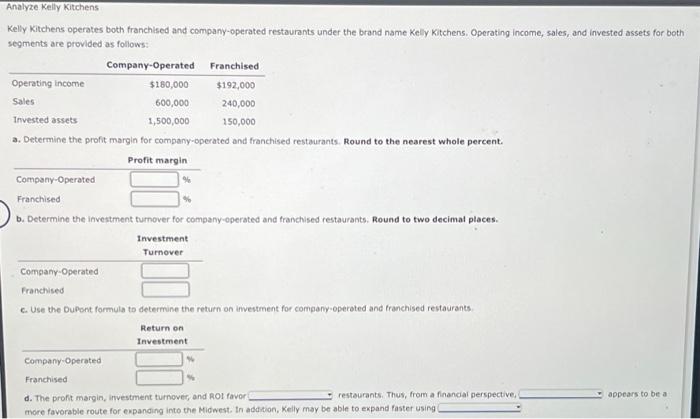

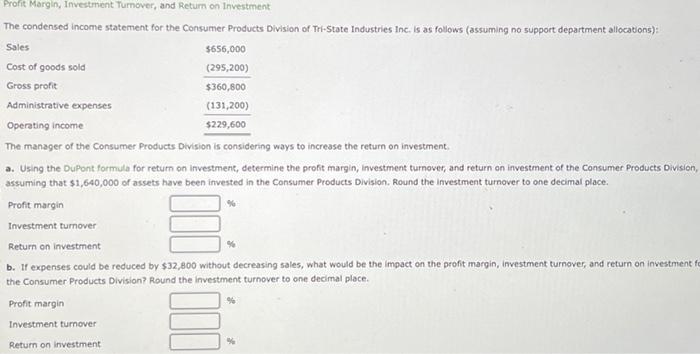

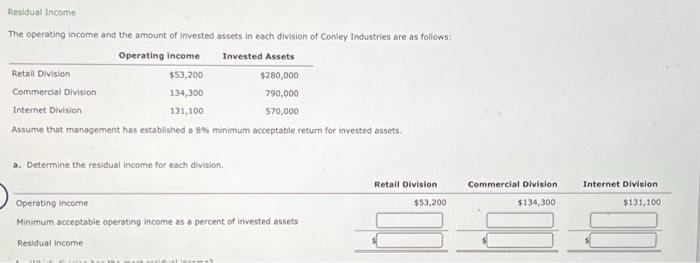

Analyze Kelly Kitchens Kelly Kitchens operates both franchised and company-operated restaurants under the brand name Kelly Kitchens. Operating income, sales, and invested assets for both segments are provided as follows: Company-Operated Franchised Operating income $180,000 $192,000 Sales 600,000 240,000 Invested assets 1,500,000 150,000 a. Determine the profit margin for company-operated and franchised restaurants. Round to the nearest whole percent Profit margin Company-Operated Franchised b. Determine the investment turnover for company-operated and franchised restaurants, Round to two decimal places. Investment Turnover Company-Operated Franchised c. Use the Dupont formula to determine the return on investment for company operated and franchised restaurants Return on Investment Company Operated Franchised appears to be a d. The profit margin, investment turnover, and ROI favor restaurants. Thus, from a financial perspective more favorable route for expanding into the Midwest. In addition, Kelly may be able to expand faster using Sales Profit Margin, Investment Turnover, and Return on investment The condensed Income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): $656,000 Cost of goods sold (295,200) Gross profit $360,800 Administrative expenses (131,200) Operating income $229,600 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,640,000 of assets have been invested in the Consumer Products Division, Round the investment turnover to one decimal place. Profit margin Investment turnover Return on investment b. If expenses could be reduced by $32,800 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment fe the Consumer Products Division? Round the investment turnover to one decimal place. Profit margin 9 Investment turnover Return on investment Residual Income The operating income and the amount of invested assets in each division of Conley Industries are as follows: Operating income Invested Assets Retail Division $53,200 $280,000 Commercial Division 134,300 790,000 Internet Division 131,100 570,000 Assume that management has established a 8% minimum acceptable return for invested assets. a. Determine the residual income for each division Retail Division Commercial Division Internet Division $53,200 $134,300 $131,100 Operating income Minimum acceptable operating income as a percent of invested assets Residual income