Analyze financial statements of the company Walmart from the year 2016.

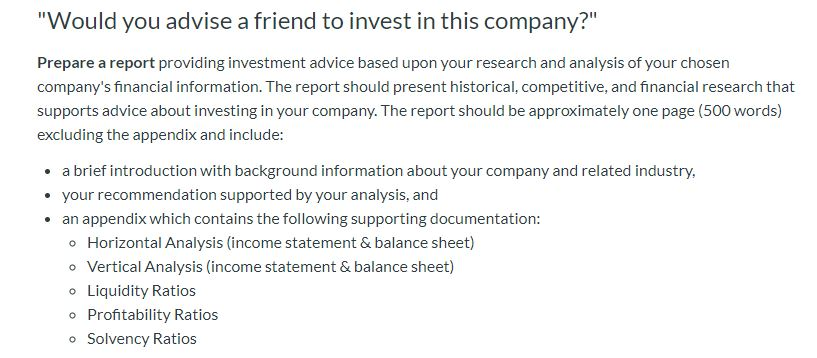

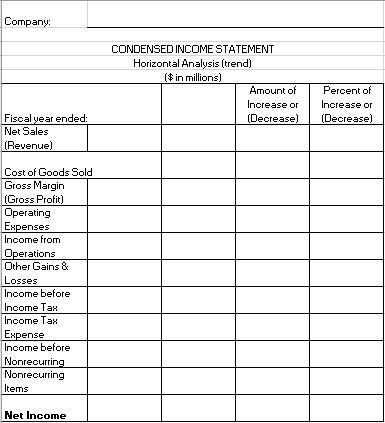

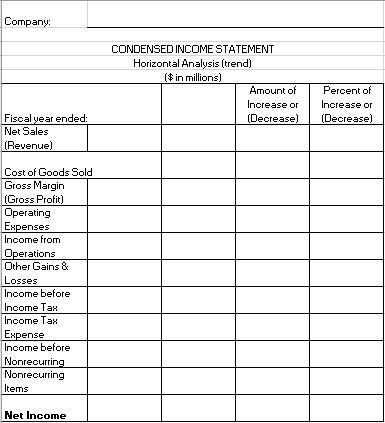

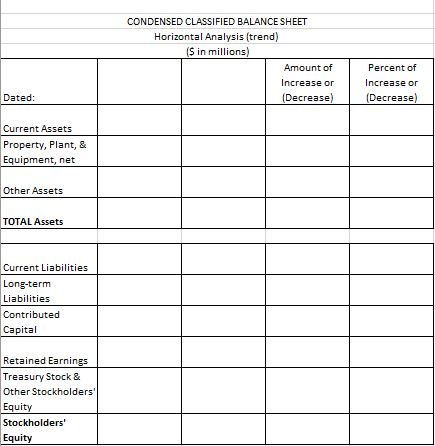

. "Would you advise a friend to invest in this company?" Prepare a report providing investment advice based upon your research and analysis of your chosen company's financial information. The report should present historical, competitive, and financial research that supports advice about investing in your company. The report should be approximately one page (500 words) excluding the appendix and include: a brief introduction with background information about your company and related industry, your recommendation supported by your analysis, and an appendix which contains the following supporting documentation: o Horizontal Analysis (income statement & balance sheet) o Vertical Analysis (income statement & balance sheet) o Liquidity Ratios o Profitability Ratios o Solvency Ratios . Company: CONDENSED INCOME STATEMENT Horizontal Analysis (trend) ($ in millions) Amount of Increase or (Decrease) Percent of Increase or (Decrease) Fiscal year ended: Net Sales (Revenue) Cost of Goods Sold Gross Margin (Gross Profit) Operating Expenses Income from Operations Other Gains & Losses Income before Income Tax Income Tax Expense Income before Nonrecurring Nonrecurring Items Net Income CONDENSED CLASSIFIED BALANCE SHEET Horizontal Analysis (trend) (S in millions) Amount of Increase or (Decrease) Percent of Increase or (Decrease) Dated: Current Assets Property, plant,& Equipment, net Other Assets TOTAL Assets Current Liabilities Long-term Liabilities Contributed Capital Retained Earnings Treasury Stock & Other Stockholders' Equity Stockholders' Equity . "Would you advise a friend to invest in this company?" Prepare a report providing investment advice based upon your research and analysis of your chosen company's financial information. The report should present historical, competitive, and financial research that supports advice about investing in your company. The report should be approximately one page (500 words) excluding the appendix and include: a brief introduction with background information about your company and related industry, your recommendation supported by your analysis, and an appendix which contains the following supporting documentation: o Horizontal Analysis (income statement & balance sheet) o Vertical Analysis (income statement & balance sheet) o Liquidity Ratios o Profitability Ratios o Solvency Ratios . Company: CONDENSED INCOME STATEMENT Horizontal Analysis (trend) ($ in millions) Amount of Increase or (Decrease) Percent of Increase or (Decrease) Fiscal year ended: Net Sales (Revenue) Cost of Goods Sold Gross Margin (Gross Profit) Operating Expenses Income from Operations Other Gains & Losses Income before Income Tax Income Tax Expense Income before Nonrecurring Nonrecurring Items Net Income CONDENSED CLASSIFIED BALANCE SHEET Horizontal Analysis (trend) (S in millions) Amount of Increase or (Decrease) Percent of Increase or (Decrease) Dated: Current Assets Property, plant,& Equipment, net Other Assets TOTAL Assets Current Liabilities Long-term Liabilities Contributed Capital Retained Earnings Treasury Stock & Other Stockholders' Equity Stockholders' Equity