Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the Amazon's cash flow statement. Include an overview of the statement of cash flow, an analysis of the cash flows from operating, investing, and

Analyze the Amazon's cash flow statement. Include an overview of the statement of cash flow, an analysis of the cash flows from operating, investing, and financing activities, as well as the change in cash and cash equivalents for each year?

How have these numbers changed over the three years, and what could be some reasons why these numbers have changed the way they have.

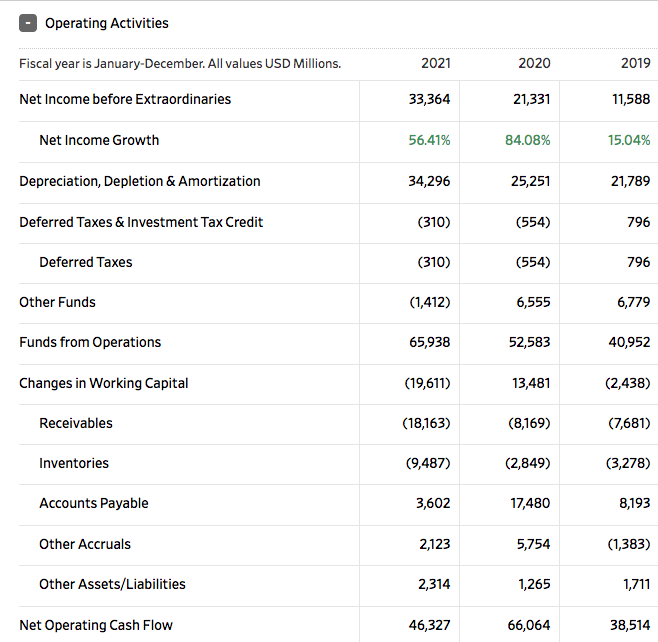

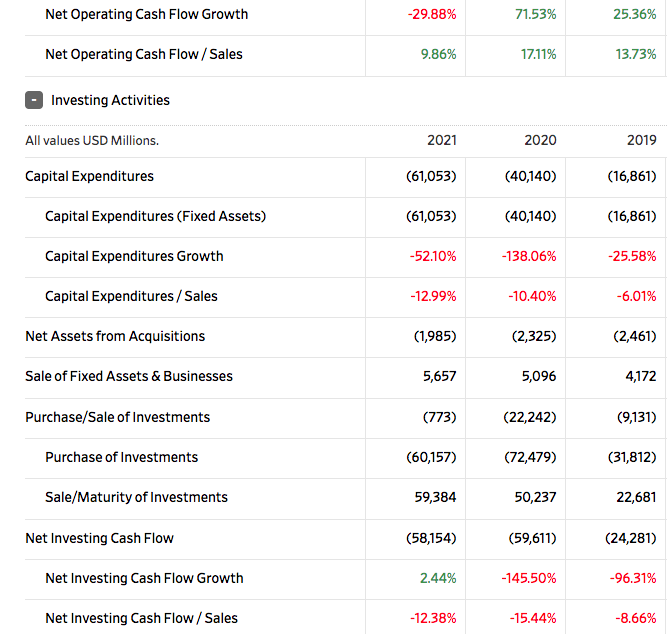

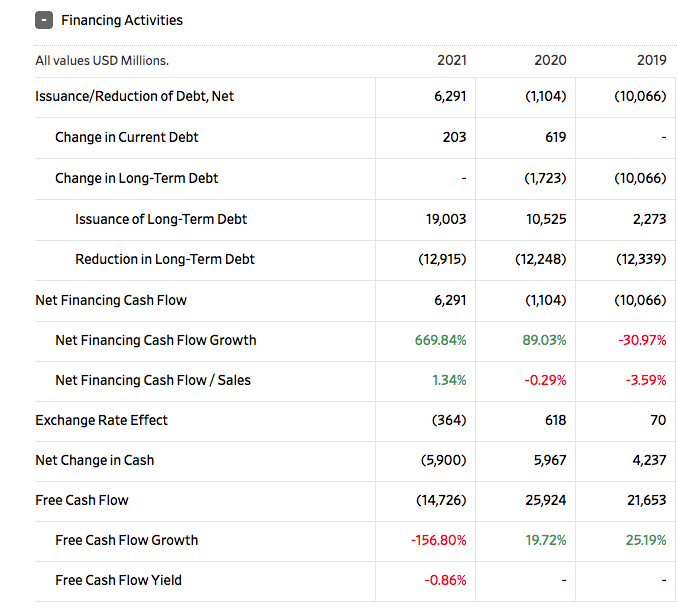

Operating Activities Fiscal year is January-December. All values USD Millions. Net Income before Extraordinaries \begin{tabular}{|r|r|r|} \hline 2021 & 2020 & 2019 \\ \hline 33,364 & 21,331 & 11,588 \\ \hline 56.41% & 84.08% & 15.04% \\ \hline 34,296 & 25,251 & 21,789 \\ \hline \end{tabular} Depreciation, Depletion \& Amortization Deferred Taxes \& Investment Tax Credit (310) Deferred Taxes Other Funds Funds from Operations Changes in Working Capital (310) \begin{tabular}{|l|r|r|r|} \hline Receivables & (18,163) & (8,169) & (7,681) \\ \hline Inventories & (9,487) & (2,849) & (3,278) \\ \hline Accounts Payable & 3,602 & 17,480 & 8,193 \\ \hline Other Accruals & 2,123 & 5,754 & (1,383) \\ \hline Other Assets/Liabilities & 2,314 & 1,265 & 1,711 \\ \hline Net Operating Cash Flow & 46,327 & 66,064 & 38,514 \\ \hline \end{tabular} (1,412) (554) 796 \begin{tabular}{|c|r|c|c|} \hline Net Operating Cash Flow Growth & 29.88% & 71.53% & 25.36% \\ \hline Net Operating Cash Flow / Sales & 9.86% & 17.11% & 13.73% \\ \hline \end{tabular} - Investing Activities Financing Activities All values USD Millions. Issuance/Reduction of Debt, Net \begin{tabular}{|r|r|r} \hline 2021 & 2020 & 2019 \\ \hline 6,291 & (1,104) & (10,066) \\ \hline \end{tabular} Change in Current Debt 203 Change in Long-Term Debt \begin{tabular}{r|r|r|} \hline & (1,723) & (10,066) \\ \hline 0,003 & 10,525 & 2,273 \\ \hline \end{tabular} Reduction in Long-Term Debt Net Financing Cash Flow Net Financing Cash Flow Growth Net Financing Cash Flow / Sales Exchange Rate Effect Net Change in Cash Free Cash Flow Free Cash Flow Growth Free Cash Flow Yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started