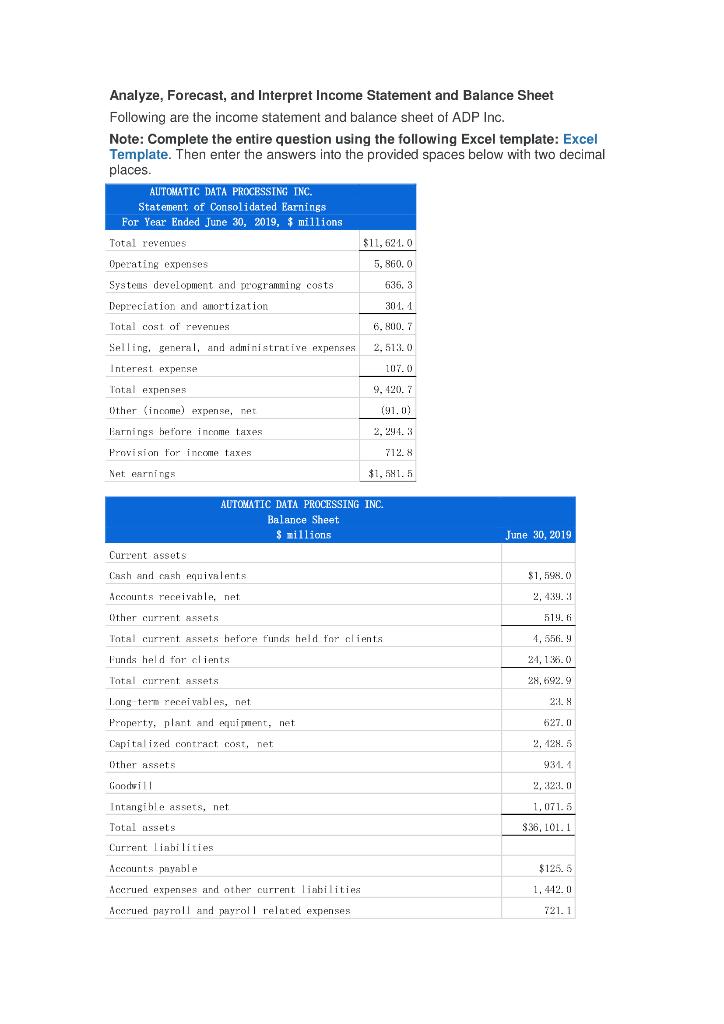

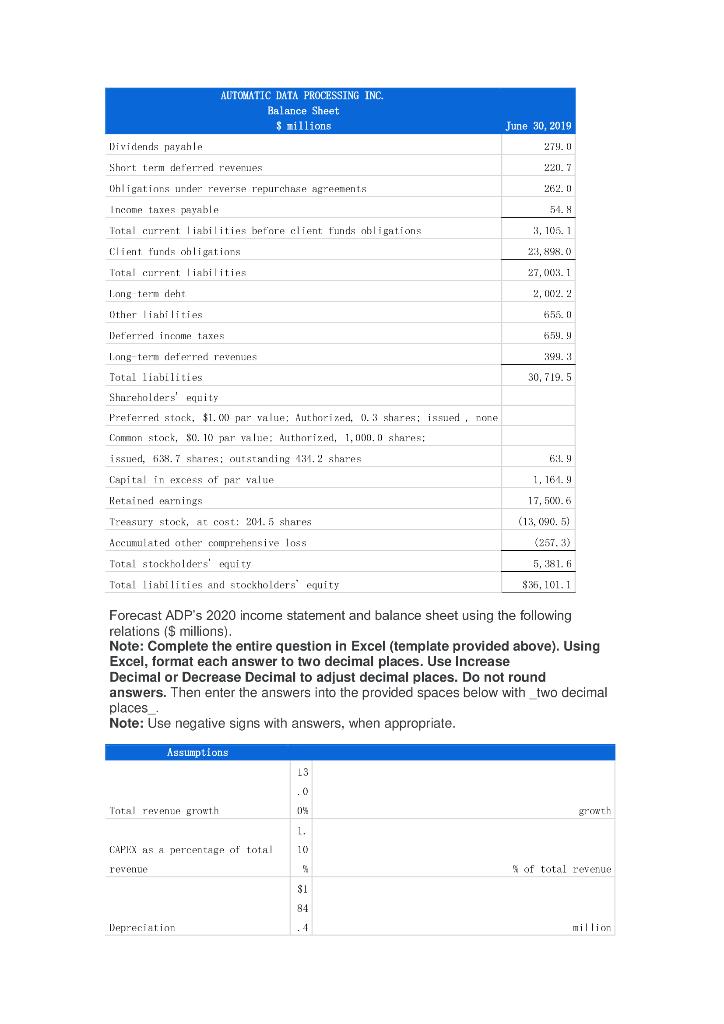

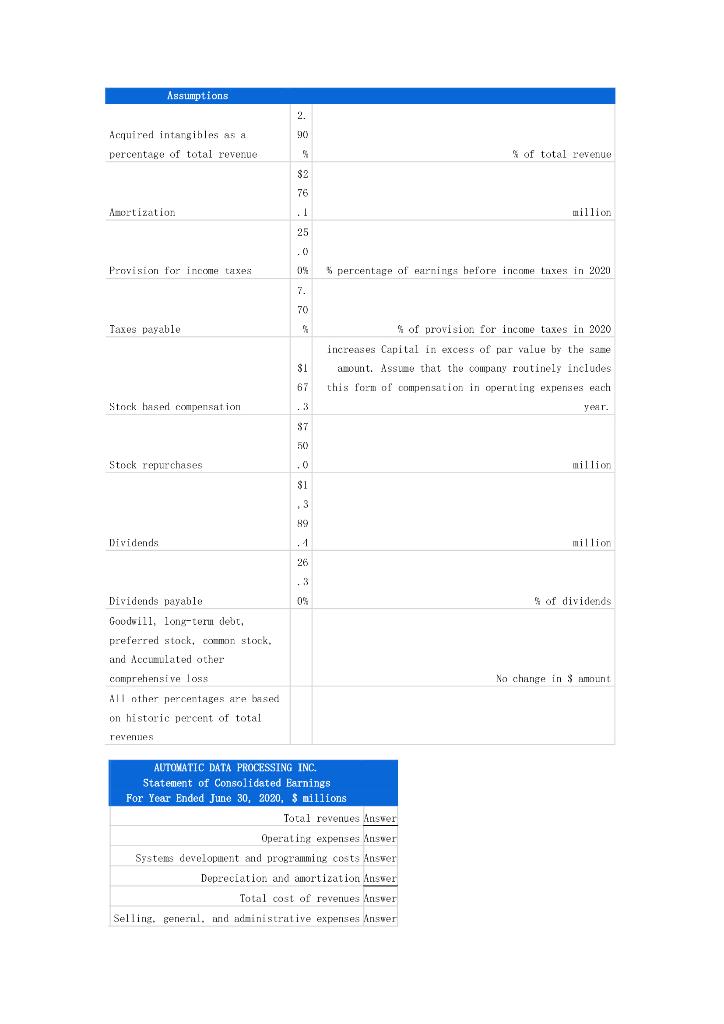

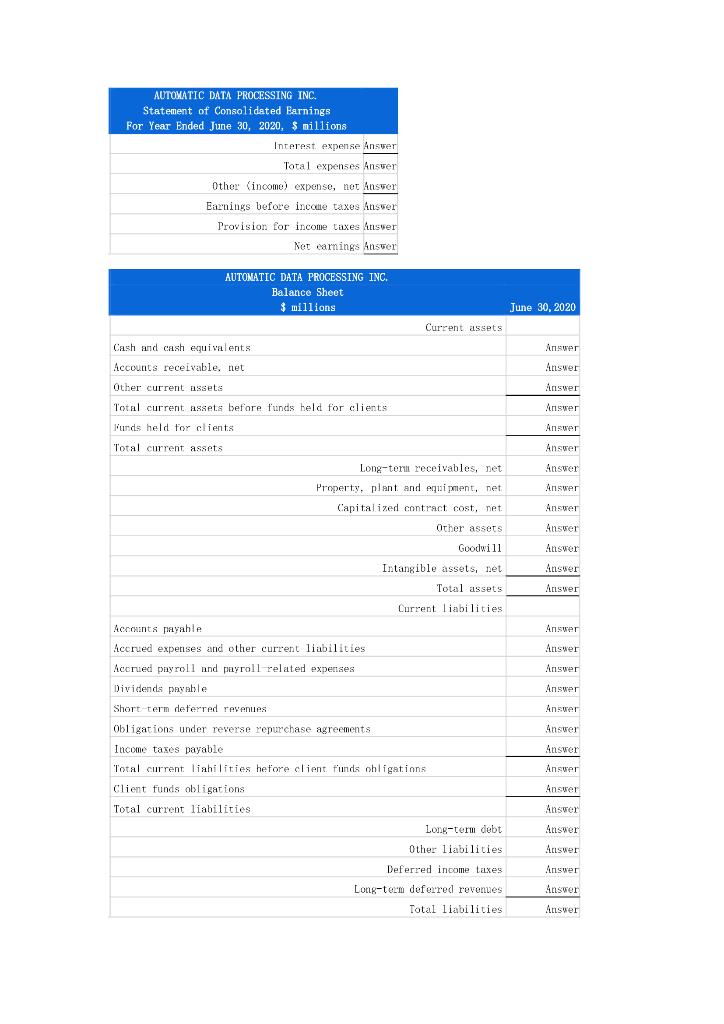

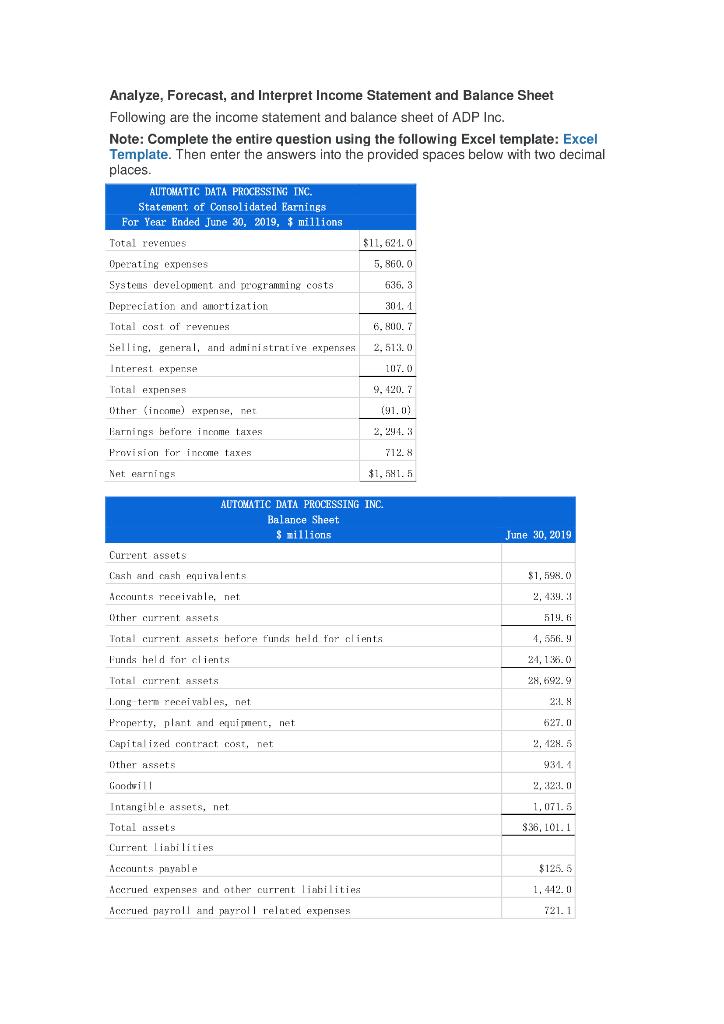

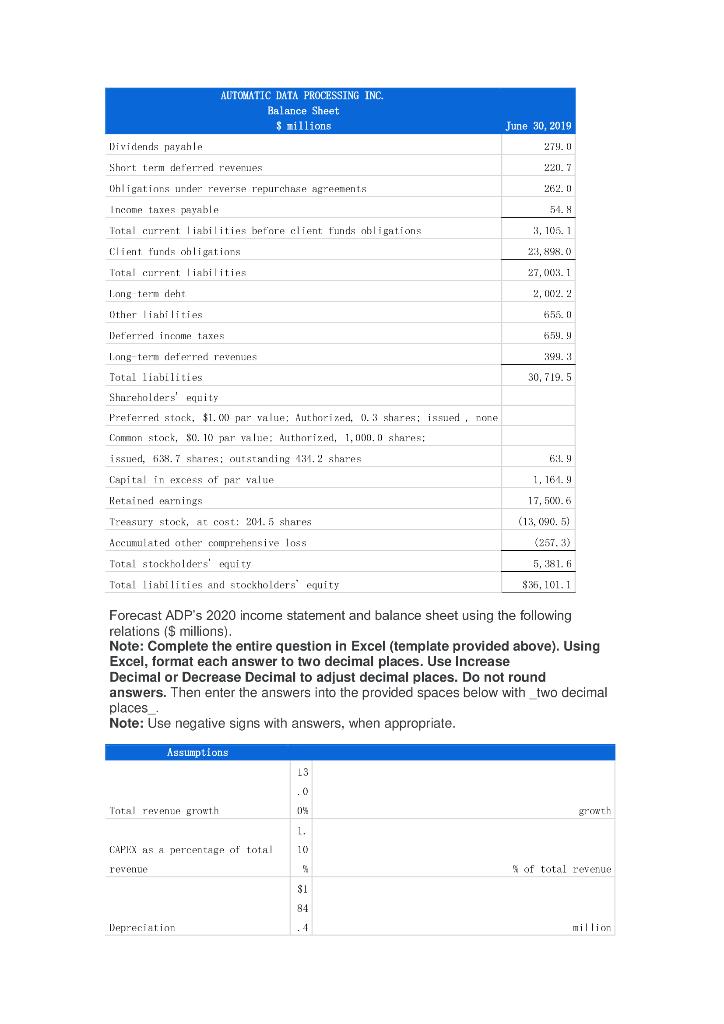

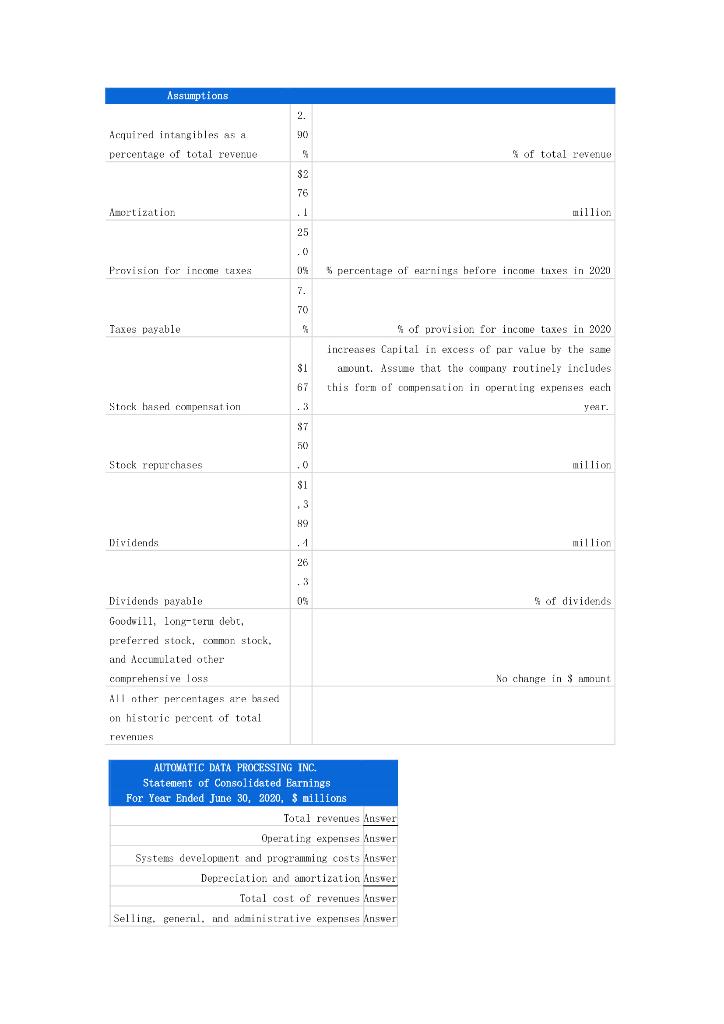

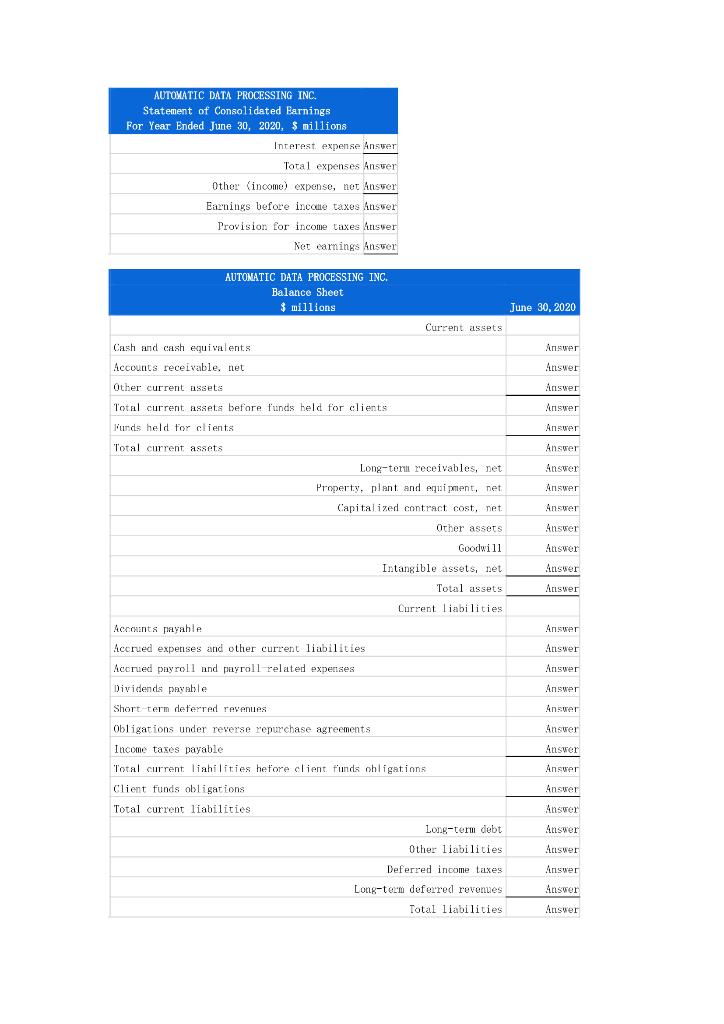

Analyze, Forecast, and Interpret Income Statement and Balance Sheet Following are the income statement and balance sheet of ADP Inc. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. relations (\$ millions). Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places. Note: Use negative signs with answers, when appropriate. AUTOMATIC DATA PROCESSING INC. Statement of Consolidated Earnings For Year Ended June 30, 2020, \$ millions Total revenues Answer Operating expenses Answer Systems development and programming costs Answer Depreciation and amortization Answer Total cost of revenues Answer Selline. general. and adainistrative expenses Answer AUTOMATIC DATA PROCESSING INC. Statement of Consolidated Earnings For Year Ended June 30, 2020, \$ millions \begin{tabular}{|r|} \hline Inrerest. expense Answer \\ Tota1 expenses Answer \\ \hline 0ther (income) expense, net Answer \\ \hline Earnings before incoue taxes Answer \\ \hline Provision for income taxes Atswer \\ Net earnings Answer \\ \hline \end{tabular} AUTOMATIC DATA PROCESSING INC. Balance Sheet $ millions June 30,2020 \begin{tabular}{|r|r|r|} \hline Shareholders' equity \\ \hline Prefred stock, \$1. 00 par value; Authorized, 0.3 shares; issued, none & Answer \\ \hline Comon stock, \$0. 10 par value: Aluthorized, 1,000.0 shares: \\ \hline issued, 638.7 shares; outstanding, 434.2 shares & Answer \\ \hline Capital in excess of par value & Answer \\ \hline Treasurg stock, at cost: 204.5 shares & Answer \\ \hline Accumulated other comprehensive loss & Answer \\ \hline Total stockholders' equity & Answer \\ \hline Total liabilities and stockholders' equity & Answer \\ \hline \end{tabular} Analyze, Forecast, and Interpret Income Statement and Balance Sheet Following are the income statement and balance sheet of ADP Inc. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. relations (\$ millions). Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places. Note: Use negative signs with answers, when appropriate. AUTOMATIC DATA PROCESSING INC. Statement of Consolidated Earnings For Year Ended June 30, 2020, \$ millions Total revenues Answer Operating expenses Answer Systems development and programming costs Answer Depreciation and amortization Answer Total cost of revenues Answer Selline. general. and adainistrative expenses Answer AUTOMATIC DATA PROCESSING INC. Statement of Consolidated Earnings For Year Ended June 30, 2020, \$ millions \begin{tabular}{|r|} \hline Inrerest. expense Answer \\ Tota1 expenses Answer \\ \hline 0ther (income) expense, net Answer \\ \hline Earnings before incoue taxes Answer \\ \hline Provision for income taxes Atswer \\ Net earnings Answer \\ \hline \end{tabular} AUTOMATIC DATA PROCESSING INC. Balance Sheet $ millions June 30,2020 \begin{tabular}{|r|r|r|} \hline Shareholders' equity \\ \hline Prefred stock, \$1. 00 par value; Authorized, 0.3 shares; issued, none & Answer \\ \hline Comon stock, \$0. 10 par value: Aluthorized, 1,000.0 shares: \\ \hline issued, 638.7 shares; outstanding, 434.2 shares & Answer \\ \hline Capital in excess of par value & Answer \\ \hline Treasurg stock, at cost: 204.5 shares & Answer \\ \hline Accumulated other comprehensive loss & Answer \\ \hline Total stockholders' equity & Answer \\ \hline Total liabilities and stockholders' equity & Answer \\ \hline \end{tabular}