Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze Mystic Bottling Company's process costs Mystic Bottling Company bottles popular beverages in the Bottling Department. The beverages are produced by blending concentrate with water

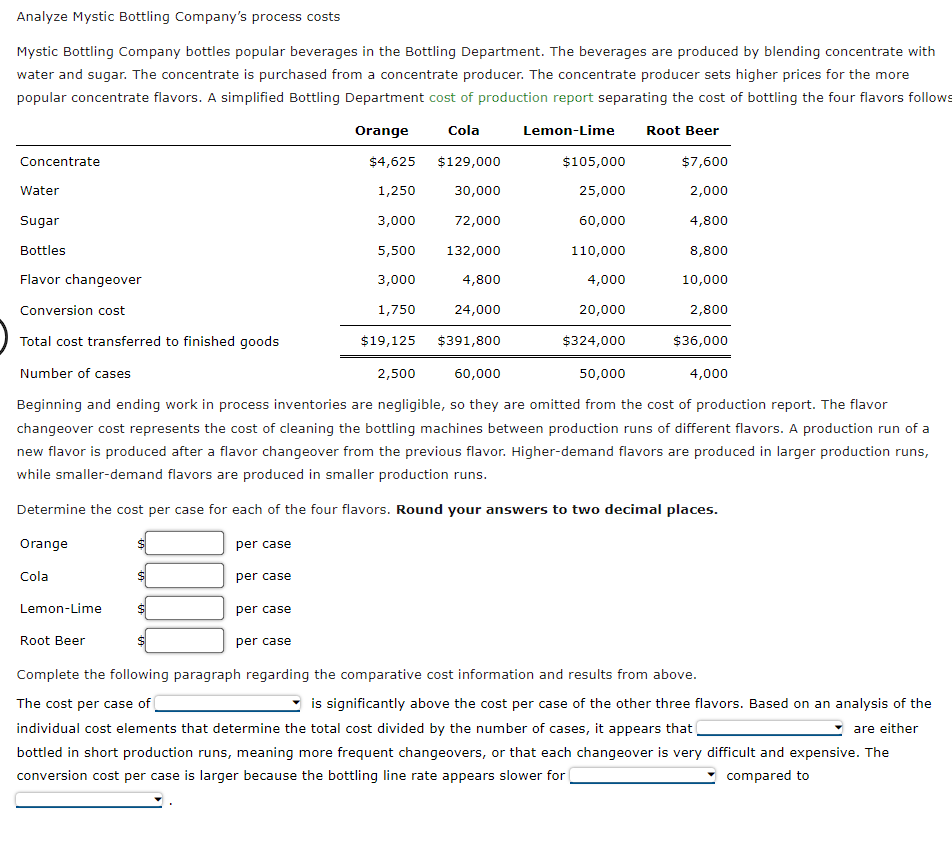

Analyze Mystic Bottling Company's process costs

Mystic Bottling Company bottles popular beverages in the Bottling Department. The beverages are produced by blending concentrate with

water and sugar. The concentrate is purchased from a concentrate producer. The concentrate producer sets higher prices for the more

popular concentrate flavors. A simplified Bottling Department cost of production report separating the cost of bottling the four flavors follows

Beginning and ending work in process inventories are negligible, so they are omitted from the cost of production report. The flavor

changeover cost represents the cost of cleaning the bottling machines between production runs of different flavors. A production run of a

new flavor is produced after a flavor changeover from the previous flavor. Higherdemand flavors are produced in larger production runs,

while smallerdemand flavors are produced in smaller production runs.

Determine the cost per case for each of the four flavors. Round your answers to two decimal places.

Complete the following paragraph regarding the comparative cost information and results from above.

The cost per case of

is significantly above the cost per case of the other three flavors. Based on an analysis of the

individual cost elements that determine the total cost divided by the number of cases, it appears that

are either

bottled in short production runs, meaning more frequent changeovers, or that each changeover is very difficult and expensive. The

conversion cost per case is larger because the bottling line rate appears slower for

compared to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started