Question

Analyze: Determine if the action represents an economic transaction, determine which accounts are affected, do they increase or decrease, do they need a debit or

Analyze: Determine if the action represents an economic transaction, determine which accounts are affected, do they increase or decrease, do they need a debit or a credit entry, and for how much. There should be 23 documents in total. Follow the example given.

Scenario:

Amanda Singh was the first of her family born in Canada, her parent's adopted country. Wanting

Amanda to embrace her new culture, they enrolled her in ski lessons as soon as she could walk. She

loved the snow and took to skiing like a natural. Every weekend and any spare moments she headed to

the snow covered peaks. By the time she was sixteen she was an accomplished competitor and a fully

licensed instructor; however, her new passion was snow boarding. For her final year in high school she

had a part-time job teaching children to ski and snow board. She was approached by the Canadian

Olympic Committee to train with the national team, but found that the demands on her time would take

her away from her real passion of teaching and coaching the sport she loved.

Amanda was accepted into the kinesiology program at university, and paid for her studies by continuing

to teach and coach for the local ski school. In her final year of studies, she took an entrepreneurship

course as an elective. When she graduated, a new Canadian business was born.

Although Amanda's parents had insisted that she pay for her own education at her commencement

ceremony, they presented her with a savings account for the full cost of her degree: $80,000. Amanda

paid off the balance of her student loans for $30,000. She then opened a bank account in the name of

her new ski/snow boarding school.

Singh Ski School was born, when on September 1, 2019 Amanda deposited $40,000 into the new

account.i

Amanda has been so busy in the months of September and October, that she has had no time to set up

an accounting system. She has asked you, a classmate from her entrepreneurship class to please get her

accounting records set up, reconciled and for you to produce financial statements for her first two

months of operations. She hands you a shoebox full of documents. First review the accounting cycle,

then complete the steps for the transactions outlined below.

We believe that Amanda's fiscal year should start on October 1, 2019.

Amanda negotiated a lease with the local ski resort for $800 per month, beginning September 1, 2019ii,

She prepaid one year's rent.iii She purchased new computer equipment worth $3,600iv, she expects that

the computer will last three years. The little office space that she rented was in superior condition, but

she wanted a new sign and hired a local shop to design and install it for $2,000, paying $1,000 depositv,

the remainder due on installation, expected for September 5th, 2019.vi Although the ski lodge attracts

many visitors who will ask for lessons, Amanda wants to expand her reach, and be able to book lessons

well in advance. She takes an advertisement out in the newspaper in the nearest large city, paying

$600vii. In addition, she hires a web designer to create a web site and an enterprise system that tracks

her bookings, and clients. It is linked to her accounting system. The total cost for the software

development is $1,500viii.

September 1st Amanda purchases a cash register for $500ix, with an expected life of 5 years. She buys

coffee supplies for $160 and postage for $40x. She negotiates with a reputable retailer to purchase

$50,000xi worth of skies, snowboards, bindings, boots, helmets and poles. On September 1st, she pays

$5,000 cash and signs a note payable for $45,000xii @ 5% for 3 years, with interest payments due

October 1st and April 1st, with the balance of the loan due on August 31st , 2020. It is expected that the

equipment will have a 3 year life.

On September 15th a school group came to the school for lessons. She charged each of the 30 students

$50xiii for one-hour group lessons, taking them out in groups of 6. September 23 she had four groups of

6 at $80xiv each for group lessons and on September 24 she gave two private clients lessons at

$150/hourxv, and she's coach a Canadian Olympic hopeful for $200 xvifor a two-hour session. She

purchases office supplies worth $500,xvii for use over the next couple of months. The cash sales report

for the month of September shows sales of (private lesson of $1,500 and group lessons of $2,100)

$3,600xviii. She had paid cash delivery charges of 160xix. On October 3 the utilities bill of $325xx for

September's usage was received and paid on the due date of October 15th.

Amanda's website has done the trick, with many advanced bookings for October. She has received

deposits of $10,000xxi for lessons to be given in October, and realizes that she will need some help with

lessons on the weekends. She interviews and hires two young instructors, for part-time work on the

weekendsxxii. They will begin work on Saturday, October 7 at $20 per hour. In addition, Amanda has had

many requests to rent equipment for the lessons. Amanda withdraws $2,000 from the business account

for personal use.xxiii On September 20th a physical count of office supplies reveals that there are $150

worth of supplies left. As September 30th is Amanda's fiscal year end, all other required adjusting

entries must be made, and proper form financial statements must be made. In addition, the books must

be closed, in preparation for the new fiscal year commencing October 1st.

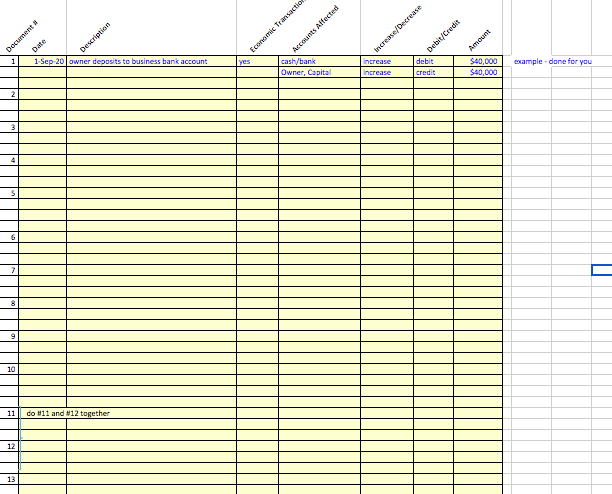

Documents Economic Transactic Account Affected Debit/Credit scription Amount Increase/Decrease 1 1-Sep-20 owner deposits to business bank account yes wample-done for you cash/bank Owner, Capital increase increase debit credit $40,000 $40,000 2 3 A 5 6 9 10 11 do #11 and 12 together 12 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started