmn Interest Burden Pre-Tax Profit/EBIT % Operating Margin EBIT/Revenue % Asset Turnover Revenue/Avg Assets Leverage Ratio Avg Assets/Avg Equity 92,73 93,03 97.82 97,58 97,77 12,09 13,41 21,29 16,34 14,03 1,39 1,04 0,86 0,90 1,61 1,54 1,30 1,24 1,23 Adjusted Return on Equity 17,23 18,06 20,83 12,55 10,78 5 Year Average Adj ROE Payout Ratio Sustainable Growth Rate 22,15 15,62 14,52 20,20 14,82 15,40 19,90 12,73 18,18 17,68 16,69 10,37 15,89 28,97 7,67Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started