Answered step by step

Verified Expert Solution

Question

1 Approved Answer

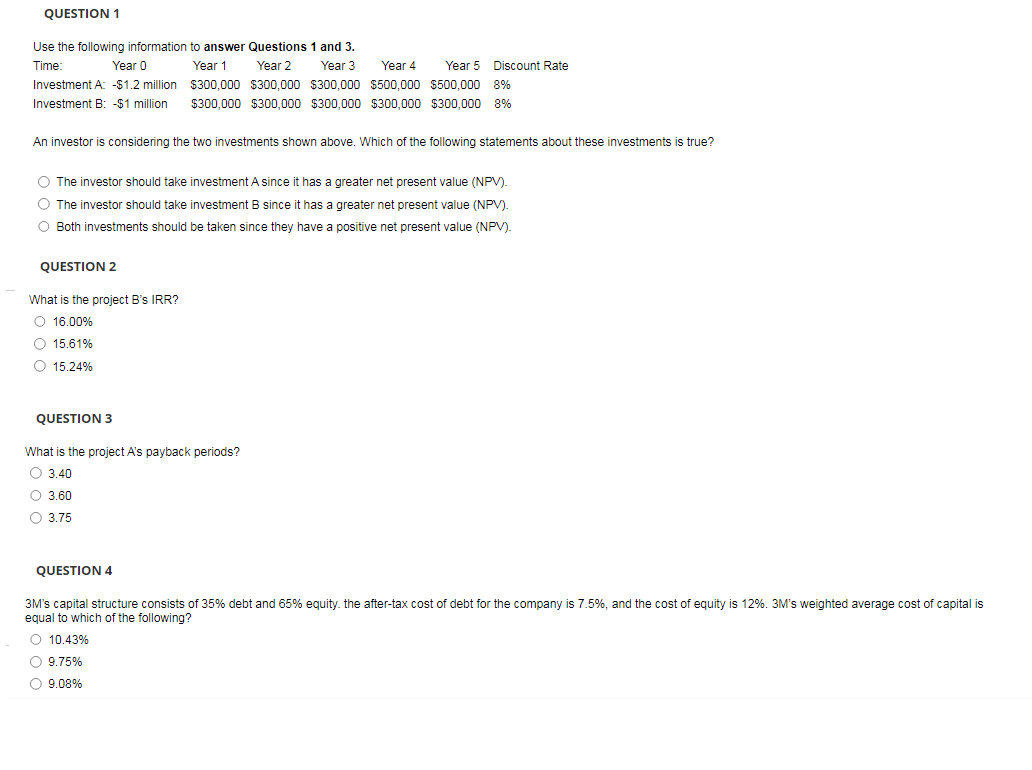

QUESTION 1 Use the following information to answer Questions 1 and 3 . An investor is considering the two investments shown above. Which of the

QUESTION

Use the following information to answer Questions and

An investor is considering the two investments shown above. Which of the following statements about these investments is true?

The investor should take investment A since it has a greater net present value NPV

The investor should take investment B since it has a greater net present value NPV

Both investments should be taken since they have a positive net present value NPV

QUESTION

What is the project Bs IRR?

QUESTION

What is the project As payback periods?

QUESTION

s capital structure consists of debt and equity. the aftertax cost of debt for the company is and the cost of equity is s weighted average cost of capital is

equal to which of the following?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started