-

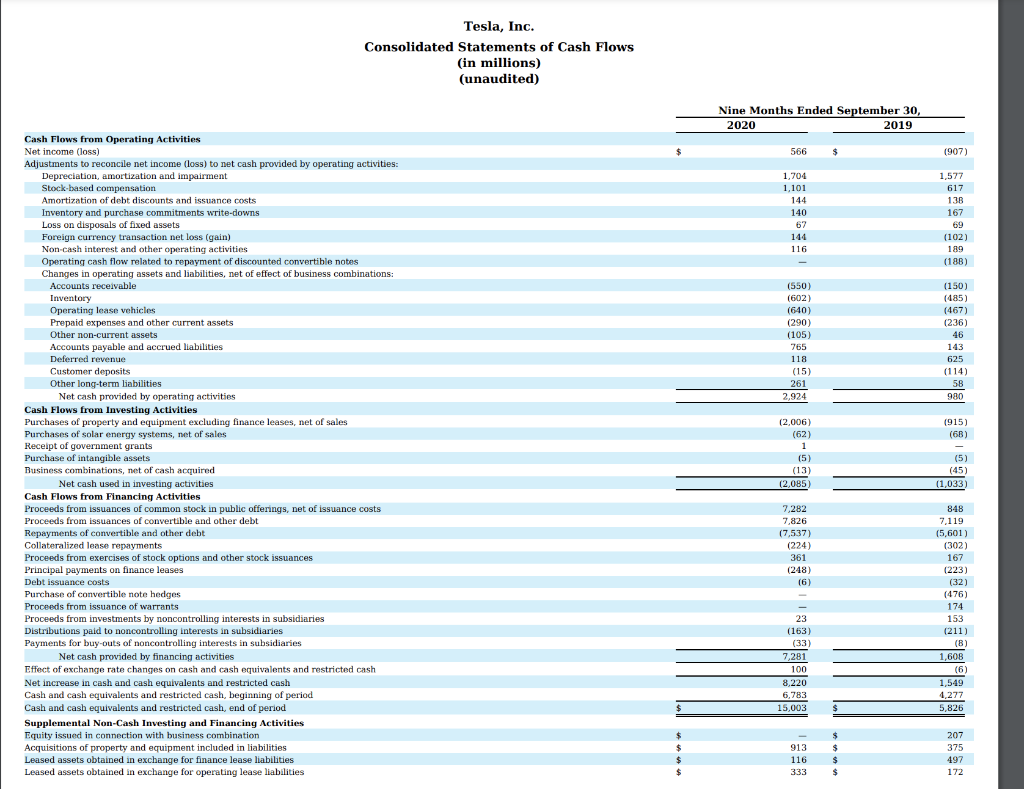

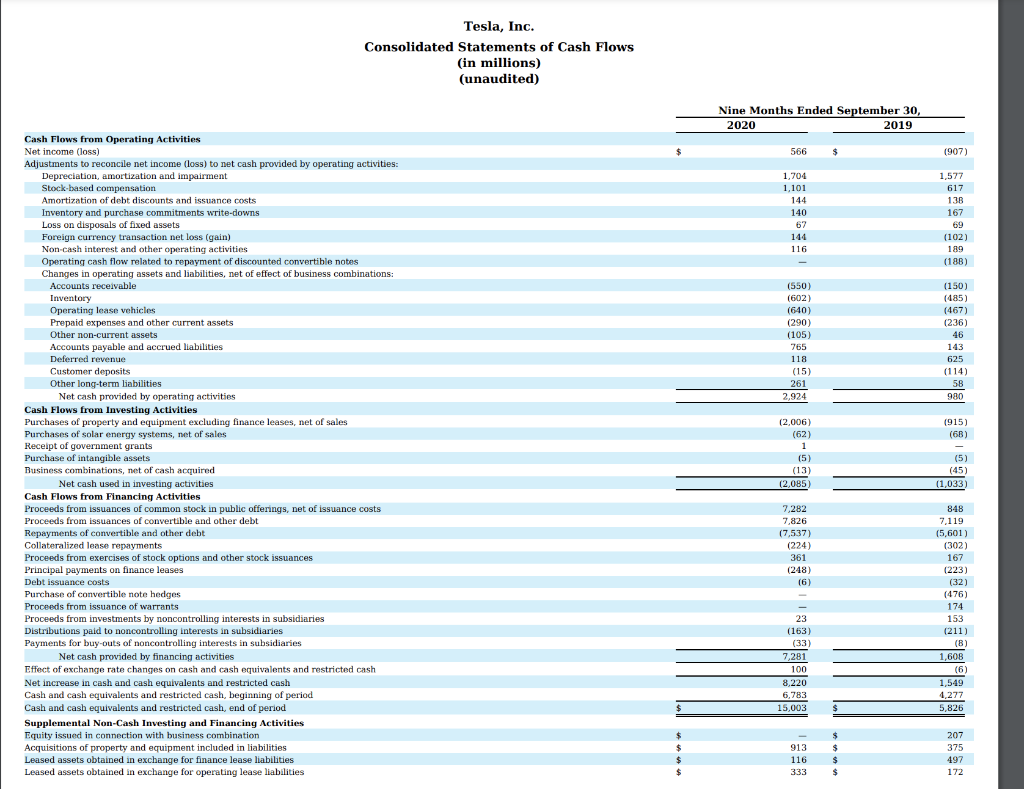

Analyze Teslas cash flow statement:

-

Describe what the companys cash flow statement tells you about the company.

-

What are the largest items in cash flows from operating activities? What does this tell you about the company?

-

What are the largest items in cash flows from investing activities? What does this tell you about the company?

-

What are the largest items in cash flows from financing activities? What does this tell you about the company?

-

Describe the larger variances between current and prior years and what that tells you about the direction of the company.

-

Discuss how the accrual accounting the company uses for their income statement transactions differs from the cash based transactions on the cash flow statement.

Tesla, Inc. Consolidated Statements of Cash Flows (in millions) (unaudited) Nine Months Ended September 30, 2020 2019 566 $ (907) 1,704 1,101 144 140 1,577 617 138 167 69 (102) 189 (188) 144 116 (550) (602) (640) (290) (105) 765 118 (15) 261 2,924 (150) (485) (467) (236) 46 143 625 (114) 58 980 1915) (68) Cash Flows from Operating Activities Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, amortization and impairment Stock-based compensation Amortization of debt discounts and issuance costs Inventory and purchase commitments write-downs Loss on disposals of fixed assets Foreign currency transaction net loss (gain) Non-cash interest and other operating activities Operating cash flow related to repayment of discounted convertible notes Changes in operating assets and liabilities, net of effect of business combinations: Accounts receivable Inventory Operating lease vehicles Prepaid expenses and other current assets Other non-current assets Accounts payable and accrued liabilities Deferred revenue Customer deposits Other long-term liabilities Net cash provided by operating activities Cash Flows from Investing Activities Purchases of property and equipment excluding finance leases, net of sales Purchases of solar energy systems, net of sales Receipt of government grants Purchase of intangible assets Business combinations, net of cash acquired Net cash used in investing activities Cash Flows from Financing Activities Proceeds from issuances of common stock in public offerings, net of issuance costs Proceeds from issuances of convertible and other debt Repayments of convertible and other debt Collateralized lease repayments Proceeds from exercises of stock options and other stock issuances Principal payments on finance leases Debt issuance costs Purchase of convertible note hedges Proceeds from issuance of warrants Proceeds from investments by noncontrolling interests in subsidiaries Distributions paid to noncontrolling interests in subsidiaries Payments for buy-outs of noncontrolling interests in subsidiaries Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalents and restricted cash Net increase in cash and cash equivalents and restricted cash Cash and cash equivalents and restricted cash, beginning of period Cash and cash equivalents and restricted cash, end of period Supplemental Non-Cash Investing and Financing Activities Equity issued in connection with business combination Acquisitions of property and equipment included in liabilities Leased assets obtained in exchange for finance lease liabilities Leased assets obtained in exchange for operating lease liabilities (2,006) (62) 1 1 (5) (13 (2,085 (5) (45) (1,033) 7,282 7,826 (7,537) (224) 361 (248) (6) 848 7.119 (5,601) (302) 167 (223) (32) (476) 174 153 (211) (8) 1,608 (6) 1,549 1,277 5,826 23 (163) (33) 7,281 100 8,220 6,783 15,003 $ 913 116 333 $ $ $ 207 375 497 172 $