Answered step by step

Verified Expert Solution

Question

1 Approved Answer

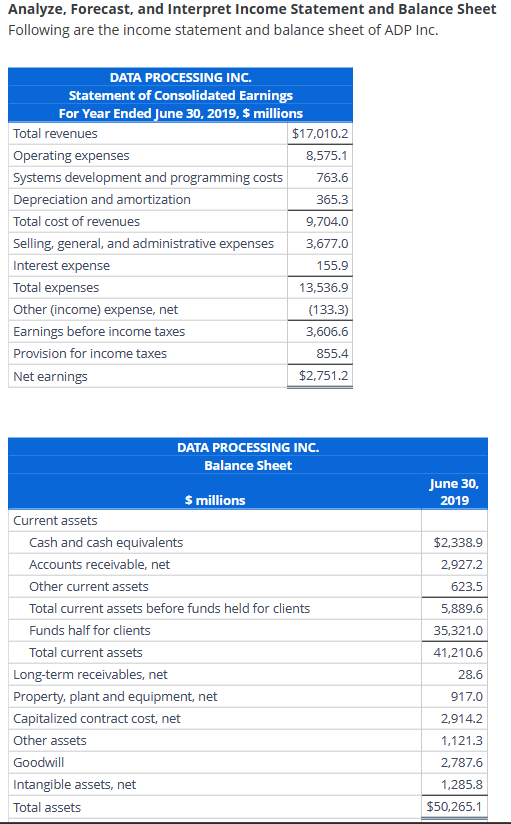

Analyze, Forecast, and Interpret Income Statement and Balance Sheet Following are the income statement and balance sheet of ADP Inc. begin{tabular}{|l|r|} hline Current liabilities &

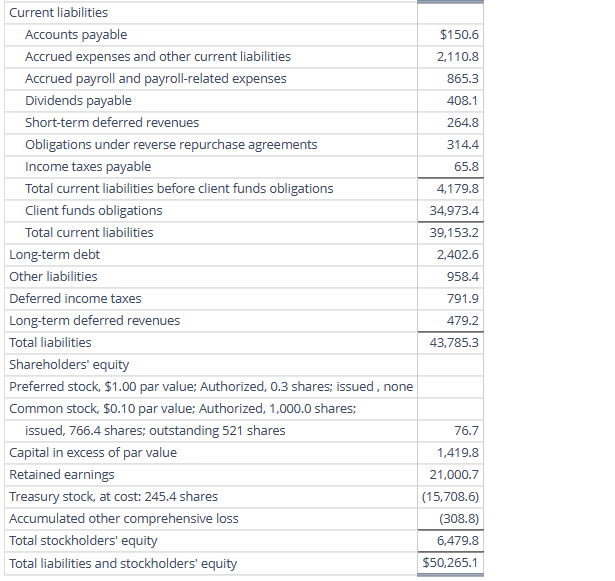

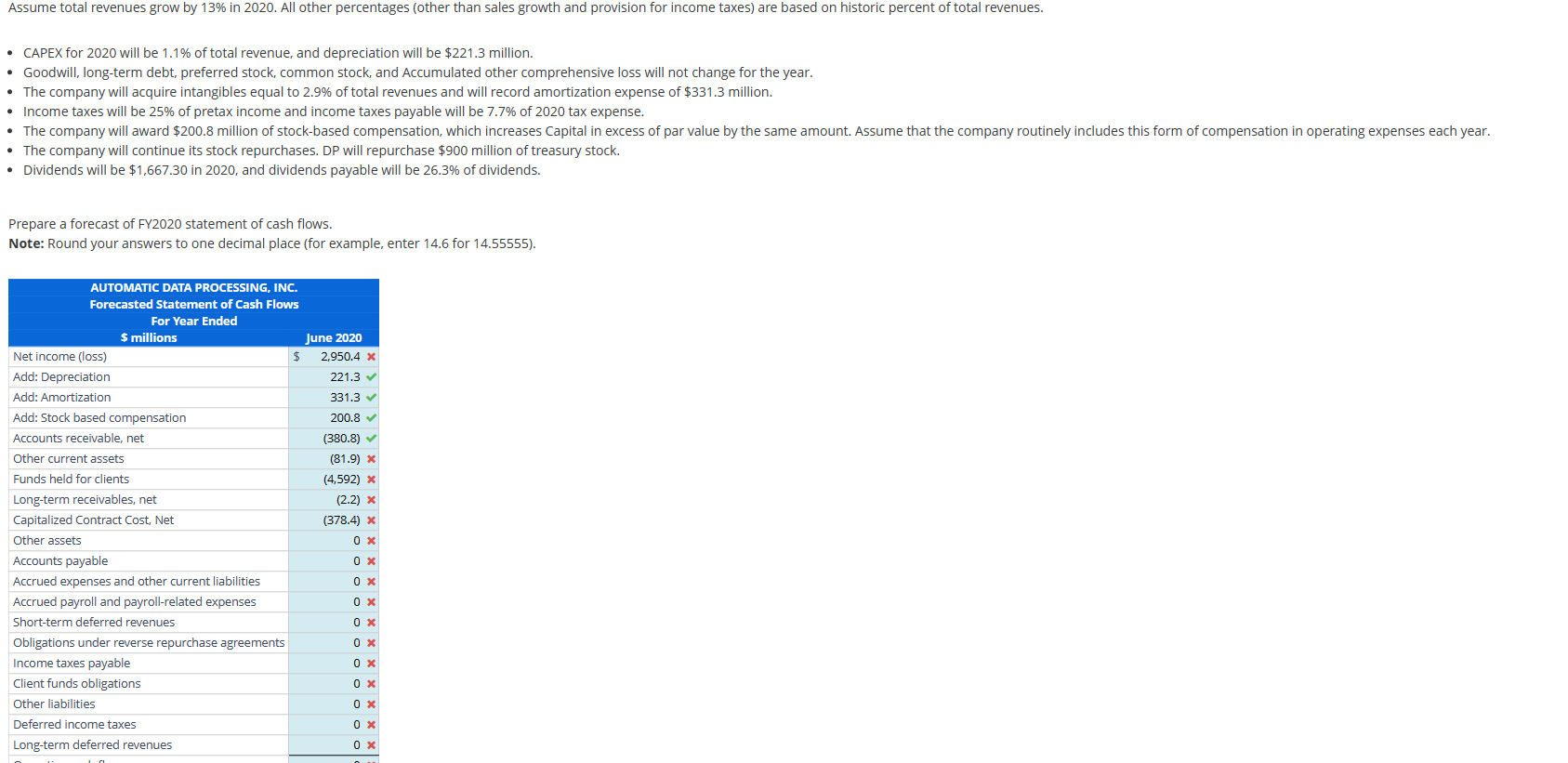

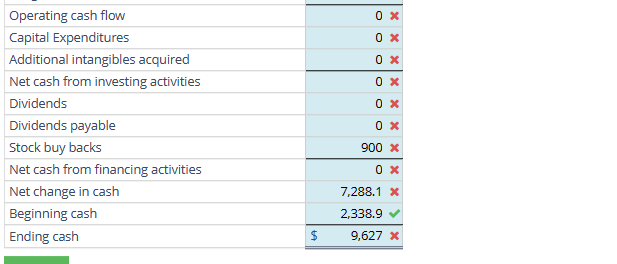

Analyze, Forecast, and Interpret Income Statement and Balance Sheet Following are the income statement and balance sheet of ADP Inc. \begin{tabular}{|l|r|} \hline Current liabilities & \\ \hline Accounts payable & $150.6 \\ \hline Accrued expenses and other current liabilities & 2,110.8 \\ \hline Accrued payroll and payroll-related expenses & 865.3 \\ \hline Dividends payable & 408.1 \\ \hline Short-term deferred revenues & 264.8 \\ \hline Obligations under reverse repurchase agreements & 314.4 \\ \hline Income taxes payable & 65.8 \\ \hline Total current liabilities before client funds obligations & 4,179.8 \\ \hline Client funds obligations & 34,973.4 \\ \hline Total current liabilities & 39,153.2 \\ \hline Long-term debt & 2,402.6 \\ \hline Other liabilities & 958.4 \\ \hline Deferred income taxes & 791.9 \\ \hline Long-term deferred revenues & 479.2 \\ \hline Total liabilities & 43,785.3 \\ \hline Shareholders' equity & \\ \hline Preferred stock, \$1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 766.4 shares; outstanding 521 shares & 76.7 \\ \hline Capital in excess of par value & 1,419.8 \\ \hline Retained earnings & 21,000.7 \\ \hline Treasury stock, at cost: 245.4 shares & (308.8) \\ \hline Accumulated other comprehensive loss & 650,265.8 \\ \hline Total stockholders' equity & \\ \hline Total liabilities and stockholders' equity & \\ \hline \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $221.3 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $331.3 million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will continue its stock repurchases. DP will repurchase $900 million of treasury stock. - Dividends will be $1,667.30 in 2020 , and dividends payable will be 26.3% of dividends. Prepare a forecast of FY2020 statement of cash flows. Note: Round your answers to one decimal place (for example, enter 14.6 for 14.55555). \begin{tabular}{|l|r|} \hline Operating cash flow & 0 \\ \hline Capital Expenditures & 0 \\ \hline Additional intangibles acquired & 0 \\ \hline Net cash from investing activities & 0 \\ \hline Dividends & 0 \\ \hline Dividends payable & 0 \\ \hline Stock buy backs & 900 \\ \hline Net cash from financing activities & 0 \\ \hline Net change in cash & 7,288.1 \\ \hline Beginning cash & 2,338.9 \\ \hline Ending cash & $9,627 \\ \hline \hline \end{tabular}

Analyze, Forecast, and Interpret Income Statement and Balance Sheet Following are the income statement and balance sheet of ADP Inc. \begin{tabular}{|l|r|} \hline Current liabilities & \\ \hline Accounts payable & $150.6 \\ \hline Accrued expenses and other current liabilities & 2,110.8 \\ \hline Accrued payroll and payroll-related expenses & 865.3 \\ \hline Dividends payable & 408.1 \\ \hline Short-term deferred revenues & 264.8 \\ \hline Obligations under reverse repurchase agreements & 314.4 \\ \hline Income taxes payable & 65.8 \\ \hline Total current liabilities before client funds obligations & 4,179.8 \\ \hline Client funds obligations & 34,973.4 \\ \hline Total current liabilities & 39,153.2 \\ \hline Long-term debt & 2,402.6 \\ \hline Other liabilities & 958.4 \\ \hline Deferred income taxes & 791.9 \\ \hline Long-term deferred revenues & 479.2 \\ \hline Total liabilities & 43,785.3 \\ \hline Shareholders' equity & \\ \hline Preferred stock, \$1.00 par value; Authorized, 0.3 shares; issued, none & \\ \hline Common stock, $0.10 par value; Authorized, 1,000.0 shares; & \\ \hline issued, 766.4 shares; outstanding 521 shares & 76.7 \\ \hline Capital in excess of par value & 1,419.8 \\ \hline Retained earnings & 21,000.7 \\ \hline Treasury stock, at cost: 245.4 shares & (308.8) \\ \hline Accumulated other comprehensive loss & 650,265.8 \\ \hline Total stockholders' equity & \\ \hline Total liabilities and stockholders' equity & \\ \hline \hline \end{tabular} Assume total revenues grow by 13% in 2020 . All other percentages (other than sales growth and provision for income taxes) are based on historic percent of total revenues. - CAPEX for 2020 will be 1.1% of total revenue, and depreciation will be $221.3 million. - Goodwill, long-term debt, preferred stock, common stock, and Accumulated other comprehensive loss will not change for the year. - The company will acquire intangibles equal to 2.9% of total revenues and will record amortization expense of $331.3 million. - Income taxes will be 25% of pretax income and income taxes payable will be 7.7% of 2020 tax expense. - The company will continue its stock repurchases. DP will repurchase $900 million of treasury stock. - Dividends will be $1,667.30 in 2020 , and dividends payable will be 26.3% of dividends. Prepare a forecast of FY2020 statement of cash flows. Note: Round your answers to one decimal place (for example, enter 14.6 for 14.55555). \begin{tabular}{|l|r|} \hline Operating cash flow & 0 \\ \hline Capital Expenditures & 0 \\ \hline Additional intangibles acquired & 0 \\ \hline Net cash from investing activities & 0 \\ \hline Dividends & 0 \\ \hline Dividends payable & 0 \\ \hline Stock buy backs & 900 \\ \hline Net cash from financing activities & 0 \\ \hline Net change in cash & 7,288.1 \\ \hline Beginning cash & 2,338.9 \\ \hline Ending cash & $9,627 \\ \hline \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started