\

\

Analyze the Cashflow Problem at SC(above) and maker recommendations for improvements

In 1000 words

- Analysis an overview of the analysis undertaken and the results obtained.

- Findings detail and justify your findings from the analysis. Take care to recognize and describe any assumptions or where additional data may be necessary to further understand the situation.

- Recommendations detail and justify your recommendations from the analysis and findings.

- Next steps Map out a plan that highlights specific actions to implement any proposed changes based on the findings and recommendations noted.

- Limitations detail the limitations from the analysis such as assumptions made.

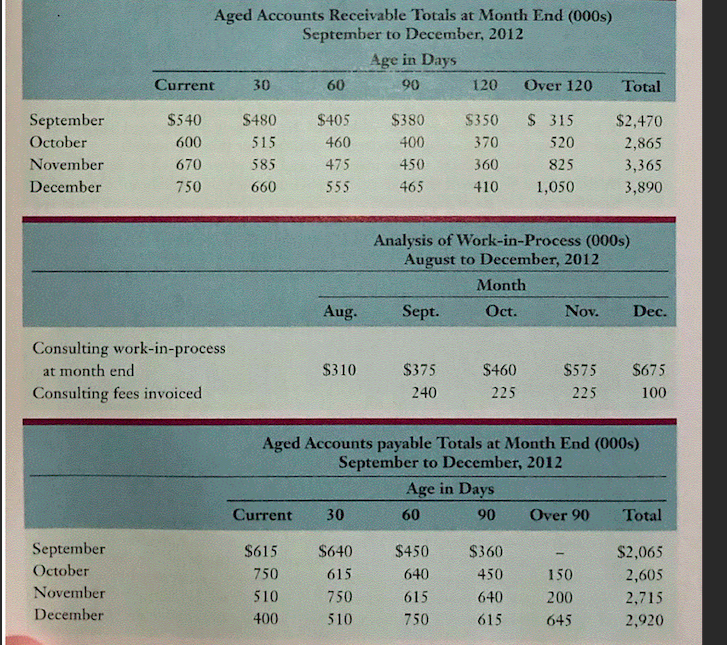

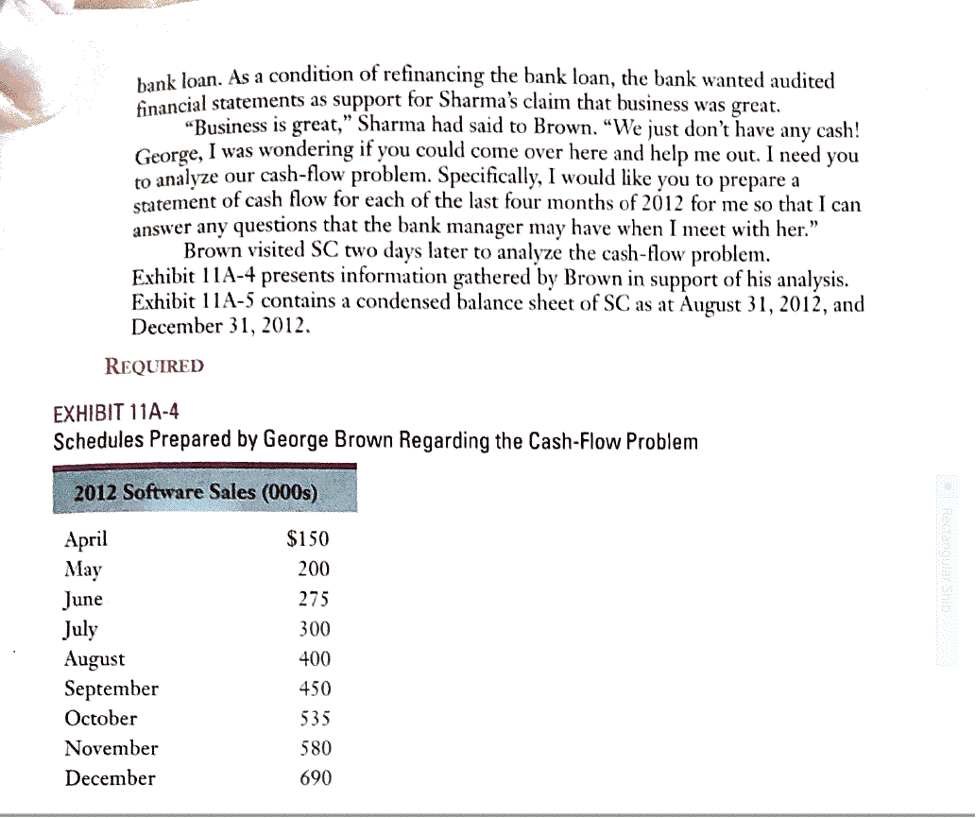

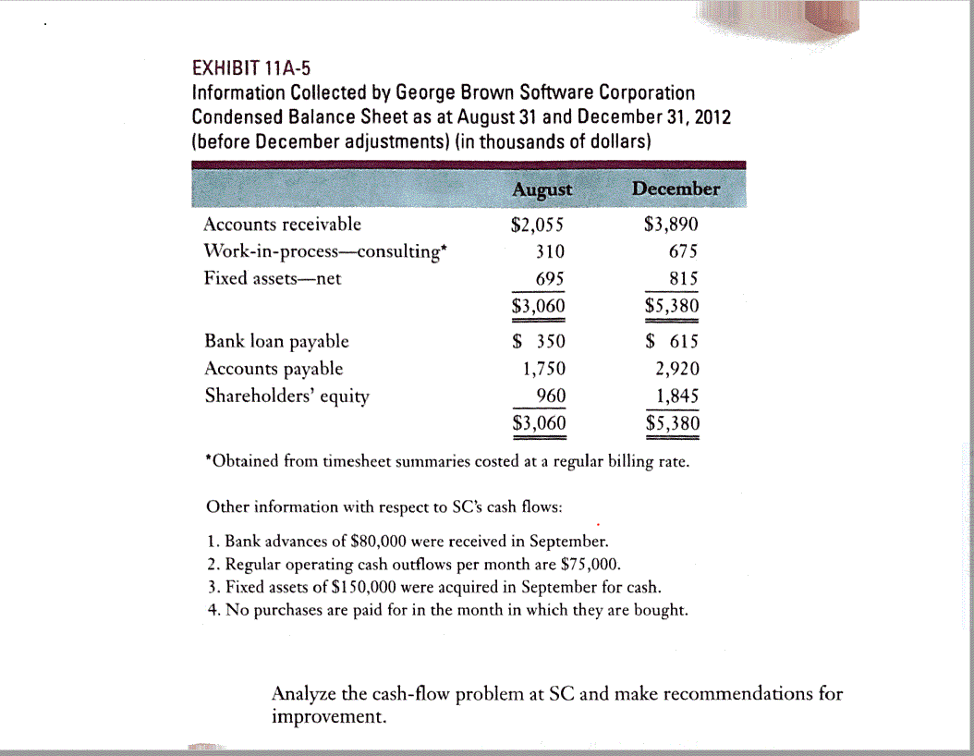

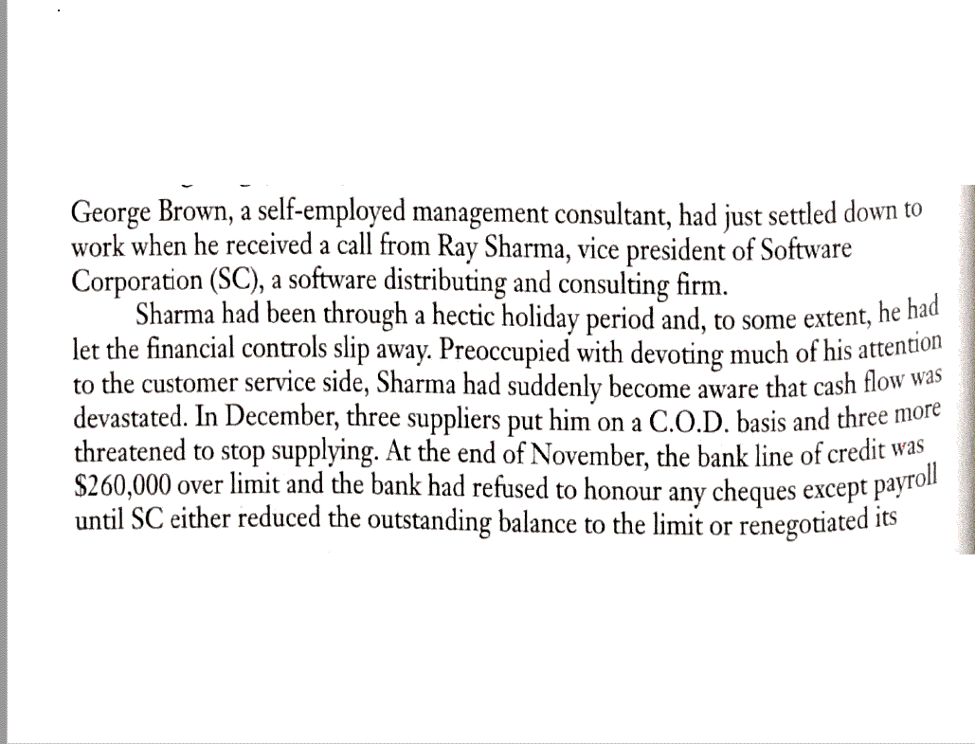

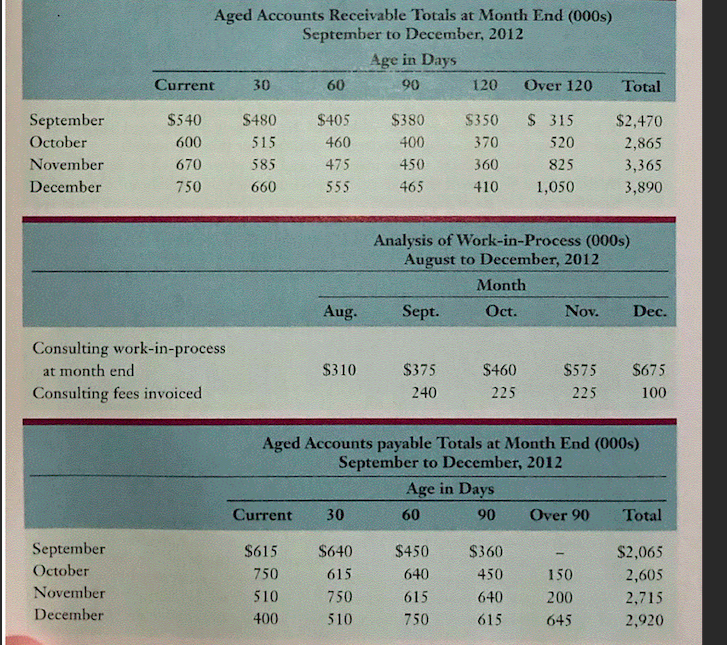

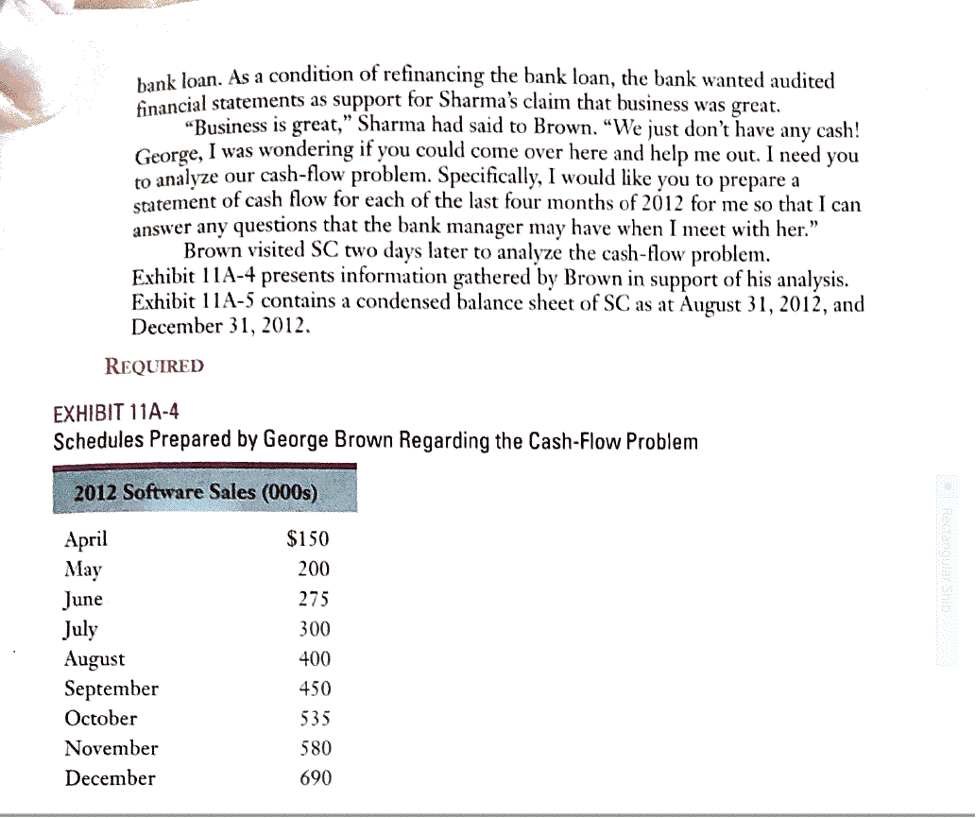

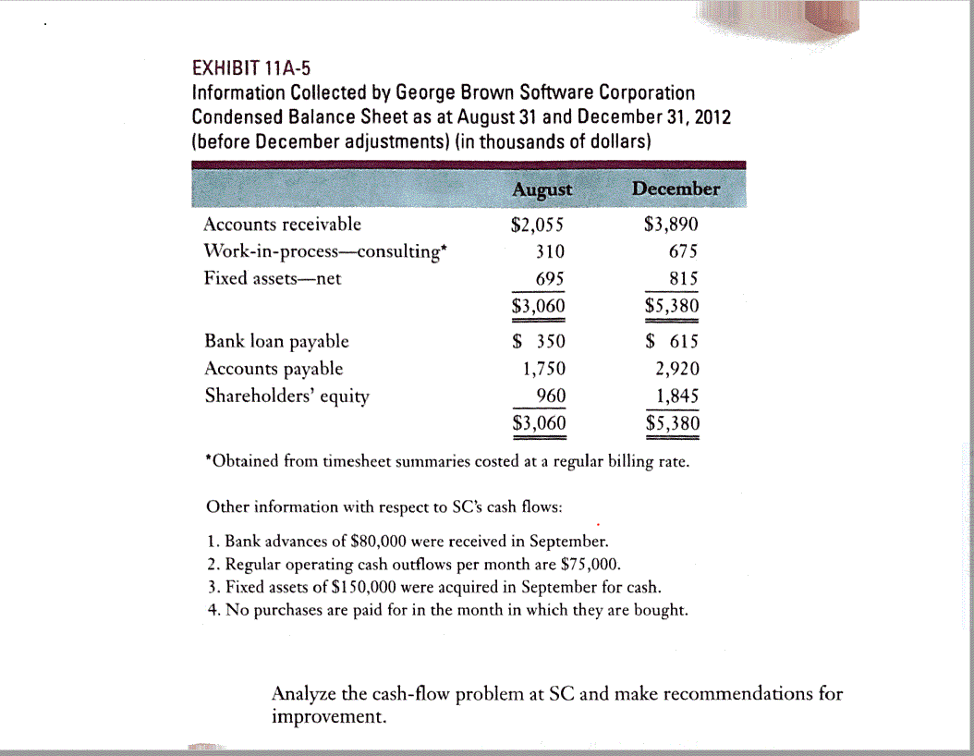

George Brown, a self-employed management consultant, had just settled down to work when he received a call from Ray Sharma, vice president of Software Corporation (SC), a software distributing and consulting firm. Sharma had been through a hectic holiday period and, to some extent, he had let the financial controls slip away. Preoccupied with devoting much of his attention to the customer service side, Sharma had suddenly become aware that cash flow was devastated. In December, three suppliers put him on a C.O.D. basis and three more threatened to stop supplying. At the end of November, the bank line of credit was $260,000 over limit and the bank had refused to honour any cheques except payroll until SC either reduced the outstanding balance to the limit or renegotiated its Aged Accounts Receivable Totals at Month End (000s) September to December, 2012 Age in Days Current 30 60 90 120 Over 120 Total September October November December $540 600 670 750 $480 515 585 660 $405 460 475 555 $380 400 450 465 $350 370 360 410 $ 315 520 825 1,050 $2,470 2,865 3,365 3,890 Analysis of Work-in-Process (000s) August to December, 2012 Month Sept. Oct. Nov. Dec. Aug. Consulting work-in-process at month end Consulting fees invoiced $310 $375 240 $460 225 $575 225 $675 100 Aged Accounts payable Totals at Month End (000s) September to December, 2012 Age in Days Current 30 60 90 Over 90 Total September October November December $615 750 510 400 $640 615 750 510 $450 640 615 750 $360 450 640 615 150 200 645 $2,065 2,605 2,715 2,920 bank loan. As a condition of refinancing the bank loan, the bank wanted audited financial statements as support for Sharma's claim that business was great. "Business is great, Sharma had said to Brown. We just don't have any cash! George, I was wondering if you could come over here and help me out. I need you to analyze our cash-flow problem. Specifically, I would like you to prepare a statement of cash flow for each of the last four months of 2012 for me so that I can answer any questions that the bank manager may have when I meet with her. Brown visited SC two days later to analyze the cash-flow problem. Exhibit 11A-4 presents information gathered by Brown in support of his analysis. Exhibit 11A-5 contains a condensed balance sheet of SC as at August 31, 2012, and December 31, 2012. REQUIRED EXHIBIT 11A-4 Schedules Prepared by George Brown Regarding the Cash-Flow Problem 2012 Software Sales (000s) April May June July August September October November December $150 200 275 300 400 450 535 580 690 EXHIBIT 11A-5 Information Collected by George Brown Software Corporation Condensed Balance Sheet as at August 31 and December 31, 2012 (before December adjustments) (in thousands of dollars) December Accounts receivable Work-in-process---consulting* Fixed assets-net August $2,055 310 695 $3,060 $3,890 675 815 $5,380 Bank loan payable Accounts payable Shareholders' equity $ 350 1,750 960 $3,060 $ 615 2,920 1,845 $5,380 *Obtained from timesheet summaries costed at a regular billing rate. Other information with respect to SC's cash flows: 1. Bank advances of $80,000 were received in September. 2. Regular operating cash outflows per month are $75,000. 3. Fixed assets of $150,000 were acquired in September for cash. 4. No purchases are paid for in the month in which they are bought. Analyze the cash-flow problem at SC and make recommendations for improvement

\

\