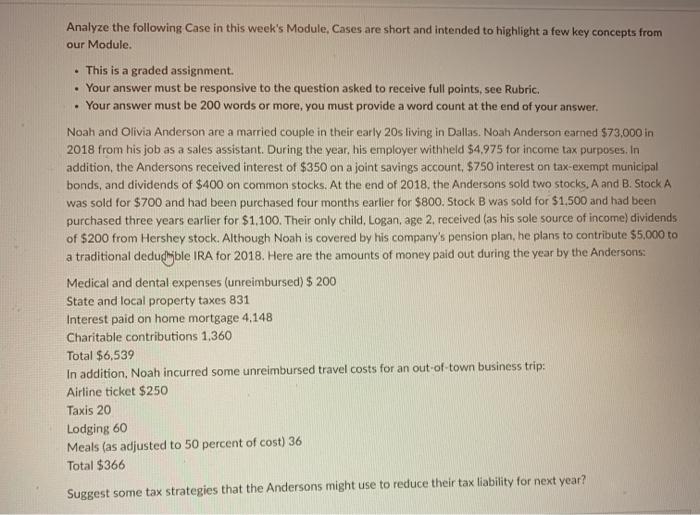

Analyze the following Case in this week's Module, Cases are short and intended to highlight a few key concepts from our Module. . This is a graded assignment. Your answer must be responsive to the question asked to receive full points, see Rubric. . Your answer must be 200 words or more, you must provide a word count at the end of your answer. Noah and Olivia Anderson are a married couple in their early 20s living in Dallas. Noah Anderson earned $73,000 in 2018 from his job as a sales assistant. During the year, his employer withheld $4.975 for income tax purposes. In addition, the Andersons received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018. the Andersons sold two stocks. A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1.500 and had been purchased three years earlier for $1,100. Their only child, Logan, age 2. received (as his sole source of income) dividends of $200 from Hershey stock. Although Noah is covered by his company's pension plan, he plans to contribute $5,000 to a traditional deducible IRA for 2018. Here are the amounts of money paid out during the year by the Andersons Medical and dental expenses (unreimbursed) $ 200 State and local property taxes 831 Interest paid on home mortgage 4,148 Charitable contributions 1,360 Total $6,539 In addition, Noah incurred some unreimbursed travel costs for an out-of-town business trip: Airline ticket $250 Taxis 20 Lodging 60 Meals (as adjusted to 50 percent of cost) 36 Total $366 Suggest some tax strategies that the Andersons might use to reduce their tax liability for next year? Analyze the following Case in this week's Module, Cases are short and intended to highlight a few key concepts from our Module. . This is a graded assignment. Your answer must be responsive to the question asked to receive full points, see Rubric. . Your answer must be 200 words or more, you must provide a word count at the end of your answer. Noah and Olivia Anderson are a married couple in their early 20s living in Dallas. Noah Anderson earned $73,000 in 2018 from his job as a sales assistant. During the year, his employer withheld $4.975 for income tax purposes. In addition, the Andersons received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018. the Andersons sold two stocks. A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1.500 and had been purchased three years earlier for $1,100. Their only child, Logan, age 2. received (as his sole source of income) dividends of $200 from Hershey stock. Although Noah is covered by his company's pension plan, he plans to contribute $5,000 to a traditional deducible IRA for 2018. Here are the amounts of money paid out during the year by the Andersons Medical and dental expenses (unreimbursed) $ 200 State and local property taxes 831 Interest paid on home mortgage 4,148 Charitable contributions 1,360 Total $6,539 In addition, Noah incurred some unreimbursed travel costs for an out-of-town business trip: Airline ticket $250 Taxis 20 Lodging 60 Meals (as adjusted to 50 percent of cost) 36 Total $366 Suggest some tax strategies that the Andersons might use to reduce their tax liability for next year