Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the financial statements of Harbor Realty on page 202 of your textbook. Calculate the following (ROUND TWO DECIMAL PLACES) : Ratio of Liabilities to

Analyze the financial statements of Harbor Realty on page 202 of your textbook. Calculate the following (ROUND TWO DECIMAL PLACES) :

- Ratio of Liabilities to Owners Equity

- Working Capital

- Current Ratio

4. Net Income as a percentage of Fees Earned

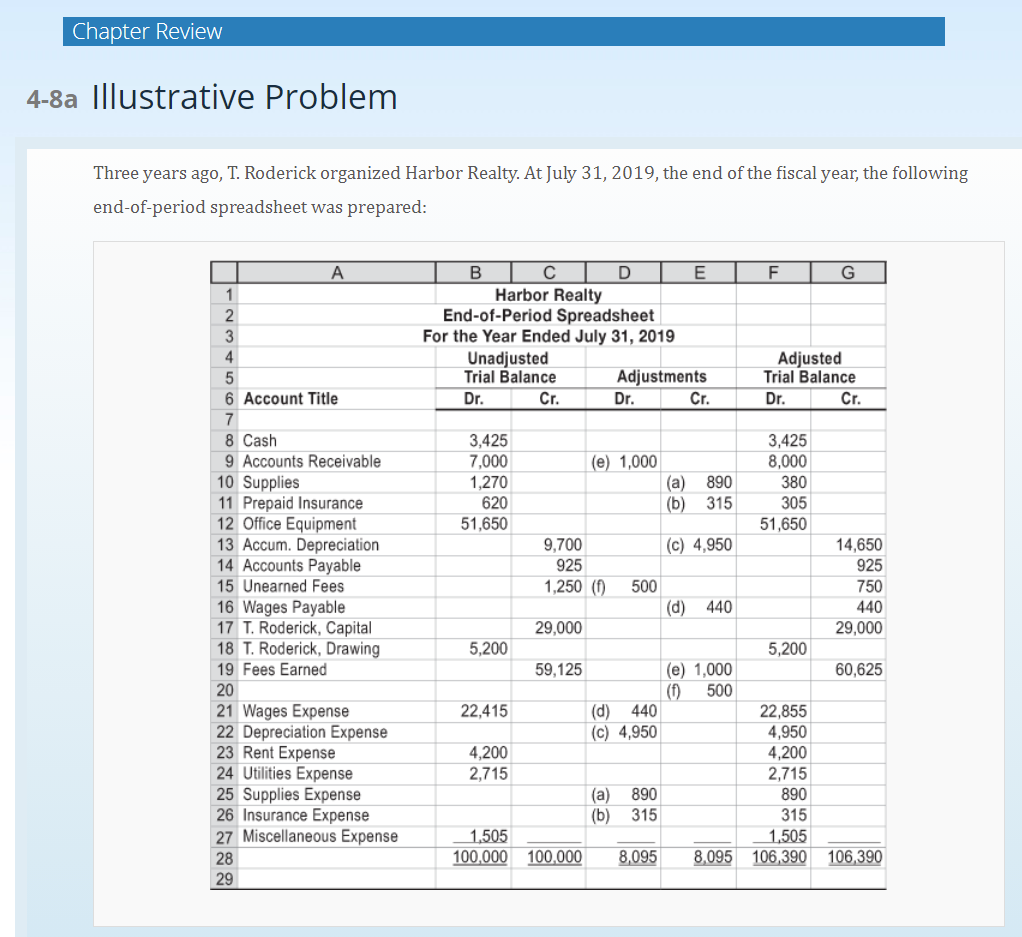

Chapter Review 4-8a Illustrative Problem Three years ago, T. Roderick organized Harbor Realty. At July 31, 2019, the end of the fiscal year, the following end-of-period spreadsheet was prepared: F G B D E Harbor Realty End-of-Period Spreadsheet For the Year Ended July 31, 2019 Unadjusted Trial Balance Adjustments Dr. Cr. Dr. Cr. Adjusted Trial Balance Dr. Cr. (e) 1,000 3,425 7,000 1,270 620 51,650 (a) (b) 890 315 3,425 8,000 380 305 51,650 (c) 4,950 A 1 2 3 4 5 6 Account Title 7 8 Cash 9 Accounts Receivable 10 Supplies 11 Prepaid Insurance 12 Office Equipment 13 Accum. Depreciation 14 Accounts Payable 15 Unearned Fees 16 Wages Payable 17 T. Roderick, Capital 18 T. Roderick, Drawing 19 Fees Earned 20 21 Wages Expense 22 Depreciation Expense 23 Rent Expense 24 Utilities Expense 25 Supplies Expense 26 Insurance Expense 27 Miscellaneous Expense 28 29 9,700 925 1,250 (0) 500 14,650 925 750 440 29,000 (d) 440 29,000 5,200 5,200 59,125 60,625 (e) 1,000 (0) 500 22,415 (d) 440 (c) 4,950 4,200 2,715 22,855 4,950 4,200 2,715 890 315 1,505 106,390 106,390 (a) (b) 890 315 1,505 100,000 100,000 8,095 8,095 Chapter Review 4-8a Illustrative Problem Three years ago, T. Roderick organized Harbor Realty. At July 31, 2019, the end of the fiscal year, the following end-of-period spreadsheet was prepared: F G B D E Harbor Realty End-of-Period Spreadsheet For the Year Ended July 31, 2019 Unadjusted Trial Balance Adjustments Dr. Cr. Dr. Cr. Adjusted Trial Balance Dr. Cr. (e) 1,000 3,425 7,000 1,270 620 51,650 (a) (b) 890 315 3,425 8,000 380 305 51,650 (c) 4,950 A 1 2 3 4 5 6 Account Title 7 8 Cash 9 Accounts Receivable 10 Supplies 11 Prepaid Insurance 12 Office Equipment 13 Accum. Depreciation 14 Accounts Payable 15 Unearned Fees 16 Wages Payable 17 T. Roderick, Capital 18 T. Roderick, Drawing 19 Fees Earned 20 21 Wages Expense 22 Depreciation Expense 23 Rent Expense 24 Utilities Expense 25 Supplies Expense 26 Insurance Expense 27 Miscellaneous Expense 28 29 9,700 925 1,250 (0) 500 14,650 925 750 440 29,000 (d) 440 29,000 5,200 5,200 59,125 60,625 (e) 1,000 (0) 500 22,415 (d) 440 (c) 4,950 4,200 2,715 22,855 4,950 4,200 2,715 890 315 1,505 106,390 106,390 (a) (b) 890 315 1,505 100,000 100,000 8,095 8,095Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started