Answered step by step

Verified Expert Solution

Question

1 Approved Answer

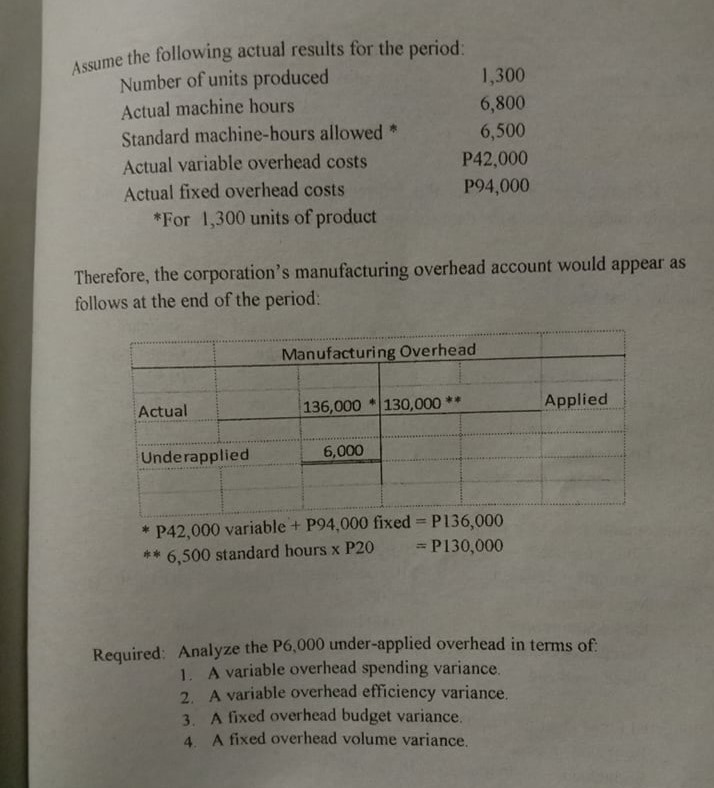

Analyze the 6,000 under-applied overhead in terms of: A variable overhead spending variance. A variable overhead efficiency variance. A fixed overhead budget variance A fixed

Analyze the ₱6,000 under-applied overhead in terms of:

- A variable overhead spending variance.

- A variable overhead efficiency variance.

- A fixed overhead budget variance

- A fixed overhead volume variance

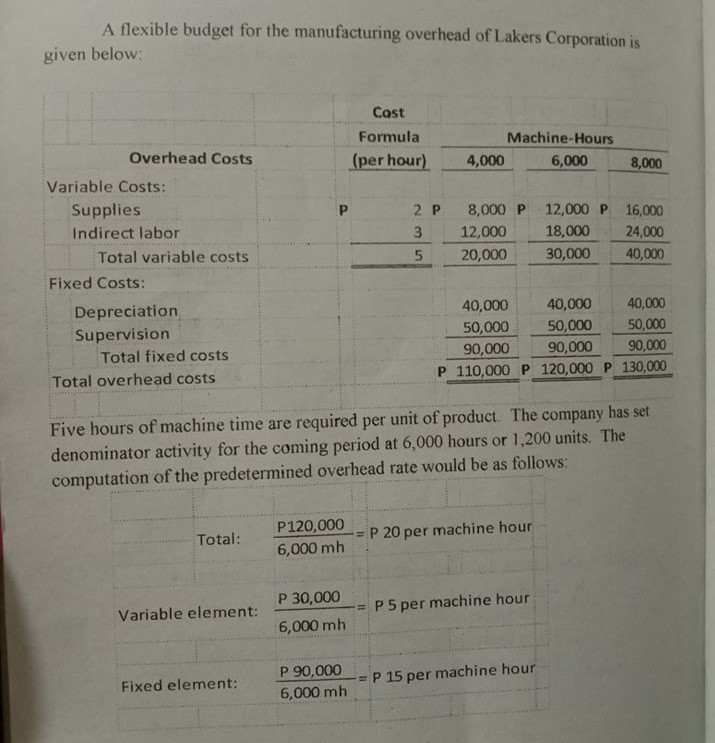

A flexible budget for the manufacturing overhead of Lakers Corporation is given below: Overhead Costs Variable Costs: Supplies Indirect labor Total variable costs Fixed Costs: Depreciation Cost Formula Machine-Hours (per hour) 4,000 6,000 8,000 P 2 P 8,000 P 12,000 P 16,000 3 12,000 18,000 24,000 5 20,000 30,000 40,000 Supervision Total fixed costs Total overhead costs 40,000 40,000 40,000 50,000 50,000 50,000 90,000 90,000 90,000 P 110,000 P 120,000 P 130,000 Five hours of machine time are required per unit of product. The company has set denominator activity for the coming period at 6,000 hours or 1,200 units. The computation of the predetermined overhead rate would be as follows: Total: P120,000 6,000 mh P 20 per machine hour P 30,000 Variable element: 6,000 mh P 90,000 Fixed element: 6,000 mh =P 5 per machine hour =P 15 per machine hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information the flexible budget for manufa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started