Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the following financial statement and balance sheet for a not-for-profit health insurer: Colhplete the tasks described in the next 2 tabs/sheets. ABC Health Insurance

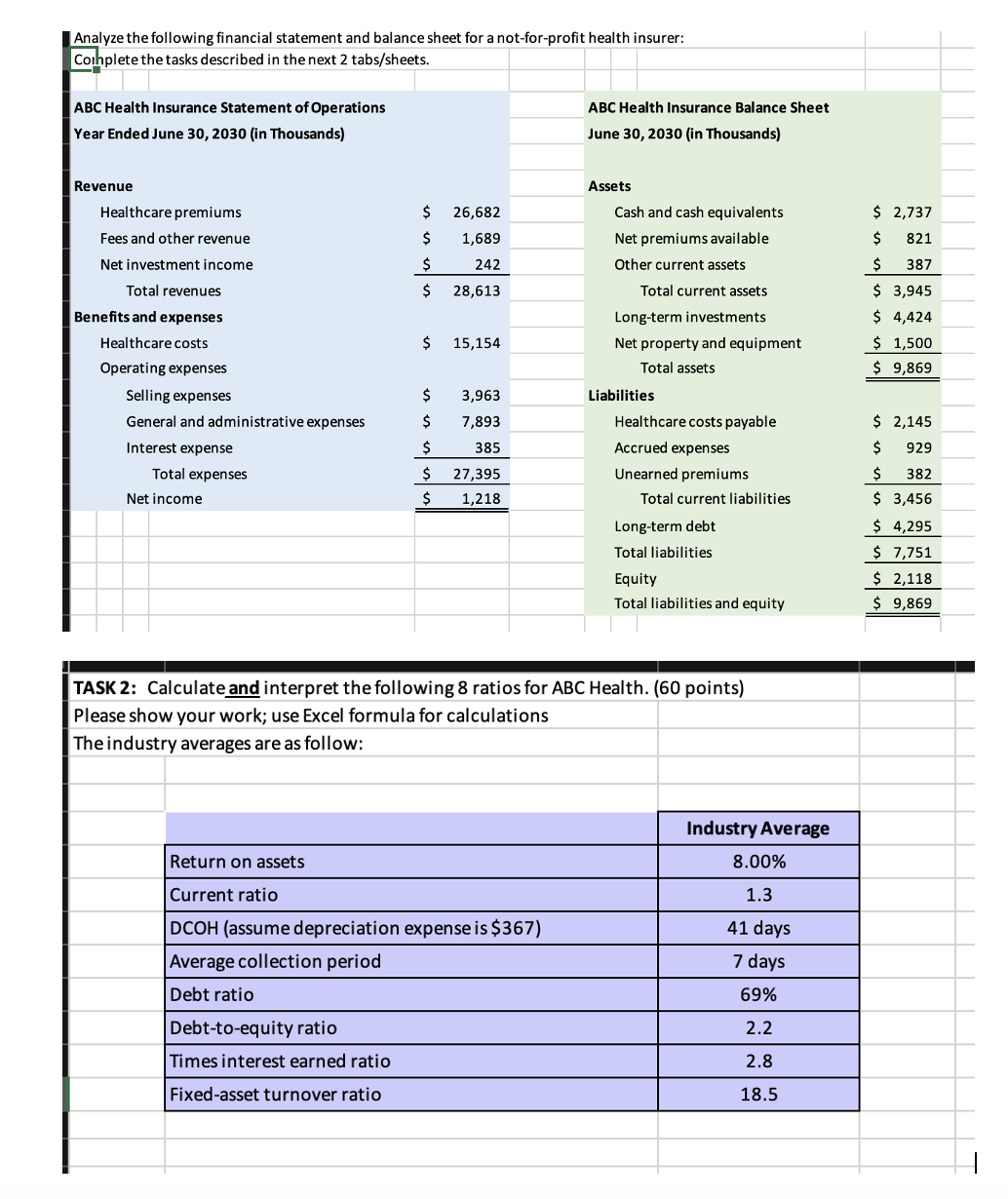

Analyze the following financial statement and balance sheet for a not-for-profit health insurer: Colhplete the tasks described in the next 2 tabs/sheets. ABC Health Insurance Statement of Operations Year Ended June 30, 2030 (in Thousands) Revenue Healthcare premiums Fees and other revenue Net investment income Total revenues Benefits and expenses Healthcare costs Operating expenses Selling expenses General and administrative expenses Interest expense Total expenses Net income Net income ABC Health Insurance Balance Sheet June 30, 2030 (in Thousands) Assets Cash and cash equivalents Net premiums available Other current assets Total current assets Long-term investments Net property and equipment Total assets Liabilities Healthcare costs payable Accrued expenses Unearned premiums Total current liabilities Long-term debt Total liabilities Equity Total liabilities and equity $2,737 $821 \begin{tabular}{rr} $387 \\ \hline$3,945 \end{tabular} $4,424 $1,500$9,869 $2,145 $929 \begin{tabular}{rr} $382 \\ \hline$3,456 \end{tabular} $4,295 $7,751 TASK 2: Calculate and interpret the following 8 ratios for ABC Health. (60 points) Please show your work; use Excel formula for calculations The industry averages are as follow: \begin{tabular}{|l|c|} \cline { 2 - 2 } \multicolumn{1}{l|}{} & Industry Average \\ \hline Return on assets & 8.00% \\ \hline Current ratio & 1.3 \\ \hline DCOH (assume depreciation expense is \$367) & 41 days \\ \hline Average collection period & 7 days \\ \hline Debt ratio & 69% \\ \hline Debt-to-equity ratio & 2.2 \\ \hline Times interest earned ratio & 2.8 \\ \hline Fixed-asset turnover ratio & 18.5 \\ \hline \end{tabular}

Analyze the following financial statement and balance sheet for a not-for-profit health insurer: Colhplete the tasks described in the next 2 tabs/sheets. ABC Health Insurance Statement of Operations Year Ended June 30, 2030 (in Thousands) Revenue Healthcare premiums Fees and other revenue Net investment income Total revenues Benefits and expenses Healthcare costs Operating expenses Selling expenses General and administrative expenses Interest expense Total expenses Net income Net income ABC Health Insurance Balance Sheet June 30, 2030 (in Thousands) Assets Cash and cash equivalents Net premiums available Other current assets Total current assets Long-term investments Net property and equipment Total assets Liabilities Healthcare costs payable Accrued expenses Unearned premiums Total current liabilities Long-term debt Total liabilities Equity Total liabilities and equity $2,737 $821 \begin{tabular}{rr} $387 \\ \hline$3,945 \end{tabular} $4,424 $1,500$9,869 $2,145 $929 \begin{tabular}{rr} $382 \\ \hline$3,456 \end{tabular} $4,295 $7,751 TASK 2: Calculate and interpret the following 8 ratios for ABC Health. (60 points) Please show your work; use Excel formula for calculations The industry averages are as follow: \begin{tabular}{|l|c|} \cline { 2 - 2 } \multicolumn{1}{l|}{} & Industry Average \\ \hline Return on assets & 8.00% \\ \hline Current ratio & 1.3 \\ \hline DCOH (assume depreciation expense is \$367) & 41 days \\ \hline Average collection period & 7 days \\ \hline Debt ratio & 69% \\ \hline Debt-to-equity ratio & 2.2 \\ \hline Times interest earned ratio & 2.8 \\ \hline Fixed-asset turnover ratio & 18.5 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started