Answered step by step

Verified Expert Solution

Question

1 Approved Answer

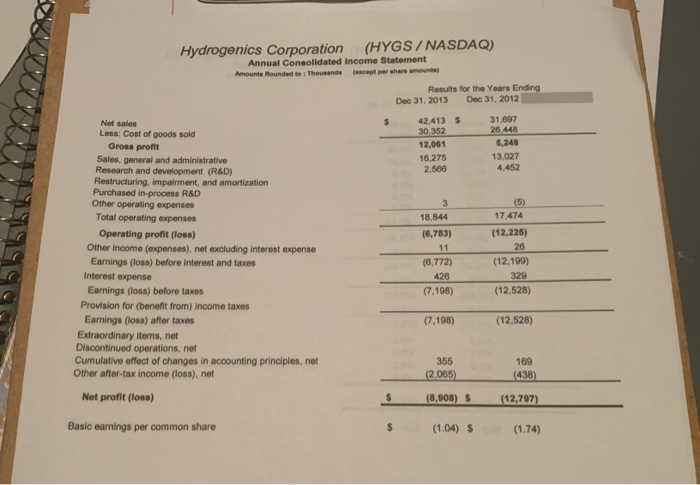

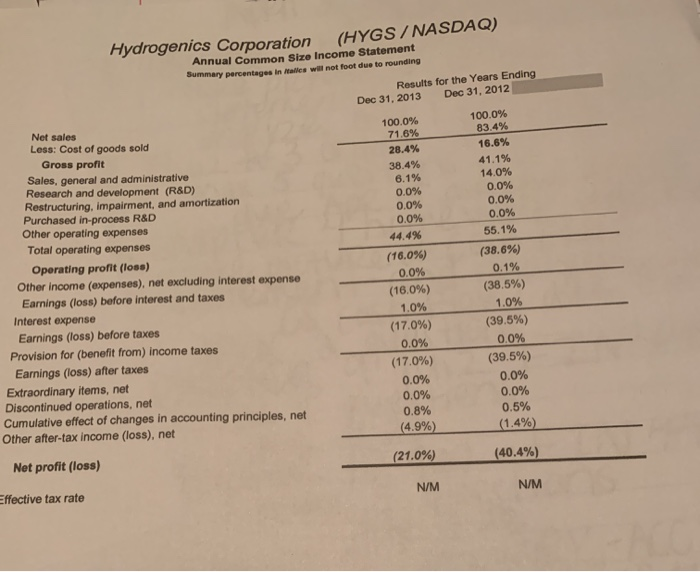

Analyze Profitability 2-Page Summary Submission Requirements (from page 154) Requirement A-Cover Sheet, Income Statement, Common Size Income Statement, and Growth Rate Analysis (Copies of Each)

Analyze Profitability

2-Page Summary

Submission Requirements (from page 154)

Requirement A-Cover Sheet, Income Statement, Common Size Income Statement, and Growth Rate Analysis (Copies of Each)

Requirement B-Analyze Profitability

2-Page Summary

Double Spaced, Font Size 11

analyze profitablity based on the pictures listed

Hydrogenics Corporation (HYGS/ NASDAQ) Annual Consolidated Income Statement Amount Rounded to: Thousands (except per share amount Results for the Years Ending Dec 31, 2013 Dec 31, 2012 42,413 $ 30,352 12,061 16,275 2,566 31.697 26.448 5,249 13.027 4.452 18,844 (6,783) Net sales Less: Cost of goods sold Gross profit Sales, general and administrative Research and development (R&D) Restructuring, impairment, and amortization Purchased in-process R&D Other operating expenses Total operating expenses Operating profit (losa) Other income (expenses), net excluding interest expense Earnings (loss) before interest and taxes Interest expense Earnings (loss) before taxes Provision for (benefit from) income taxes Earnings (loss) after taxes Extraordinary items, net Discontinued operations, net Cumulative effect of changes in accounting principles, net Other after-tax income (loss), net 17,474 (12,225) 26 (12,199) (6.772) 426 (7.198) 329 (12,528) (7,198) (12,528) 355 (2,065) 169 (438) Net profit (loss) (8,908) S (12,797) Basic earnings per common share $ (1.04) $ (1.74) Hydrogenics Corporation (HYGS / NASDAQ) Annual Common Size Income Statement Summary percentages in alles will not foot due to rounding Results for the Years Ending Dec 31, 2013 Dec 31, 2012 Net sales Less: Cost of goods sold Gross profit Sales, general and administrative Research and development (R&D) Restructuring, impairment, and amortization Purchased in process R&D Other operating expenses Total operating expenses Operating profit (loss) Other income (expenses), net excluding interest expense Earnings (loss) before interest and taxes Interest expense Earnings (loss) before taxes Provision for (benefit from) income taxes Earnings (loss) after taxes Extraordinary items, net Discontinued operations, net Cumulative effect of changes in accounting principles, net Other after-tax income (loss), net 100.0% 71.6% 28.4% 38.4% 6.1% 0.0% 0.0% 0.0% 44.4% (16.0%) 0.0% (16.0%) 1.0% (17.0%) 0.0% (17.0%) 0.0% 0.0% 0.8% (4.9%) 100.0% 83.4% 16.6% 41.1% 14.0% 0.0% 0.0% 0.0% 55.1% (38.6%) 0.1% (38.5%) 1.0% (39.5%) 0.0% (39.5%) 0.0% 0.0% 0.5% (1.4%) (21.0%) (40.4%) Net profit (loss) N/M N/M Effective tax rate Hydrogenics Corporation (HYGS/ NASDAQ) Annual Consolidated Income Statement Amount Rounded to: Thousands (except per share amount Results for the Years Ending Dec 31, 2013 Dec 31, 2012 42,413 $ 30,352 12,061 16,275 2,566 31.697 26.448 5,249 13.027 4.452 18,844 (6,783) Net sales Less: Cost of goods sold Gross profit Sales, general and administrative Research and development (R&D) Restructuring, impairment, and amortization Purchased in-process R&D Other operating expenses Total operating expenses Operating profit (losa) Other income (expenses), net excluding interest expense Earnings (loss) before interest and taxes Interest expense Earnings (loss) before taxes Provision for (benefit from) income taxes Earnings (loss) after taxes Extraordinary items, net Discontinued operations, net Cumulative effect of changes in accounting principles, net Other after-tax income (loss), net 17,474 (12,225) 26 (12,199) (6.772) 426 (7.198) 329 (12,528) (7,198) (12,528) 355 (2,065) 169 (438) Net profit (loss) (8,908) S (12,797) Basic earnings per common share $ (1.04) $ (1.74) Hydrogenics Corporation (HYGS / NASDAQ) Annual Common Size Income Statement Summary percentages in alles will not foot due to rounding Results for the Years Ending Dec 31, 2013 Dec 31, 2012 Net sales Less: Cost of goods sold Gross profit Sales, general and administrative Research and development (R&D) Restructuring, impairment, and amortization Purchased in process R&D Other operating expenses Total operating expenses Operating profit (loss) Other income (expenses), net excluding interest expense Earnings (loss) before interest and taxes Interest expense Earnings (loss) before taxes Provision for (benefit from) income taxes Earnings (loss) after taxes Extraordinary items, net Discontinued operations, net Cumulative effect of changes in accounting principles, net Other after-tax income (loss), net 100.0% 71.6% 28.4% 38.4% 6.1% 0.0% 0.0% 0.0% 44.4% (16.0%) 0.0% (16.0%) 1.0% (17.0%) 0.0% (17.0%) 0.0% 0.0% 0.8% (4.9%) 100.0% 83.4% 16.6% 41.1% 14.0% 0.0% 0.0% 0.0% 55.1% (38.6%) 0.1% (38.5%) 1.0% (39.5%) 0.0% (39.5%) 0.0% 0.0% 0.5% (1.4%) (21.0%) (40.4%) Net profit (loss) N/M N/M Effective tax rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started