Answered step by step

Verified Expert Solution

Question

1 Approved Answer

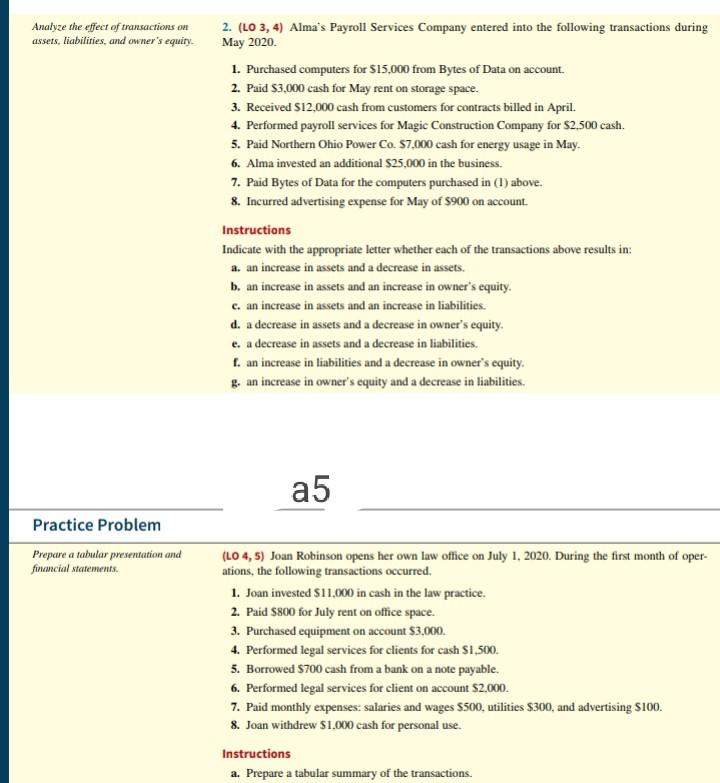

Analyze the effect of transactions on assets, liabilities, and owner's equity 2. (LO 3, 4) Alma's Payroll Services Company entered into the following transactions during

Analyze the effect of transactions on assets, liabilities, and owner's equity 2. (LO 3, 4) Alma's Payroll Services Company entered into the following transactions during May 2020 1. Purchased computers for $15,000 from Bytes of Data on account. 2. Paid $3,000 cash for May rent on storage space. 3. Received $12,000 cash from customers for contracts billed in April. 4. Performed payroll services for Magic Construction Company for $2.500 cash. 5. Paid Northern Ohio Power Co. 57.000 cash for energy usage in May. 6. Alma invested an additional S25,000 in the business. 7. Paid Bytes of Data for the computers purchased in (1) above. 8. Incurred advertising expense for May of $900 on account. Instructions Indicate with the appropriate letter whether each of the transactions above results in: a. an increase in assets and a decrease in assets. b. an increase in assets and an increase in owner's equity. c. an increase in assets and an increase in liabilities. d. a decrease in assets and a decrease in owner's equity. e. a decrease in assets and a decrease in liabilities. 1. an increase in liabilities and a decrease in owner's equity. g. an increase in owner's equity and a decrease in liabilities. a5 Practice Problem Prepare a tabular presentation and financial statements (LO 4,5) Joan Robinson opens her own law office on July 1, 2020. During the first month of oper- ations, the following transactions occurred. 1. Joan invested $11,000 in cash in the law practice. 2. Paid $800 for July rent on office space. 3. Purchased equipment on account $3,000. 4. Performed legal services for clients for cash $1,500. 5. Borrowed $700 cash from a bank on a note payable. 6. Performed legal services for client on account $2,000. 7. Paid monthly expenses: salaries and wages S500, utilities $300, and advertising $100. 8. Joan withdrew $1.000 cash for personal use. Instructions a. Prepare a tabular summary of the transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started